Summary

- IsoRay's Cesium 131 cancer therapy is FDA approved, and superior to any cancer therapy by many measures, like the unmatched high 98% to 100% efficacy rate.

- IsoRay has a monopoly on the Cesium 131 brachytherapy market, and a recent valid CE Mark opens the door for significant revenue growth.

- Broad unawareness and warrant conversion pushed shares down to an irrationally low level, creating a very favorable risk vs reward investment opportunity.

Today's article features IsoRay (ISR), a virtually unknown small biotech stock listed on the AMEX. After hours of research and speaking with management, we found out IsoRay has developed the most cutting edge therapy for treating cancer patients, a market worth $77 billion annually, which is destined to become the standard of care. The five most important trends and catalysts for IsoRay are:

Number 1: The efficacy rate of IsoRay's Cesium 131 therapy is 98% to 100%.

IsoRay's Cesium 131 is the biggest advancement in 20 years in low-dose radiation therapy and brachytherapy. Studies prove a 100% success rate with low-risk prostate cancer and 98% success at five years for low and intermediate risk patients. These are truly phenomenal results, superior to any other radiation therapy.

Number 2: IsoRay's technology is FDA approved.

The fact that IsoRay's technology is FDA approved sets the company a warpspeed ahead of other biotech companies, who still linger in lengthy, risky and costly trial phases. For example, the FDA recently cleared liquid cesium for use in IsoRay's GliaSite radiation therapy system. GliaSite is a balloon catheter device used to treat certain brain cancer, and the FDA clearing should have a big impact in revenue growth.

Number 3: IsoRay holds a monopoly on Cesium 131.

IsoRay has a monopoly on the Cesium 131 brachytherapy market. Cesium 131 is the first new isotope to be available in seed form and now in liquid for brachytherapy and its issued patents and FDA approval for several types of cancer make the barrier for entry almost impossible.

Number 4: IsoRay received a five year extension to its CE mark covering IsoRay's entire product offering of Cesium-131 seeds.

A valid CE Mark permits IsoRay to sell its products in 33 European countries, which opens the door for significant revenue growth.

Number 5: IsoRay is dramatically undervalued.

At current levels, we think this stock is dramatically undervalued. Most investors do not even know this company exists, and the handful investors who do know may not fully comprehend the story. Shares are currently trading at $0.80, but we think it should be trading at $3.00 as we speak. Longer term, shares could be trading at much higher levels.

In order to understand more about the company, its technology and future prospects, we initiated a conference call with IsoRay's CEO, Dwight Babcock.

The interview

Dwight Babcock joined IsoRay as Chairman and CEO after having served as a director of the company. He has over 30 years experience as a CEO and has knowledge and experience in the equity arena and has participated in various activities within the venture capital, private and institutional capital markets. Following are excerpts of the interview:

Question: In layman's terms, could you explain what IsoRay is all about?

Dwight Babcock: IsoRay provides cutting edge internal radiation therapies for the treatment of cancer patients. Our therapy is a single application following the surgical removal of a tumor thus avoiding numerous return trips to the hospital for external beam radiation. IsoRay's solution not only provides the required dose of radiation but as a single treatment enhances the patient's quality of life.

Question: Could you give a brief technical explanation?

Dwight Babcock: Radiation therapy has been used in the treatment of cancer for over 100 years. In general, higher radiation doses lead to better cancer control. The radiation dose that can be delivered to any particular cancer is limited, however, as "collateral damage" can be very harmful to other nearby organs. IsoRay has developed treatment solutions that deliver high doses of radiation to a depth of 5-10 mm with minimal risk of injury to other, uninvolved body structures and surrounding healthy cells.

Question: For which type of cancer is IsoRay's technology being developed?

Dwight Babcock: The insertion of radiation therapy sources into cancerous tissue (brachytherapy) is best known in the treatment of prostate cancer, and IsoRay's cesium-131 sources have been used widely in over 8,000 patients for the treatment of prostate cancer. Currently study reports show a 98% biochemical success (PSA) at 5 years which is the highest success of any modality/treatment. Other current targets for IsoRay's products which involve current study include cancers of the brain, head & neck, lung, vagina and uterine cervix, and pelvic floor. Applications under development and showing promise include treatments for pancreatic, esophageal and breast cancers.

Question: To what degree is the technology validated?

Dwight Babcock: The principles of radiation oncology have been long established dating back over 100 years and are applicable to IsoRay's radiation therapy products today. IsoRay has developed patented technology in the separation of Cesium-131 with a 9.7 day half-life and providing it in a medical device for the treatment of aggressive cancers which has never been done before. In terms of clinical results, reports continue to emerge demonstrating the effectiveness and absence of complications associated with IsoRay's products while providing amazing results. Recent reports which should be published in the near term have described excellent five year disease control in prostate cancer as well as very positive reports on outcomes following brain, head and neck, lung and gynaecologic cancers.

Question: How is IsoRay's technology any better or different than what's on the market now?

Dwight Babcock: The majority of radiation-based cancer treatments are delivered by "external beam" - a powerful ionizing radiation stream that originates in a machine outside the body and is pointed at the cancerous target inside the body or where the tumor was removed. Because the beam must travel through the body to get to its target (and continue to travel on its way out), organs and other bodily structures outside the cancerous target can take high doses of radiation, a scenario that may and often does produce complications. IsoRay markets products based on the idea of "brachytherapy", where the radiation source is placed in very close proximity to the cancerous target. In this way uninvolved structures can be spared from significant radiation dose while destroying any localized cancer cells left in the tumor bed or margins.

While other brachytherapy products are used in the treatment of cancer, IsoRay's products possess specific advantages that make them best-in-class. IsoRay's permanently implantable cesium-131 based products, for instance, contain the fastest decaying isotope available 9.7 day half-life with the energies typically used in permanent brachytherapy. The biologic benefits of fast decaying isotopes has been an area of intense interest for many years, and recent reports suggest a faster resolution of common side effects with IsoRay's cesium-131 based products when compared to other, longer-lived brachytherapy isotopes like iodine which has a 60 day half-life. Important to note the shorter half-life allows cesium-131 to successfully treat fast growing cancers such as brain, lung and others mentioned previously.

Question: How valuable are IsoRay's patents?

Dwight Babcock: IsoRay owns issued patent claims related to (1.) the chemistry of cesium-131 separation - without which highly purified cesium-131 is very difficult and expensive to obtain and (2.) the construction of IsoRay's proprietary CS-1 permanently implantable cesium-131 source.

Question: To what degree is the technology already being adopted by the medical community?

Dwight Babcock: We have medical institutions utilizing our products and performing medical studies and they all purchase our products unlike pharma which has to give their products for study purposes.

Question: A couple of weeks back, the FDA cleared liquid cesium for use in IsoRay's GliaSite radiation therapy system. What does this exactly mean?

Dwight Babcock: IsoRay manufactures and markets the GliaSite Radiation Therapy System (RTS). This FDA cleared device delivers radiation to brain tissue that is very likely to harbor recurrent cancer after surgery. For GliaSite treatment, a sophisticated "balloon" is placed in the brain, after which it is filled with a radioactive solution. In this way high doses of radiation can be delivered where cancer cells are residing without depositing dose to healthy brain tissue. The original radioactive solution used with the GliaSite RTS (Iotrex) utilized the radioactive isotope iodine-125. The addition of liquid cesium-131 as an alternative to Iotrex allows centers who use GliaSite to choose from two options which have different radiation protection requirements - with liquid cesium-131 being somewhat easier to handle. Liquid cesium-131 should have a big impact in our revenue even during our early studies.

Question: 3 weeks later, IsoRay received a five year extension to its CE mark covering IsoRay's entire product offering of Cesium-131 seeds. What does this mean?

Dwight Babcock: CE marks are given in 5 year terms. This was a renewal and confirmed our current product success and that we met all the required reporting and manufacturing standards. Obtaining and maintaining a valid CE mark allows IsoRay to market in 33 European countries that require it in order to sell medical devices. IsoRay is currently engaging European distributors for its products.

Question: What do you think IsoRay is actually worth today?

Dwight Babcock: I believe easily $1.50-2.50 per share. If it were a pharma it would be $25-50. Pharma can't sell its product into studies and generate revenue until they get FDA approval. We sell our product into studies being FDA cleared thus avoiding dilution equal to the annual revenue amount. People often think that with revenues flat we are not getting traction, however the revenue created from study sales will be flat until publication. The positive news is the current studies that are now just waiting for their data to accrue continue to buy as they know how successful the treatment has been but can't report just yet.

Question: How large is IsoRay's addressable market?

Dwight Babcock: We estimate addressable $45 billion and our current portfolio could secure $350 million.

Question: What's your current cash and debt position?

Dwight Babcock: It was last reported approximately $8 million assets and $6 million cash and we have no debt.

Question: What's your cash burn?

Dwight Babcock: About $0.25 million per month.

Question: What can investors broadly expect from IsoRay?

Dwight Babcock: To continue to innovate with our disruptive technology and press the market with the lowest cost solution, highest efficacy and improved lifestyle for those afflicted with cancer. These are the items that will then dive superior shareholder returns.

Question: What are the major catalysts shareholders can expect?

Dwight Babcock: Launch of a GliaSite study with Iotrex and soon Liquid Cesium 131. We continue to have new adopters in brain and lung cancer and anticipate a new body site in Pancreatic cancer.

(end of interview)

Interview summary: Dwight Babcock was so kind to provide us some valuable information. First of all, IsoRay holds an highly disruptive technology in the cancer market, unrivalled by any other company. Secondly, IsoRay is financially healthy. Low cash burn, ample cash and no debt are exactly the features biotech investors wish for. Furthermore, the company's current valuation does not reflect the company's true potential, which provides investors an opportunity for a short-term 100% gain. Longer term, the return could be much greater, as several catalysts are to unfold.

Scientific research underlines brachytherapy is to become standard of care

Many academic research reports predict brachytherapy will become standard of care for certain types of cancer, surpassing the use of surgery, chemotherapy and regular radiation therapy. For example, it's widely known high-risk prostate cancer represents a therapeutic challenge for both the urologist and radiation oncologist. Biochemical outcomes with radical prostatectomy and external-beam radiation therapy are poor in this subset of patients. These unfavourable results have led some to believe that high-risk prostate cancer is not curable with conventional treatment approaches, which has been an impetus for many of the current trials using chemotherapy and prostatectomy. With the established efficacy of interstitial brachytherapy, these efforts are likely excessive. Most modern trials indicate excellent biochemical control rates among high-risk patients treated with an aggressive locoregional approach that includes brachytherapy. A thoughtful review of the literature would suggest that interstitial brachytherapy offers a therapeutic advantage over other local treatment modalities andshould be considered standard treatment for aggressive organ-confined prostate cancer. The most compelling evidence is the outcomes data published by several of the highest-volume prostate brachytherapy centers in the United States. Modern brachytherapy trials continue to demonstrate excellent clinical outcomes for other types of cancer as well.

Why we believe IsoRay's brachytherapy stands out

Brachytherapy has a bright future, but here's why we believe IsoRay, among many cancer stocks, is the cancer stock to own:

Number 1: IsoRay's Cesium-131 in liquid form, used with the GliaSite radiation therapy system, as well as the sutured seeds and seeded mesh products, provide physicians exactly the ability to directly place a specified dosage of radiation in areas where cancer is most likely to remain after completion of brain tumor removal. The ability to precisely place a specified dose of radiation means there is less likelihood for damage to occur to healthy brain and lung tissue as well as critical structures compared to other alternative treatments. IsoRay's cancer fighting products reduce the ability of the tumor to recur, which means important benefits for patients in longevity as well as quality of life.

Number 2: IsoRay has a monopoly on the Cesium 131 brachytherapy market; the first new isotope to be available in seed form and now in liquid for brachytherapy. Its issued patents and FDA approval for several types of cancer protects the company from competitors entering the market. Cesium-131 allows for the precise treatment of many different cancers (brain, head and neck, lung, prostate and gynaecological) because of its unrivalled blend of high energy and its 9.7 day half-life (its unequalled speed in giving off therapeutic radiation). IsoRay's Cesium 131 is probably the biggest advancement in low-dose radiation therapy and brachytherapy in the last decades.

Number 3: In prostate alone a five-year history shows the company has achieved 100% success with low-risk prostate cancer and 98% success at five years for low and intermediate risk patients. Such high efficacy rates are superior to any other low-dose radiation isotope or any other modality such as prostatectomy and/or external radiation therapy.

Number 4: IsoRay's therapy is less expensive than most other forms.

Number 5: It also comes with fewer side effects compared to any of the existing solutions.

Number 6: The medical community is already adopting IsoRay's technology. For example, a couple of weeks back the company announced it has two more medical centers use its sutured seeds in mesh to treat colon and lung cancers. Management routinely hears from potential new adopters considering Cesium-131 in the coming year based on the abstracts being presented at various conventions showing the early successes of utilizing Cesium-131 to fight difficult cancers, and managements expect results from additional studies to be presented in the remainder of 2014, with many studies approaching time frames where peer reviewed articles can be expected to be published in the coming quarters.

CEO Dwight Babcock noted:

"We are extremely encouraged by the number of new facilities taking notice of the successes achieved by other major cancer centers when Cesium-131 is made available to their patients. We are excited to have the University of California and John Muir Medical Center as our newest thought leaders utilizing Cesium-131 products for newly diagnosed and recurrent cancers where other treatments have previously failed. Currently all of our studies in multiple medical centers are performing well with positive results in treating brain cancers, meningioma tumors, pelvic wall, lung cancer, colon cancer, gynecologic cancer and prostate cancer with our Cesium-131 product line. We are making a difference in thousands of lives by providing new ideas and solutions in the battle against cancer and we believe Cesium-131 is the isotope of the future."

Why a valid CE Mark could lead to significant revenue growth

The extension of a valid CE Mark allows IsoRay to market in 31 European countries that require it in order to sell medical devices for another 5 years. This extension greatly enhances revenue potential. In Europe alone, 3.5 million unfortunate new cancer cases are detected each year. In fact, the European market as a whole is bigger than the US. Also, CE Marking on a product is considered as an indication of conformance to laid down minimum standards, and therefore a minimum level of quality which other products may lack. CE Marking is thus for many a symbol of quality. The European Commission refers to it as a 'passport' which allows products to be freely circulated within the EU single market. According to the CEO, the company is currently engaging European distributors for its products. The company just achieved its first success already, as it announced yesterday that IASIS Medical has received formal approval for the sale of IsoRay's complete product line in Greece.

CEO Dwight Babcock commented:

"We are very optimistic about the unique opportunities for growth in Greece for our expanding product line and look to the international market to contribute it the future of IsoRay's profitability. IsoRay's products currently carry FDA clearance and the CE Mark, making them eligible to be sold in 31 European nations. Physicians and institutions throughout the US are continuing to report outstanding results in the use of our Cs-131 seeds for brain cancer, head and neck cancer, prostate cancer and lung cancers. As peer reviewed papers are released we anticipate a growing acceptance and interest in our products. We remain committed to our strategic national and international marketing objectives and believe this will contribute to our long term success and shareholder value."

We expect other European countries to follow suit soon.

Comparison shows how undervalued IsoRay is

Let's analyze how IsoRay's current valuation compares to other cancer plays:

- Ziopharma (ZIOP), has a whopping price/sales multiple of 468, price/book 102, low cash, high burn, is still lingering in a Phase II trial, and has a market cap of $368 million.

- Threshold Pharmaceuticals (THLD), has a high price/sales multiple of 25, negative book value, high debt, is still lingering in a Phase III trial, and has a market cap of $277 million.

- Synta Pharmaceuticals (SNTA), generates no revenue at all, low cash, high debt, high burn, is still lingering in Phase II/III trials, and has a market cap of $445 million.

- Endocyte (ECYT), high burn, is still lingering in Phase II/III trials, and has a market cap of $558 million.

- IsoRay: low price/sales multiple of 5, no debt, ample cash, low burn, FDA approval and a market cap of....just $30 million.

The other cancer plays are trading at high multiples because the cancer market is so big, and margins are so high. Even if IsoRay, with its superior features, were given what we consider a low market cap of $120 million, shares would be trading at $3 right now, which still would be undervalued by comparison. The vast difference in valuation defies all logic, and emphasizes our belief IsoRay is, at current levels, dramatically undervalued.

Why is the market cap so low?

It comes down to this: most do not even know this stock exists, and the investors who do know may not fully comprehend its potential. But if are you willing to do the work (contact management, study SEC filings, scientific papers, etc), it becomes possible to decipher a valuation. Based on above comparison, we think the share price should be at least $3.00 today.

Near end of warrant overhang provides ideal investment opportunity

An other good reason for the low share price is the warrant supply that came with a equity financing last year. Remember, most warrant holders are arbitrageurs, not buy and hold investors, who simply lock in profit when they have the opportunity. This created an artificial form of selling pressure which lasted months. Behavioral finance research suggests such a selling pressure causes shareholders to wrongly assume the selling has anything to with the underlying business, while in fact it isn't, and start selling as well (vicious cycle), or are forced to sell (stop-losses, margin calls).

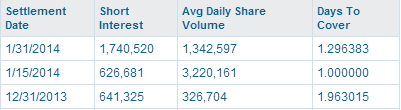

We analyzed the share price pattern and conclude the warrant overhang is nearly gone. Here's why: late August, the company issued 3.1 million warrants with a strike price of $0.53 to be exercised directly and 5.6 million warrants with a strike price of $0.72 exercisable after 6 months. So the $0.53 warrant holders began exercising the warrants, slowly pushing the share price down to the $0.53 strike price. A few months later, the FDA approval and the CE Mark extension were announced. The share price exploded to a high of $1.19, on a trading volume that surpassed 15 million shares. We believe the $0.53 warrants are now all exercised, and not only that, the holders of the 5.6 million warrants with a strike price of $0.72 began 'exercising' by shorting the stock, that pushed the share price even further down. Check out the sudden increase in shorts:

We think the warrant holders caused this, because the 6 months lock-up period was not over yet (it now is). We suspect the short interest is higher as we speak, because the official short statistics are lagging. We will soon know.

That begs the question: how many $0.72 warrants are left to be exercised? We estimate there are 2 million or less left, and think the warrant holders are exercising in the $0.85 - $0.90 range. But 2 million is relatively small since the average daily volume is about 1 million. On the other hand, it could also be that some warrants holders decide not to exercise at current levels, because IsoRay is so undervalued. Also keep in mind that warrant conversion leads to more cash to the balance sheet, which is obviously a positive.

But here's the really good news: because of this 'artificially' low share price, investors now have the opportunity to buy overly cheap shares on the open market. The last time we spotted such a compelling buy due to warrant arbitrage was Tonix Pharmaceuticals (TNXP). Warrant conversion kept the share price at irrationally low levels, and the moment an high-impact article by a fellow SA author was published, the remaining warrant supply was gobbled up quickly, shorts began covering, and the share price went from $4 to $12 in just a couple of weeks.

What could IsoRay be worth?

According to management, the company's current portfolio is able to secure $350 million in a $45 billion addressable market. Any statistic will tell you this market is growing, but let's stay conservative and set the growth at a rate of zero. We go with management estimates, and think IsoRay is able to capture $350 million in revenue at least, which is in our view very conservative. $350 million revenue, with 40 million shares outstanding and a price/sales multiple of 3 (industry average is much higher) translates to a value of $25 per share, or a 30X return on investment.

But as discussed, chances are IsoRay will become standard of care, and seize a monopoly position. Our estimates will then prove to be way off the mark, and shares could then be trading at $50 and above. As mentioned, IsoRay holds an highly unrivalled disruptive technology, and if management executes well, shareholders could be rewarded immensely, by initiating a long position at current low levels.

IsoRay's financial status

On the balance sheet sits about $6 million cash, $8 million in assets and no debt. Given the monthly cash burn of about $0.25 million, we believe IsoRay is fully funded for at least 16-20 months. This substantially diminishes any near-term dilution risk. The fact that the stock price is trading not much above book value, and the fact that IsoRay is already generating revenue, limit downside risk.

Insiders continue to buy shares

During the last 2 years, insiders across the board bought shares on a regular basis - most were direct purchases in the open market - and the CEO bought a sizeable amount just a few months ago. We always like to see insider buying as confirmation of such an undervalued situation.

Analyst firm puts IsoRay on buy

Maxim Group, a leading investment banking, securities and investment management firm with a premier niche is emerging-growth companies, recently initiated coverage. According to them, IsoRay is severely undervalued, and the firm has put a $1.50 short-term price target on the stock. That means investors could double their investment by going long at current levels. We like to stress that the best timing often is to get on board before institutions step in. Right now, institutional ownership is quite low (3%), but that could change the moment small-cap fund managers discover this stock, that may create large pent-up demand for IsoRay shares in the process.

Risks involved

A primary risk is any delay in the roll-out of its products. IsoRay is listed on the stock market for a while now, and due to delays, investors haven't really seen a return on their investment yet.

Secondly, the presumed remaining warrant supply could temporary cap any share price appreciation. If so, it will only last a few days, and since the conversion brings new cash to the balance sheet, the risk factor will actually be reduced.

Lastly, we do not expect dilution this year, but if IsoRay keeps incurring losses, management might be forced to dilute again. We expect the market cap to be substantially higher, so impact will be low.

Conclusion

IsoRay is a dramatically undervalued stock. Unknown to many, its FDA approved technology is becoming the standard of care in treating cancer patients, and if they succeed, shareholders will be rewarded with a tremendous return on their investments. Right now, warrant arbitrage and complete unawareness pushed the share price down to an irrationally low level, but this is about to change. The moment Wall Street catches on, IsoRay's share price could rise substantially. Meanwhile, the healthy financials limit downside risk. Similar to our previous recommendations that returned investors big short-term gains, IsoRay offers the ideal investment opportunity: little downside risk, huge upside potential.

For full disclosure and disclaimer information click here

Editor's Note: This article covers a stock trading at less than $1 per share and/or has less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Editor's Note: This article covers a stock trading at less than $1 per share and/or has less than a $100 million market cap. Please be aware of the risks associated with these stocks.

选择“Disable on www.wenxuecity.com”

选择“Disable on www.wenxuecity.com”

选择“don't run on pages on this domain”

选择“don't run on pages on this domain”