The ongoing debate as to when and if the Fed will ever end the zero interest rate policy that is in place, continued to rage on even after Ben Bernankestated his casefor continuity of all QE policies.

It seems pretty clear to me thatAnnaly Capital(NLY) will continue to have a rather stable interest rate environment for quite some time. Further confirmation has once again been given by the Fed that they have no plans to stop buying longer term Treasuries, or mortgage backed securities, to the tune of $85 billion per month.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

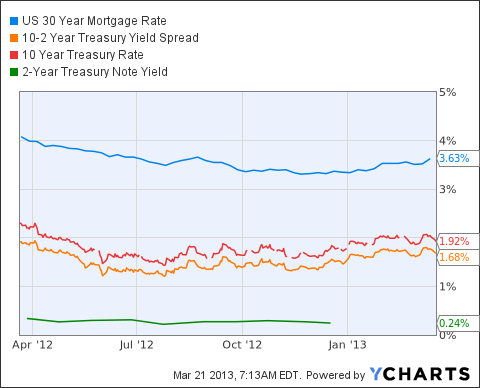

While the Fed remains committed to all current policies, it is not clear how effective the programs will be going forward. By taking a quick look at interest rates and spreads, I would suggest that the Fed policies have placed a lid on long term rates, rather than continuing to push them down.

Actually, the 30 year mortgage rate has ticked up a bit, while the spread between the 2 and 10 year Treasuries has remained stable. It still appears that the most effective policy the Fed has in place is in keeping the short term rates near zero. As long as this policy remains in place, the agency mREIT sector knows where it stands, and can continue to profit.

If the Fed were to cease spending $85 billion on MBS and Treasuries every month, the longer end of the yield curve would probably rise, and that would create an even wider spread for Annaly to work within.

To further support the Fed continuation of all policies,these projectionswere also submitted. According to the Fed projections, they believe that core inflation, and unemployment, will remain within the range to continue current policies well into 2015.

| Variable | Central tendency1 | Range2 | ||||||

|---|---|---|---|---|---|---|---|---|

| 2013 | 2014 | 2015 | Longer run | 2013 | 2014 | 2015 | Longer run | |

| Change in real GDP | 2.3 to 2.8 | 2.9 to 3.4 | 2.9 to 3.7 | 2.3 to 2.5 | 2.0 to 3.0 | 2.6 to 3.8 | 2.5 to 3.8 | 2.0 to 3.0 |

| December projection | 2.3 to 3.0 | 3.0 to 3.5 | 3.0 to 3.7 | 2.3 to 2.5 | 2.0 to 3.2 | 2.8 to 4.0 | 2.5 to 4.2 | 2.2 to 3.0 |

| Unemployment rate | 7.3 to 7.5 | 6.7 to 7.0 | 6.0 to 6.5 | 5.2 to 6.0 | 6.9 to 7.6 | 6.1 to 7.1 | 5.7 to 6.5 | 5.0 to 6.0 |

| December projection | 7.4 to 7.7 | 6.8 to 7.3 | 6.0 to 6.6 | 5.2 to 6.0 | 6.9 to 7.8 | 6.1 to 7.4 | 5.7 to 6.8 | 5.0 to 6.0 |

| PCE inflation | 1.3 to 1.7 | 1.5 to 2.0 | 1.7 to 2.0 | 2.0 | 1.3 to 2.0 | 1.4 to 2.1 | 1.6 to 2.6 | 2.0 |

| December projection | 1.3 to 2.0 | 1.5 to 2.0 | 1.7 to 2.0 | 2.0 | 1.3 to 2.0 | 1.4 to 2.2 | 1.5 to 2.2 | 2.0 |

| Core PCE inflation3 | 1.5 to 1.6 | 1.7 to 2.0 | 1.8 to 2.1 | 1.5 to 2.0 | 1.5 to 2.1 | 1.7 to 2.6 | ||

| December projection | 1.6 to 1.9 | 1.6 to 2.0 | 1.8 to 2.0 | 1.5 to 2.0 | 1.5 to 2.0 | 1.7 to 2.2 | ||

... the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored.

Annaly And CreXus Confirmation

Withthis announcement,the deal to acquire all remaining shares ofCreXus(CXS) is just about completed for $13.00 per share. The BOD of CreXus clearly supports the deal.

The Board of Directors of CreXus, acting in accordance with a unanimous recommendation by a Special Committee of that Board consisting entirely of directors who are independent and are not employees or affiliates of Annaly or any of its subsidiaries (including the Annaly subsidiary that manages CreXus, FIDAC), unanimously (with the two directors who are employees of Annaly not present or voting) determined to recommend that the CreXus stockholders, other than Annaly and its subsidiaries, tender their shares in response to the Offer.

While the deal seems unlikely to derail, Annaly has raised a few eyebrows by asking NLY shareholders toapprove shiftingits management to a newly created firm.

The firm's board is asking shareholders to approve at its annual meeting on May 23 a shift in which investing would be overseen by a new company called Annaly Management Co. owned by its management, according to a regulatory filing yesterday with the Securities and Exchange Commission.

What this will mean is that the amount each executive is paid will no longer be under public scrutiny. While moves like this do make me wonder why this is necessary, the amounts paid to top management has been viewed as excessive. That being said, the amounts are no more excessive than highly compensated hedge fund executives (as noted in the article). Based on the historical track record of the NLY management, I will not concern myself with this as long as the dividends keep rolling in.

On top of that, Annaly has stated for the record that if this strategy was in place last year, the company would have saved a significant amount of money.

Annaly's management company would be paid a base fee totaling 1.05 percent of stockholders' equity under the board's proposal, the firm said in the filing. The structure would have saved $48 million in expenses last year, Annaly said.

"During the past several years, a number of changes have occurred in our business and in the market that the independent members of our board of directors believe makes it desirable for us to externalize our management functions," the firm said.

My opinion is that the management team would be able to manage all of the business of both CreXus (under the Annaly wing of course) as well as FIDAC[which manages the business model of Chimera (CIM) right now], and the core business of Annaly itself, without the overblown scrutiny of finger pointers. As I stated, as long as the business profits, flourishes, and continues to pay solid dividends to shareholders, I will keep cashing the checks myself.

Annaly Declares A Dividend

When I decided to add NLY back into the core holdings of the Team Alpha Retirement Portfolio, I believed that thestable rate environment, as well as the slowdown in pre-payments, would give shareholders a better dividend outlook. At the same time, I also thought there might have been one or two small dividend cuts coming. As of yesterday, I was pleased to learn that I was wrong.

Withthis announcement, Annaly declared a dividend of $.45/share. While we do not know all of the details, suffice it to say that there was no cut this time, and I believe that with the current strategies in place, NLY could continue making the profits to pay these steady dividends.

As the longer term interest rates continue to remain stable, or even a bit higher, NLY could actually increase profits (and dividends). Not to mention whatever profits are accretive to NLY from the CreXus acquisition.

Keep in mind that there also might be another move that NLY makes, which would be a potential takeover of Chimera. While there has been no substantive discussions about that, there has been speculation from just about every journalist who follows this sector. While I never count the chickens before they hatch, it does give shareholders more food for thought.