http://seekingalpha.com/article/218573-what-the-new-record-10-year-30-year-treasury-bond-spread-means

What the New Record 10-Year, 30-Year Treasury Bond Spread Means

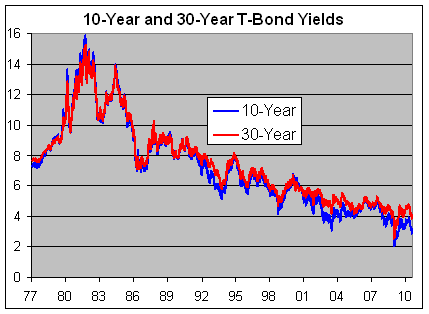

The spread between the 10-year (TNX) and 30-year Treasury is now at its widest spread ever since the 30-year started trading in 1977.

Here's a look at the two yields:

As you can see, the two bonds track each other pretty closely so it's hard to see the difference. Here's a look at just the difference between the two:

The spread is now at 114 basis points. We just took out the previous high of 111 points from October 6, 1992.

So what does this mean for the stock market? It's hard to say. It could mean that the deflation bet is off the table for now.

I ran the numbers and was surprised to learn that the S&P 500 hasn't shown any net capital gain whenever the 10-year/30-year spread is wider than 43 basis points.