Natural Gas Prices Have Bottomed

Summary

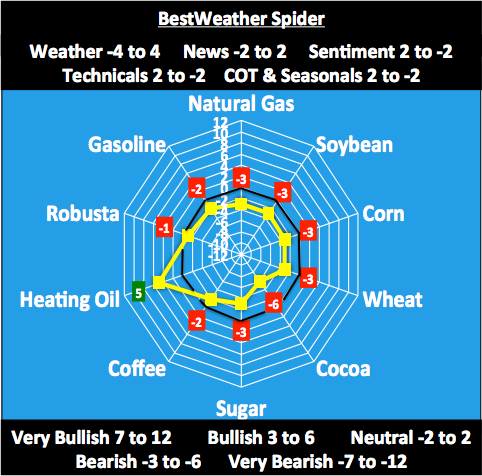

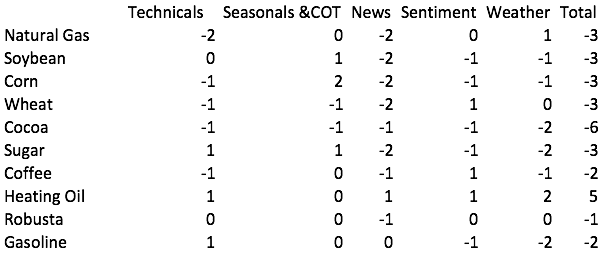

BestWeather Spider and La Nina impacts.

Big production increases, warm December and lack of U.S. snow cover pressures natural gas. but prices have bottomed.

For global grain markets, South American crops look good, but growing drought for Plains wheat.

My weather spider above was written a couple weeks ago for clients and is now old news. For wheat and natural gas (UGAZ), the weather should become a more bullish factor. See how La Nina actually made me predict mostly bearish ideas for many commodity markets. Cocoa (ETF:NIB), for example, has fallen some 15% the last few weeks and nearly 40% since the end of the last El Nino. For more information about La Nina and its effect on commodities click here.

If you would like to see a paid version on SA's Market Place with my weekly spider, please comment below. You can also comment on my blog here

The sell-off in Natural Gas

While we have expected a cold winter for U.S. natural gas areas, and some regions have had some decent snows and cold, La Niña is creating warm weather over the southern U.S. where production has been ramping up. Anytime there is a feeble rally in natural gas (UNG), commercial energy companies are hedging due to an extra 4BCF+ a day of production vs the last few years.

However, this could change for the month of January as a huge consistent block towards the North Pole potentially ushers in the coldest weather in a few years to the Midwest and East in coming weeks. I expect natural gas prices may bottom this week for a while and traders might want to look at some of these equities, which have lagged the S&P 500.

- Antero Resources (NYSE:AR)

- Gulfport Energy (NASDAQ:GPOR)

- Rice Energy (NYSE:RICE)

- Range Resources (NYSE:RRC)

- Southwestern Energy (NYSE:SWN)

When trading commodities based on weather, it is often the “supply” part of the equation that can create massive price rallies and commercial hedge fund panic. For example, the El Niño driven bull market in cocoa and sugar a year or two ago, or the Midwest corn and soybean droughts of 2011-2012 (just a few of many examples). With natural gas, however, there are NO supply disruptions. Give me -10°F temps in the Midwest and wells freezing along the Gulf coast, and I will give you a bull market in natural gas. This could well happen as snow cover increases in the Midwest or east by the end of the month.

Traders will be watching very closely the potential for some cold weather and a possible bottom in natural gas prices -- I still expect a cold winter as we head deeper into December and January. Heating oil and various spreads have been the “weather play” the last few weeks.

Traders are closely watching South American Weather for Corn/Soybeans and Plains Wheat drought

There has been a lot of talk and hype over La Niña and potentially devastating droughts for Argentina soybeans and corn. However, this talk has been over-done. Something we call the western hemispheric pool index (WHWP) has been positive. This has offset any consistent hot, dry potential for Argentina. You can see an article about this, and why wheat prices have not yet rallied, here. However, longer term, we like the wheat ETF (WEAT). The market has been under great pressure the last few months from huge global stocks and record Russian production. More of a high confidence trade in wheat will be formulated come spring, as we get into the main weather season.

选择“Disable on www.wenxuecity.com”

选择“Disable on www.wenxuecity.com”

选择“don't run on pages on this domain”

选择“don't run on pages on this domain”