and the cycle is still on-going. If we start counting from 2008 GFC, we are at the end of easing cycle and the 2nd half of the same cycle just got started. I say it will take another 10 yrs to see the full impact of massive Fed balance sheet unwinding as well as the impact of massive increase in Federal debt level.

Yet for many investors, the 1/2 cycle which lasted 15 yrs were the ENTIRE life span for stock market investment. human beings are known to project personal immediate past experience into distant future. and human beings also tend to attribute personal sucess to personal skills, and personal failure to bad luck. For equity investment, luck, good or bad, is frequently far more likely than skills in determing the outcome

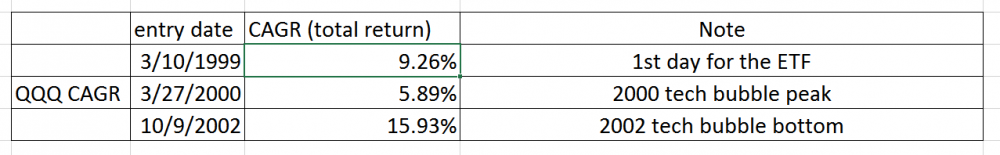

entry point determines a big part of your investment outcome. it is easy to use 10-, 20- or even 50-yr avg return for projection.

1 first simple mean return is subject to "volatility drag". for the minimum use LONG term CAGR; (data from yahoo finance historical price)

2 can one sit tight thru 2000-2002? if you held thru it, you only lost 80%. So congrats! You still have 20% Left and it took more than a decade to recover the loss from 2000 high. If you BTDF, you would have been entirely wiped out and would NOT participate in the bounce and recovery. it is one thing to talk about what you will do. it is entirely a differnt thing to sit through an 80% DD. 20% is the max I can sit without questioning my investment thesis and even my personal merits.

3 equity mkt, tech in particular, is MORE expensive today in terms of valution multiples even tho the index is below ATH. why? riskfree rate much higher. So stocks are NOT cheaper. It is more expensive. To expect past return, you need another 15-year QE and massive fiscal deficit spending. The Q is can we afford it?

Hindsight is 20/20. So the million dollar Q finally: does this look like i bottom; ii peak; iii decent pricing in your eyes?