谁说这不是房产投资,俺跟他急!

所有跟帖:

•

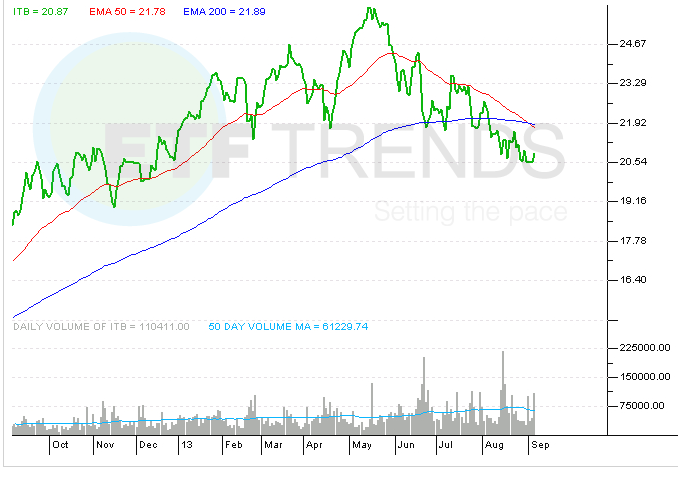

所有sectors 中, 目前homebuilder股票涨了最好,大多数在new height,所以买出租房目前看是不如home

-trimtip-

♂

![]() (27 bytes)

()

05/02/2012 postreply

08:39:42

(27 bytes)

()

05/02/2012 postreply

08:39:42

•

what's logic? 房投风险不大?

-美西游子-

♀

![]()

![]() (377 bytes)

()

05/02/2012 postreply

08:56:35

(377 bytes)

()

05/02/2012 postreply

08:56:35

•

简单地说,就是,如果有十栋出租房,每栋可以有净月租金1200,每月就有12K,可以靠租金养活自己

-trimtip-

♂

![]() (243 bytes)

()

05/02/2012 postreply

10:33:22

(243 bytes)

()

05/02/2012 postreply

10:33:22

•

再说一遍!

-美西游子-

♀

![]()

![]() (165 bytes)

()

05/02/2012 postreply

11:14:35

(165 bytes)

()

05/02/2012 postreply

11:14:35

•

哪来的买房投资的钱?第一桶最难,以后越来越容易了。可大部分人就是永远弄不到足够的第一桶去产生

-trimtip-

♂

![]() (77 bytes)

()

05/02/2012 postreply

11:25:14

(77 bytes)

()

05/02/2012 postreply

11:25:14

•

Got sizable holdings on both XHB & ITB

-beachlver-

♂

![]() (228 bytes)

()

05/02/2012 postreply

08:58:29

(228 bytes)

()

05/02/2012 postreply

08:58:29

•

俺不懂理论,只认数据。

-美西游子-

♀

![]()

![]() (0 bytes)

()

05/02/2012 postreply

09:14:59

(0 bytes)

()

05/02/2012 postreply

09:14:59

•

数据is the 理论, but size also matters a lot

-beachlver-

♂

![]() (646 bytes)

()

05/02/2012 postreply

10:00:53

(646 bytes)

()

05/02/2012 postreply

10:00:53

•

说白了, 世上没有好坏投资

-美西游子-

♀

![]()

![]() (360 bytes)

()

05/02/2012 postreply

10:31:06

(360 bytes)

()

05/02/2012 postreply

10:31:06

•

马后炮吗? 请进

-美西游子-

♀

![]()

![]() (211 bytes)

()

05/02/2012 postreply

09:21:15

(211 bytes)

()

05/02/2012 postreply

09:21:15