当11/3/2021,FOMC正式宣布Tapering,美国长期国债的价格非但不跌,而且还涨,其内在逻辑是怎样?几天来一直让人困惑,直至看到下面的一段:

The U.S. Treasury announced reduced issuance across maturities. The 20-year auction will see the largest cut, followed by the 7-year and then other maturities across the curve. Some estimates call for cuts of approximately $800 billion in issuance from October of this year through the end of next year. Remember this $800 billion number. At the same time, the Federal Reserve announced that it will begin tapering asset purchases by $15 billion per month ($10 billion of Treasuries with the remainder being mortgage-backed securities). At this pace, pandemic-related quantitative easing will wind down by mid-2022. The Fed taper will result in a net reduction in purchases of approximately $800 billion. Sound familiar?

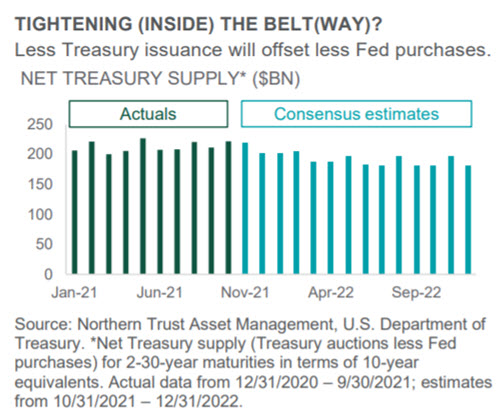

Another way to view this is in 10-year equivalent duration terms. We take every tenor that is auctioned by the U.S. Treasury, and the same for the Fed Permanent Open Market Operations (POMO), and convert them into a common duration of 10 years. The chart to the right shows the expected monthly net Treasury supply (i.e. Treasury issuance less Fed POMO) in terms of 10-year equivalents. Despite the Fed pumping the brakes on purchases, net Treasury supply is not expected to materially rise. Less net issuance and still-transitory inflation will keep rates low.

所以,

- The Federal Reserve has announced the beginning of their tapering — likely to be concluded by mid-2022.

- Treasury issuance will fall over the next year.

- The two points above net out and will keep rates low.

选择“Disable on www.wenxuecity.com”

选择“Disable on www.wenxuecity.com”

选择“don't run on pages on this domain”

选择“don't run on pages on this domain”