People'll point out that the apple company is still growing fast, that the third quarter saw revenues grow 27%, and earnings grow 23%, and that analysts are expecting 12% growth in 2013 and 18% in 2014. Then they’ll point to the stock’s forward PE ratio of 12 and say, “Apple is cheap!”

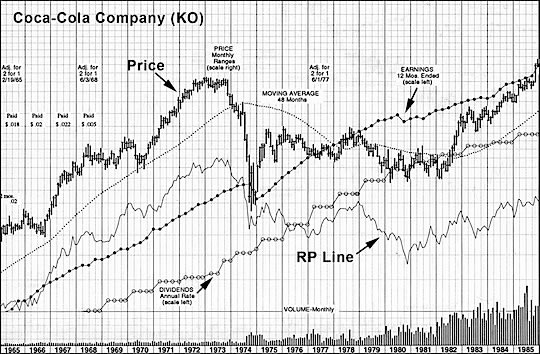

But before I get deeper into Apple’s case, I want you to study this long-term chart of Coca-Cola (KO) (the number one brand in the world today), spanning the years from 1965 to the end of 1985.

Note the earnings line, with each dot marking a quarterly earnings figure. It’s a steady uptrend, with the exception of a sharp dip in late 1974 and a stumble in 1981-1982. Then look at the dividend line; Coke’s dividends were increased every year, like clockwork. Finally, observe the price line, noting that Coke’s price peaked in late 1972 and didn’t exceed that level until late 1985, 13 years later.

The explanation for those “lost 13 years” lies not in the numbers; it lies in crowd psychology, and specifically, in the investing environment of the times.

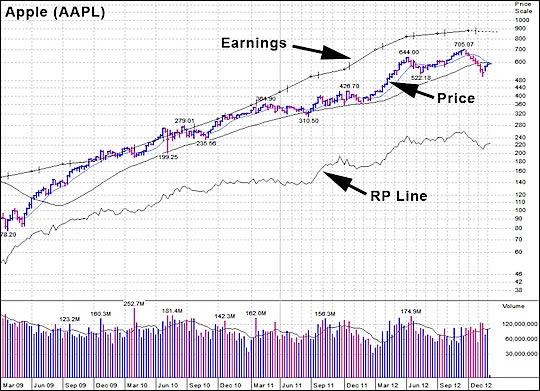

Here’s Apple’s chart, since the 2009 bottom.

Note that over the past four years, whenever AAPL corrected, its RP line basically flattened out (ignoring the tiny weekly movements). But in this year’s correction, AAPL’s RP line turned down, and for eight weeks, AAPL performed worse than the overall market.

Now, this underperformance alone is not the kiss of death. Many stocks can pull out of similar corrections and move out to new highs.

But look back at Coke’s chart. If you look at the RP line, you’ll see the same pattern! From 1964 through 1973, KO was pretty healthy, beating the broad market overall, and holding its own in corrections. But after 1973, as sentiment turned, and the selling pressures slowly overwhelmed buying pressures, KO’s RP turned clearly negative, beginning a pattern that lasted many years longer than most investors could stomach.

And that’s very likely where AAPL is today.

So when you put it all together…

• The extremely high market cap

• The extremely positive public opinion

•The extremely high level of institutional ownership

• The deceleration of earnings growth

• The weakening relative performance line

…it looks ominous.

Now, big, well-respected stocks don’t collapse overnight. To the contrary; when a high-quality stock like Apple pulls back, you’ll hear a new chorus of “It’s a great value down here” and “Buy the dips.” But as time goes by, and the stock fails to return to its old highs, those choruses fade, and the stock falls slowly out of the limelight—just like Coca-Cola did in the 1970s.