目前有不少人认为加国房市(主要是民居住宅)有大泡沫,很快会大幅下跌,下面的这篇文章就是这种观点。在文章的最后,我

加了一个持反对意见的网友评论,我觉得从正反二方面来思考比较是个很好的方法。

我个人觉得大多数认为加国房市会像美国一样大跌的人,对加国缺乏最基本的了解。加国大都市的房价是很高,与加国经济收入

有脱节, 但是如果以此就认为房价就会大跌,未免考虑问题太简单了。

多市的移民增长和城市周边的Green Belt 的限制,都决定了房价虽然高,但是很难下来。

Will Canadian Real Estate Crash?

Summary

- Canadian real estate prices are constantly breaking all time highs across Canada, and are soaring away from the fundamentals.

- Canada's overpriced real estate ultimately has their origins in Vancouver, Toronto, and Calgary. These cities are being fueled by Chinese investment, soaring finance markets, and oil prices, respectively.

- The Chinese market starting to collapse, almost zero interest rates set to rise, and an ongoing oil glut may cumulatively create a large correction in Canada.

Introduction

Canada's real estate market has started to look eerily similar to the conditions that were present before the United States' real estate crash. Large hedge fund managers have begun taking short positions against the Canadian real estate market. From an investment standpoint, the picture does not look good for Canadian real estate. This article reviews the data to compare the Canadian real estate values to the US real estate market, to suggest why the Canadian real estate market is due for a significant correction.

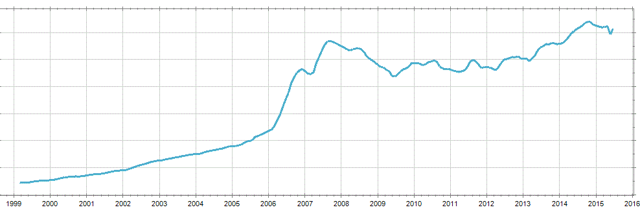

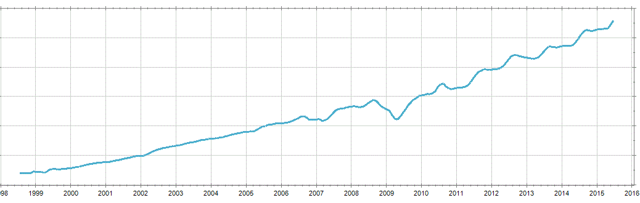

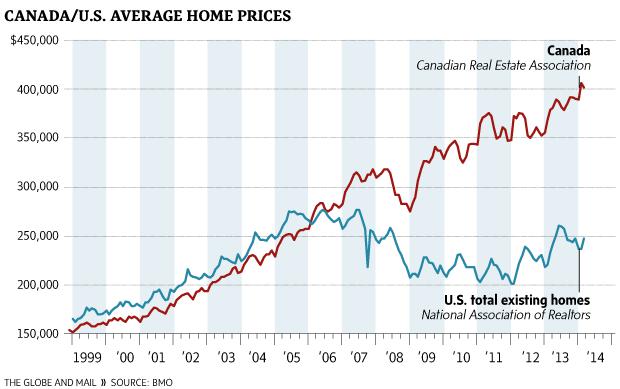

Canada's real estate market has followed the trends of the United States' real estate market very closely for several decades, up until 2007. While the US suffered a rapid crash across the country, Canada had only a minor dip, followed by several years of continued growth. A look at the average real estate price in both Canada and the United states demonstrates this point very clearly. We see that as the US faltered in 2007, Canada's market continued to gain strength.

However, it's important to be aware of why Canada's market is different from the United States. The US had a much higher percentage of sub-prime mortgages in the market than Canada has now, and Canadian banks have generally been much more conservative than American banks. In addition to this, further safeguards were added in Canada to prevent the same crash that happened in the US.

For example, it used to be relatively easy to purchase investment properties in Canada with less than 20% down, but now this has become a requirement. Furthermore, Canadians must pay a default insurance premium when they are depositing less than 20% down, and they are not allowed to buy their own home with less than 5% down. These safeguards, and the much smaller presence of sub-prime lenders in Canada, suggest that the price correction will be much more gradual and less severe than what occurred in the United States.

The Fundamentals

Although the sale price can always escape the fundamentals of a company, it is only a matter of time before they eventually catch up to each other. Therefore, the best indicator of house prices should rely in the fundamentals.

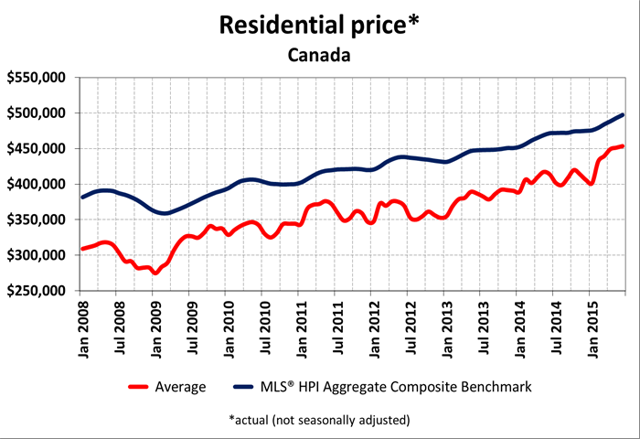

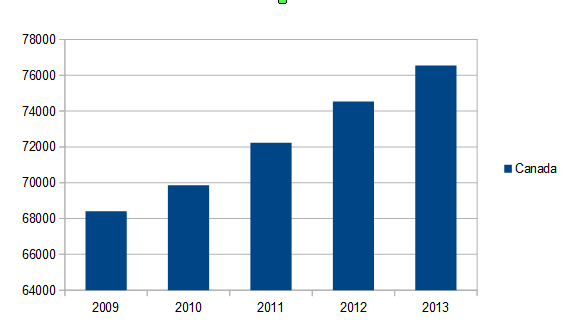

Perhaps the best indicator of the average home price for an area is the average income; therefore, if we see house prices far outgrow wages, it cannot be sustainable forever. The chart below shows the average wages across Canada from 2009 to 2013 (as far as the data would go). We can see that the average income in Canada has risen 12% from $68.4 to $76.6 thousand per year.

Looking at the average house price in Canada more closely for the last few years, we see that Canada's housing prices have soared since 2009. We see that from January 2009, the house prices rose from approximately $275,000 to just under $400,000 by 2014; therefore, despite a 12% increase in wages, house prices have increased more than 25%. Furthermore, since the end of 2013, house prices have risen more than 10% to exceed an average price of $450,000. Now, I could not obtain data for the 2014 annual income for Canadians, but I can guarantee that it did not cover the 25% difference.

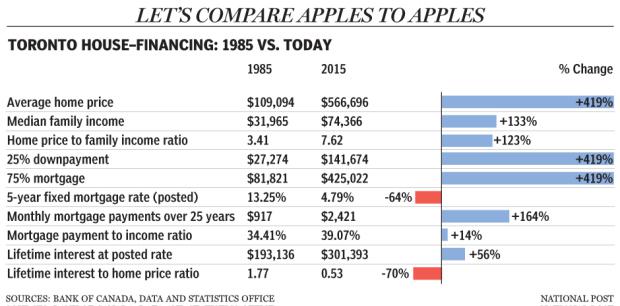

In fact, the Financial Post offered a great example of Canada's overheated market by using Toronto. We see from the chart below, that in 30 years, in Toronto, house prices have gained about 420%, while income has gone up about 133%. The reason why I specifically included this table is because it shows that despite these two enormous differences in house value and income, the percent of income going towards mortgage payments have only changed less than 5%. The Financial Post stated that it took mortgage rates as a percentage of income to hit 50%, as it did in 1989, before the bubble finally bursting, suggesting we may have another 10% to go. I disagree with this statement, because the interest rates skew the picture entirely.

It's important to understand that the only way for house values to increase that much beyond wages without a large impact of mortgage as a percentage of income, would be for the average cost of financing to change considerably. This is a perfect example of how prime interest rates can affect house prices. It is also important to understand how quickly mortgage payments can grow when the starting point for interest is almost zero.

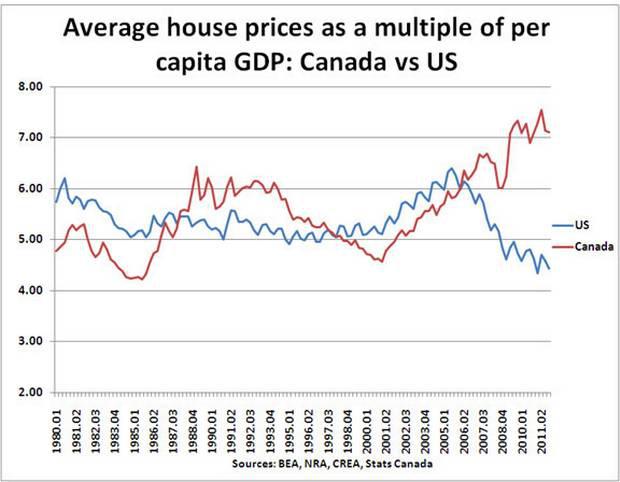

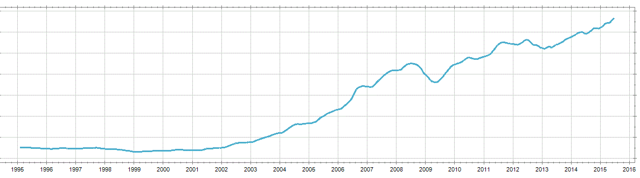

Another similar indicator to test the real estate values is the average house price as a ratio of the GDP. Logically, we would expect this relationship to be somewhat constant, and deviations from this would suggest a poor valuation. Looking at the house price to GDP at both the United States and Canada, we see a pretty scary picture for Canada.

Although I could not find more recent data, this shows the start of a significant deviation of house prices from GDP. To help extrapolate the data, be aware that GDP has grown approximately 2% per year over the last two years.

Demographics

One good thing for Canadian real estate is that Canada has had a steady flow of immigrants moving to Canada, which tends to increase house prices. This can explain some of the differences between the prices and the fundamentals, but does not explain all of it. Furthermore, some of this effect should be offset by the baby-boomer generation not buying a house.

The Catalysts

Canadian house prices are not that unreasonable across much of Canada. In fact, if you bought property in a small town almost anywhere in Canada, you likely could obtain a home for a reasonable cost. However, many foreigners are unaware that Canadians generally live in a small number of cities, and that the majority of Canada's population lives in the few largest cities in Canada. Therefore, although only a few markets are likely to experience heavy corrections, these markets constitute an enormous percent of the Canadian real estate market. The three most overvalued cities I believe are Vancouver, Toronto, and Calgary. As of 2011, Toronto had 5.132 million, Vancouver had 2.135 million, and Calgary had 1.095 million; therefore approximately one fourth of Canada's population live in these overheated markets.

The first catalyst towards overpriced Canadian real estate has been the notoriously high price of oil. Canada has the third largest oil reserves in the world; however, the energy industry in Canada has been hit hard due to the very high cost of production. Massive job cuts have already occurred across the Alberta oil patch, and more job cuts are forecasted. In addition, most energy companies have begun cutting wages and salaries across their workforce as the notoriously overpaid industry has begun to slow down. The oil boom in Alberta, which has the epicenter of offices in Calgary, has led to Calgary as a whole booming. The huge job and wage cuts across Calgary will likely have a trickle down effect across a number of industries, most notably the construction industry which is hugely disproportionate in Calgary because of the explosion in growth over the last few years.

Toronto's inflated housing costs seems to be the most legitimate of the three, and may be the least susceptible to a correction. Toronto's housing market success has been largely driven by increasing immigration, and the success of the Canadian financial markets as it houses the Toronto Stock Exchange. Many would argue that because of this, Toronto's real estate market should follow the overall strength of the Canadian economy, or at least the strength of the stock market. However, several years of near zero interest rates may have ultimately created a false belief in the strength of the financial markets that are likely to experience pressure with rising interest rates.

The second catalyst for the house prices increasing has been the enormous amounts of foreign investment in Vancouver. Vancouver has always been a central location for Chinese immigrants; however, the population has surged over the last few years due to the Chinese economy. There has been huge amounts of capital invested into Vancouver, especially in real estate. Here's a fact that will shock some of the American readers: The average home price within the city of Vancouver is over 1.9 million dollars Canadian, up from just $700k in 2005. This may not seem as shocking with the USD/CAD at 1.30, but last year when the currencies were close to par, you can see how unbelievable these prices are.

Vancouver has essentially become no longer affordable for locals, and many young people move away due to the very high cost of houses has far exceeded the relatively average wages. Furthermore, Vancouver's real estate market seems to be the most vulnerable to a crash, as the real estate values are so dependent upon foreign investment. Many Chinese investors have turned Vancouver's real estate into a Ponzi scheme as more money is piled in from China, and investors have leveraged their properties to purchase more properties.

The unabated purchasing from China has made this Ponzi scheme sustainable, for now. Furthermore, much of this money has been relatively recent wealth made from China's financial system which ultimately seems to be resting on a house of cards. The Shanghai index has already started to collapse as it has fallen from above 5000 to 3500 in a few short weeks, despite ongoing measures from the Chinese government to spur investment and loosen leveraging rules. This has ultimately set China up for a bigger fall, and much of the 'new money' in China (which has invested heavily into Vancouver) will disappear.

As foreign investments are sold off, a chain reaction could occur that would lead to many of the foreign investors being in negative equity and possibly going into default. Although I mentioned earlier that Canada as a whole will likely correct significantly, but not crash, Vancouver is the one city in Canada that has the potential for a US style crash due to the unstable Chinese financial system ultimately driving most of the investment.

The final catalyst that I will mention is something that will have an effect across the entire country: several years of near zero interest rates. The problem with having interest rates so low for so long, is that it has increased the overall mortgage approval amount per person. Over time, this has led to houses as a whole becoming overvalued, as these interest rates are not sustainable. The longer the interest rates remain so low, the more time the bubble has to develop and grow larger. This ultimately creates the possibility of an eventual bigger fall when prices do rise. The problem is that interest rates have been low for so long, it is likely going to have catastrophic consequences if it were to be raised too quickly.

My Predictions

I believe that either Calgary or Vancouver will be the first to start to fall, and Calgary has already shown evidence of prices starting to decrease in the last few months. Despite the crash in the price of oil, Calgary house prices have remained relatively robust for now, although it is no longer the name your price boom town that it was last year. Sustained low oil prices will ultimately lead to emigration from Calgary, which I think will gradually fall over the next 3-4 years as the price of oil remains in the $40 to $60 slump.

I think that Calgary will eventually approach the troughs found in March 2009, or approximately 30% lower. I think that Vancouver's real estate has the possibility of a fast and sharp correction in prices that is comparable to the United States; however, this would not have a significant chain reaction effect across the country, as other parts of Canada have not experienced the same causes for inflation. I do not see it that unlikely for Vancouver to fall anywhere from 30-60%, depending upon the strength of the Chinese economy.

Finally, I think that as Calgary and Vancouver's market fall over the next couple of years, the Toronto real estate market should fall, but not nearly to the same degree. Toronto's market will likely be the hardest to predict as it is based on variables that do not make it so clearly overvalued, and has been sustained by stable immigration. It seems that Toronto's market correction will depend upon Canada's economy as a whole.

How to profit?

Well I wouldn't recommend buying a million dollar bachelor suite condo in Vancouver right now. I also would never recommend that someone sell their home, and I doubt that anyone would make a decision like that based on something that they read online. However, one way to make money off a possible crash is to short some of the subprime mortgage lenders in Canada. I will be publishing an article soon going over all of the subprime lenders in Canada, to suggest which ones may have the most up and downside potential, as I am currently still researching the area right now.

一个网友的评论:

I enjoy your articles. In this case, I disagree on some points.

The Canadian housing market is completely different from the US housing market, even today. 40% of Canadians own their home free of any mortgage or line of credit debt. This has never been the case in the US and still isn't today where 25% of current homeowners are still under water on their mortgage. All crashes have a cause and effect. The cause in the US was excessive lending where 125% mortgages were common and with mortgage interest deductibility, there was no incentive to pay off your mortgage. Today you can still buy a home with 3% down almost anywhere and still enjoy the same tax advantages.

In Canada, there is no tax deductibility and you can't get a conventional mortgage with less than 20% down (35% down for most rental properties). Canada's mortgage default has gone over 1% only a few times in recorded history. US mortgage defaults peaked at 7%. Canada has suffered a number of home price crashes where friends of mine lost their home - so it does happen, but not for any reason similar to the US.

All home price crashes in Canada that I recall occurred during severe economic distress, high inflation and/or high interest rates. None of these conditions exist today. Canada's housing bubble is really just the 3 cities you quote - Vancouver, Calgary and Toronto. I can drive 2 hours east of Toronto and buy a brand new custom built bungalow for 1/3 the price here in Toronto (or less). In fact, it's the same in all directions, not just east.

Vancouver is paradise - many rich Canadians either wants to be there or are already there. Vancouver will always command a premium because of the climate.

Calgary is/was a boom town and has been in the past. I know because I was there in 1982 when the fun began. The drop in 2008 was 1/2 of what it was in '82 - '84 and 2008 was a much worse financial crisis. http://bit.ly/1LVAILK

Canadian banks rarely evict people from their homes. Yes we have a few foreclosure auctions, but nothing like what I was able to get in Florida in 2012 where a home with a foreclosed mortgage of $350,000, I bought for $128,000. This has never happened in Canada in my lifetime and from what I can tell can't happen. I know can't is a strong word, but you'd have to explain to me how we are going to get a 7x increase in foreclosures before I need to explain why it can't. Think about the scale of a 7 fold increase in foreclosures when 40% of the population doesn't have a mortgage. That means that 7 fold increase has to come from the 25% of the market with less equity in their home where walking away and going personally bankrupt is better than just working out something with the bank.

I have facts and history on my side - I have a lot of nevers in my case. You have provided only charts and quite frankly rather weak comparisons that any knowledgable author would know don't apply here. The Canadian market is nothing like the US market.

As for Canadian workers, you write, "as the notoriously overpaid industry has begun to slow down." What are you talking about? Would you live in Fort McMurray without reasonable compensation? Calgary and Edmonton are very liveable cities and not everyone works in the oil industry there. Calgary was recently ranked as one of the best cities in the world in which to live.

As for the Chinese, "The Chinese market starting to collapse" - have you been there? It's booming and yes slowing, but slowing to 6% vs 10% is hardly collapsing. We would dream about that kind of growth here.

Canada has always welcomed immigrants and they aren't stopping because house prices are high (even though in US$ homes are now 30% cheaper in just 2 years). There are 250,000 immigrants to Canada every year and most settle in 3 cities. I would suggest that the vast majority settle in Toronto, but it's probably closer to 50%. That's 2.5% population growth just from immigration, let alone from other cities in Canada (migration) and our own births (about 1%). In case you haven't heard, Toronto (the GTA) is now surrounded by a designated green space that will never be developed on and all new construction in the city is infill or repurpose. There is no land available for wide open development in Toronto and even in some of the surrounding communities. Once you take all of these factors into play, a housing crash seems remote although the condo market could crash any time - however unlikely until facts change. Canada just lowered interest rates, not raised them. Canada has 7% unemployment, up a bit since oil has crashed - not 13% like in 1982.

You aren't the only one writing articles like this. You can see here in April http://seekingalpha.co... or this one in Jan http://seekingalpha.co... or this one last summer http://seekingalpha.co...

He's not the only one:

http://seekingalpha.co...

http://bit.ly/1LVALr0

http://seekingalpha.co...

http://seekingalpha.co...

http://seekingalpha.co...

and so on. One of these days, someone will be right but good luck with any investment angle on this. I would never say home prices can't go down or even possibly crash, but nothing in your article suggests either a time frame or any investment idea that is solid enough to actually act on.

One last anecdote. I sold my home 3 years ago for $750,000 and downsized. I figured that prices couldn't go up from there, but here we are and that house is now $850,000. While the numbers sound large, the reality is that 13% increase in value over 3 years is hardly bubbly. By that metric, the stock market is insane.

If Canada enters a recession, which seems possible to likely, then housing could drop. But you have to be right on the recession call and there's another month before we get data on that. If you want to sort Canada, just buy US$.

I guess I could just be dreaming and the housing market will crash. We'll have to come back in a year and see who was right.