当诈骗性金融做烂了某个资产之后,这个资产类型往往要持续腐烂上5到10年、甚至20年(比如日本),等人们抹去了痛苦的记忆之后才有可能恢复,10年后的NASDAQ如今还不到鼎盛时期的一半,现在的房地产就像是刚崩盘后的NASDAQ.

甭管干什么,相信现在看得见的数据和事实,别被卖房子的、卖贷款的、卖保险的、涨房地产税给自己发工资的、和狂印纸币再造泡沫的给忽悠了。有直升机BEN从天上撒钞票,美国总有一天会从紧缩走向通胀,但散发着霉味的房地产却吸引不了大宗的投机资金,只有那些天生有捡垃圾本能的人才会现在炒底房地产。

别相信什么 positive cash flow 能救你的命,就像股价跌破了底儿、多高的 dividends 也没用,经过了 BS, Lehman, ML, C, FNM, FRE, AIG, ... 谁买股票还看 dividends ?也别以为没人每天告诉你房子值多少钱你就安全了,该来的还是来,倒腾房子和炒股票没区别,最终都得看升值贬值,甭管别的,起码大千股坛的人敢於每天面对风险,而不是缩起脖子来做鸵鸟。

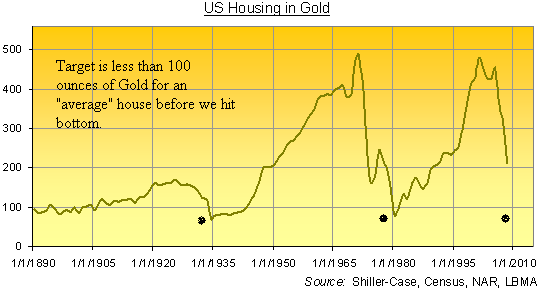

你觉得现在就是底?说实话,有点嫩。Adam Brochert 说的对,等1盎司黄金能买半个Dow index, 100盎司黄金能买一个平均价的房子时才是底,在那之前,都是扯淡。

More Ugly Housing Data

by Adam Brochert

Every month, tout TV and mainstream financial sites like Yahoo! Finance and Marketwatch re-print propaganda pieces from the National Association of Realtors (NAR) and other vested interests related to real estate. The headlines are ALWAYS spun to look positive, as comfort is more important than truth. The NAR has been calling the bottom in housing every month since before the top was in! Statistics are twisted and tricks like comparing the current month to the prior month instead of the same month in the prior year are used routinely to baffle, confuse, satiate and/or soothe those who still turn to mainstream media sources for truthful data.

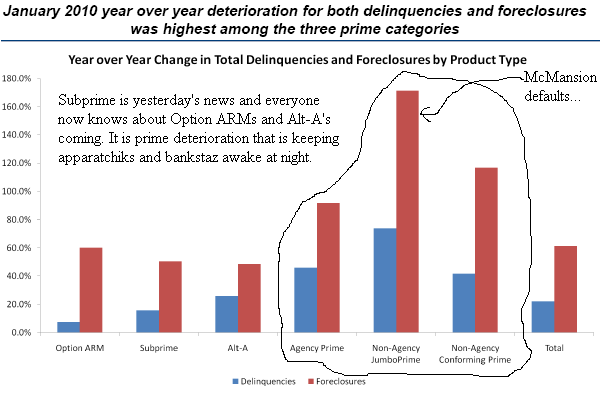

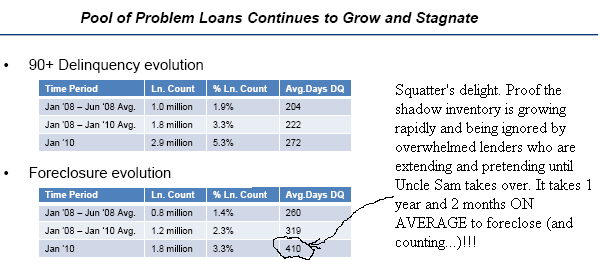

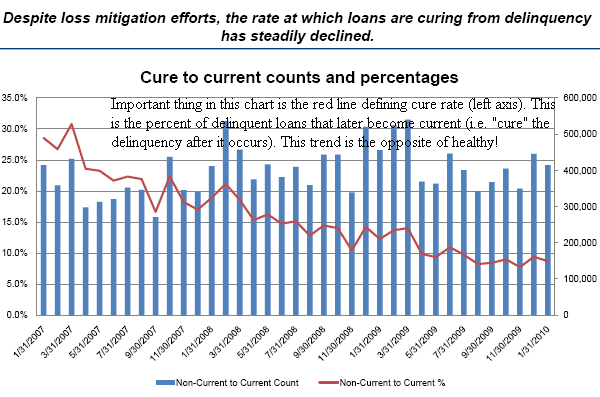

The numbers in housing are becoming surreal. I urge anyone who is interested in the true state of the housing market to check out this report from Lender Processing Services, Inc. The truth will set you free as they say, though you may not like what you see if you own a home or debt on a home. Some chilling graphics and data points reproduced without permission from this current report below with my comments scribbled on the graphics:

There is more data in the report for those who are interested. This is the data the bankers and apparatchiks are using to make decisions. Add in the commercial real estate disaster and rising delinquencies on other types of consumer debt, and it is easy to see why the banking system of the U.S. is insolvent and why there will be many more bank failures.

There is no recovery in housing coming in the next few years. Things will get much worse, particularly in bubble areas. There will eventually be mass liquidations of blocks of homes in bubble areas for 10-30 cents on the dollar at the wholesale level. Rents will continue to drop, particularly in bubble areas. Don't buy a home right now thinking you are going to make a profit any time soon. There are always exceptional individual opportunities available in any area and housing fulfills a need for long-term basic shelter, which is very different than investing/speculating.

If you are a home renter, be more confident in going "month to month" once your current lease runs out and don't be afraid to ask for rent concessions as often as local conditions allow. Why? Many "investors" are buying homes so they can rent them out. Many "homeowners" who can't sell due to being underwater on their mortgage are trying to rent their vacation/second homes. Many banks would like to get into the rental business to salvage some cash flows from their rapidly growing real estate portfolios. Translation: supply pressure on the rental market will continue and rents should continue to fall.

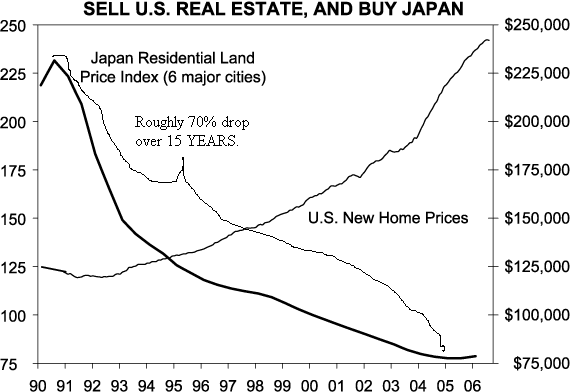

We are following the route of Japan in the 1990s when it comes to real estate: extend and pretend, cover-ups, and massive government support of zombie banks. This is not a new playbook, it is an old recycled one. It didn't work last time and it won't work now. I forget where I stole this chart from, but it not only shows what we're in store for, but also the fact that there were indeed people who "saw it coming" (notice the final dates on this older chart) before the current mess in real estate started:

History repeats again. In the inflation-deflation debate, there is absolutely no doubt that the housing market is "in deflation" and this has bankrupted the financial industry in the U.S., which is also deflationary. The only question is how far will "the powers that be" go in trying to destroy the currency to counteract these forces? As the world's biggest debtor (the opposite of Japan in the 1990s), we don't have as much wiggle room for quantitative easing (i.e. counterfeiting money) as Japan did because we rely on external funding. Global capital flows must be taken into account when trying to decide if the Dollar will rise or fall since our own savings are inadequate to support creation of more government debt.

Serious consequences await the real U.S. economy regardless. If we do manage to get additional inflation into the system, it won't flow into housing in any significant way. Inflation moves from asset class to asset class, keeping many people in the dark regarding its pernicious effects. A bubble burst is gone and inflation won't bring it back. Gold will continue to benefit from attempts at monetary inflation that are ongoing at this point in the cycle due to the lack of confidence in the real economy and will act to protect your savings from the financial storm until the Dow to Gold ratio gets to 2 (and we may well go below 1 this cycle).

For those who already own Gold and want to buy a house in the future, here's how to know when to start looking for a house (chart stolen from Adrian Ash at bullionvault.com):

Forget the hype about a bottom and a recovery in housing. Don't worry about catching the bottom. Once we finally hit bottom, we will scrape along the lows for a few years. As in at least 2 years, maybe 5 or 10 (depends on government policies - the more they artificially prop up prices and support the market, the longer it takes to find a real bottom). There is no rush to buy and you won't miss out on the deal of a lifetime by waiting longer when it comes to real estate in the United States. Why buy now when you can buy for less later? This is asset price deflation (and a bubble collapse dynamic) in action and it ain't even close to over yet when it comes to housing.

最新房地产数据:从很烂走向更烂

所有跟帖:

•

这就是抄底的最高境界 :)

-gd3-

♂

![]() (346 bytes)

()

03/19/2010 postreply

19:14:34

(346 bytes)

()

03/19/2010 postreply

19:14:34

•

我上次就说过,失业问题不解决,房市是救不活的。

-想说我就说-

♂

![]()

![]() (143 bytes)

()

03/19/2010 postreply

19:21:42

(143 bytes)

()

03/19/2010 postreply

19:21:42

•

恢复制造业 = "The Mother of All Wars" with China then.

-gd3-

♂

![]() (153 bytes)

()

03/19/2010 postreply

19:28:37

(153 bytes)

()

03/19/2010 postreply

19:28:37

•

回复:Here is a true story that a Jew posted on a wall street

-gd3-

♂

![]() (75 bytes)

()

03/19/2010 postreply

22:11:05

(75 bytes)

()

03/19/2010 postreply

22:11:05

•

hmmm, maybe it's a good time to sell

-mm48-

♂

![]() (99 bytes)

()

03/19/2010 postreply

20:14:09

(99 bytes)

()

03/19/2010 postreply

20:14:09

•

08 是好时候出手,现在价可能低点但还来得及。刚出一套,比08年底了10%。

-joozen-

♀

![]() (0 bytes)

()

03/19/2010 postreply

20:28:35

(0 bytes)

()

03/19/2010 postreply

20:28:35

•

等利率到8-10%,看房价跌到哪吧。

-any_more_left-

♂

![]()

![]() (0 bytes)

()

03/19/2010 postreply

20:21:25

(0 bytes)

()

03/19/2010 postreply

20:21:25

•

房子的问题是现在supply太多太多,没个10几年消化不了

-dividend_growth-

♀

![]()

![]() (56 bytes)

()

03/19/2010 postreply

21:54:02

(56 bytes)

()

03/19/2010 postreply

21:54:02

•

It depends on where you live.

-QinHwang-

♂

![]()

![]() (0 bytes)

()

03/19/2010 postreply

22:50:24

(0 bytes)

()

03/19/2010 postreply

22:50:24

•

Good analysis, couple points come to mind

-sunskitehomes-

♂

![]()

![]() (2544 bytes)

()

03/19/2010 postreply

22:09:39

(2544 bytes)

()

03/19/2010 postreply

22:09:39

•

too persimistic, life is beautiful, enjoy it,

-laoyangdelp-

♀

![]()

![]() (63 bytes)

()

03/20/2010 postreply

17:03:57

(63 bytes)

()

03/20/2010 postreply

17:03:57

•

Hope for the best

-sunskitehomes-

♂

![]()

![]() (40 bytes)

()

03/20/2010 postreply

17:44:10

(40 bytes)

()

03/20/2010 postreply

17:44:10

•

Besides, I'm in Midwest

-sunskitehomes-

♂

![]()

![]() (31 bytes)

()

03/20/2010 postreply

17:46:56

(31 bytes)

()

03/20/2010 postreply

17:46:56

•

According to the two countries’ 2000 censuses,Switzerland

-luguozhe-

♀

![]()

![]() (149 bytes)

()

03/19/2010 postreply

22:12:34

(149 bytes)

()

03/19/2010 postreply

22:12:34

•

房市可能一蹶不振好多年,但不想信正现金流没道理

-QinHwang-

♂

![]()

![]() (163 bytes)

()

03/19/2010 postreply

22:39:45

(163 bytes)

()

03/19/2010 postreply

22:39:45

•

十年后加州的房地产税增长50%是有可能的。

-春木-

♂

![]()

![]() (103 bytes)

()

03/19/2010 postreply

23:42:55

(103 bytes)

()

03/19/2010 postreply

23:42:55

•

加州的地产税不是关键,民主党一党独大花的太多才是根源.

-luckyd-

♂

![]() (94 bytes)

()

03/20/2010 postreply

02:06:20

(94 bytes)

()

03/20/2010 postreply

02:06:20

•

共和党和现在TG也差不多--能化纳税人

-hetero-

♂

![]() (0 bytes)

()

03/20/2010 postreply

02:35:42

(0 bytes)

()

03/20/2010 postreply

02:35:42

•

不要那么悲观--TG和其他地区的海藻嘶鸣会来帮忙的

-hetero-

♂

![]() (0 bytes)

()

03/20/2010 postreply

02:39:20

(0 bytes)

()

03/20/2010 postreply

02:39:20

•

10年房价才涨50%?不高哦。

-joozen-

♀

![]() (0 bytes)

()

03/20/2010 postreply

07:25:54

(0 bytes)

()

03/20/2010 postreply

07:25:54