Tesla: Get Ready For Another Profitable Fourth Quarter

Tesla has been on fire lately (in a good way), appreciating by roughly 125% from its mid-year lows.

Despite some weakness in the first two quarters of 2019, Tesla delivered an outstanding Q3, and Q4 is likely to be even more profitable.

Tesla's Gigafactory in Shanghai is already rolling out Model 3s and the company is planning to start construction on its next Gigafactory in Europe in 2020.

The company is positioning itself to produce up to 1.5 million vehicles annually within the next 5 years or so.

Revenues, efficiency, profits, and the company's share price are likely to increase substantially in future years.

This idea was discussed in more depth with members of my private investing community, Albright Investment Group . Get started today »

Source: CNBC.com

Source: CNBC.com

Tesla: Brace Yourselves For Another Profitable Quarter

Tesla (TSLA) has been on fire lately (in a good way), as the stock charged through to new all-time highs above $400 in recent trading sessions due to increased optimism and various positive fundamental developments. In fact, shares are now up by about 125% since my “Tesla: In the Buy Zone Now” article was released in late May, and are likely going substantially higher over the intermediate and long term.

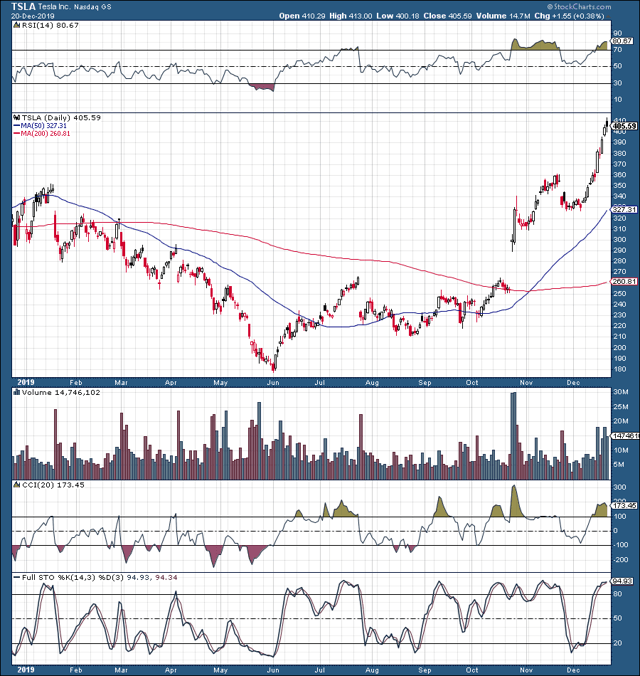

Tesla 1-Year Chart

Source: StockCharts.com

On a side note, Tesla's chart now looks massively overbought, and if I were a short to intermediate term trader, I would be taking profits, hedging, selling calls, or possibly even shorting the stock here. The black candle on Friday looks particularly bearish and a temporary reversal looks likely from here. Nevertheless, long-term the stock is still likely going much higher.

Now, back to the analysis:

Tesla’s stock temporarily dipped under the $200 level due to a “worse than expected” Q1. The company lost a staggering $702 million in the first quarter, followed by another significant loss of $408 million in Q2. Thus, it is understandable that the stock has been volatile, and shares were under some temporary pressure throughout parts of 2019.

Nevertheless, and despite such losses, the company’s cash position remained strong throughout the year, the high Tesla vehicle penetration rate in the U.S. appears to be a transitory phenomenon, the Chinese Gigafactory is already rolling cars out in China, Tesla is planing to start building its next Gigafactory in Europe (Germany), the company has a very strong pipeline filled with remarkable new vehicles, Q3 financial results were much better than anticipated, and Q4 will probably be another extremely profitable quarter for Tesla.

Therefore, while there is a good possibility that Tesla shares may correct, and/or go through a consolidation phase in the short term, I expect the stock can continue to move much higher long term. As Tesla continues to increase sales, improve production efficiency, continues to build its revolutionary ecosystem, and resumes to capture substantial market share in the global vehicle market, the stock should proceed appreciating long term.

So, What Will Q4 Look Like?

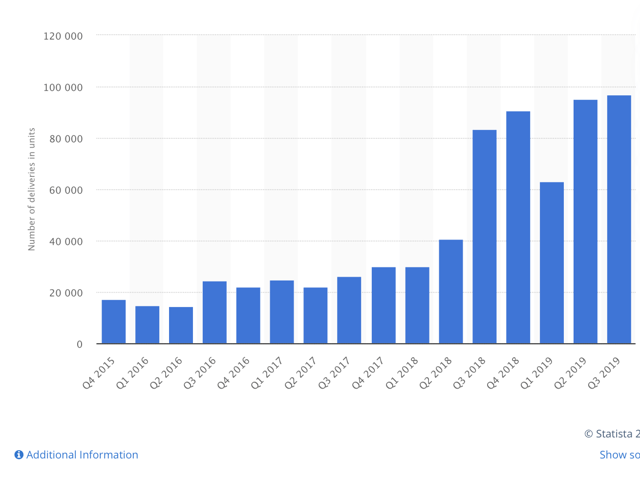

Tesla sold roughly 255,200 vehicles in the first 3 quarters of 2019. It’s also important to mention that deliveries in Q2 and Q3 were roughly 50% above Q1. This tells us that Tesla can scale production extremely well and demand remains robust for Tesla vehicles despite the lackluster results we witnessed in the first quarter.

Tesla Sales by Quarter

Source: Statista.com

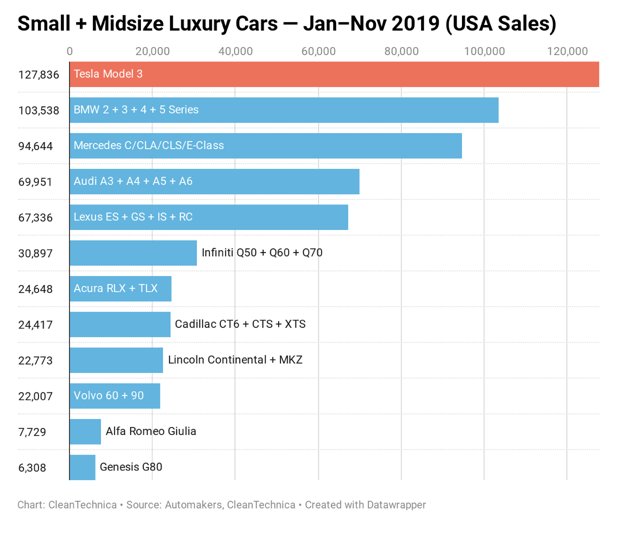

Source: CleanTechnica.com

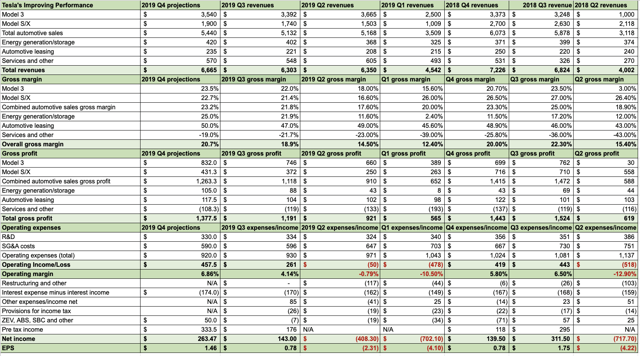

Furthermore, we can see that Tesla’s margins improved substantially in recent quarters. For instance, if we compare Q2 2019 with Q3 2019, overall gross margin improved dramatically from just 14.5% to 18.9%, operating margin went up from negative 0.8% in Q2 to about 4.14% in Q3, and thus Tesla delivered a much higher profit in Q3 2019 than most analysts expected.

Additionally, the trend of improved efficiency and higher margins is likely to continue in Q4 and Tesla could deliver substantially more vehicles than it has in any other previous quarter. We know that Tesla has repeatedly reiterated that it will very likely deliver more than 360,000 total vehicles this year. This implies that in Q4 Tesla will probably deliver at least 105,000 total vehicles, and that is if the company hits its low-end target range of 360K.

Results could be higher, but for the sake of keeping our projections conservative, let’s presume the company delivers just 105K automobiles in Q4. This is only about an 8% increase over Q3, and about a 16% YoY rise. In Q3, Tesla delivered roughly 80K Model 3s and about 17.5K Model S/X vehicles. If we add 8% to the Model S/X deliveries, we arrive at roughly 19K Model S/X vehicles, which would leave roughly 86K Model 3 deliveries in Q4.

We can apply an average selling price (ASP) of roughly $100K for each Model S/X vehicle, and an ASP of about $45K for Model 3s. This will amount to roughly $3.54 billion in revenues for the Model 3 segment, and about $1.9 billion in revenues for the Model S/X segment. Other segments like energy generation and storage, leasing, services, etc. will likely stay around the same or rise slightly from prior quarters.

Thus, our projections for Q3 revenues are:

- Model 3: $3.54 billion

- Model S/X: $1.9 billion

- Energy generation and storage EGS: $420 million

- Automotive leasing: $235 million

- Services and other $570 million

- Total revenues: $6.665 billion

Once again, I believe I am being conservative here. My projections are slightly below consensus analysts’ figures of $6.86 billion, and the Model 3s rolling off the Gigafactory in China may enable the company to deliver 110K vehicles or more in the quarter. Nevertheless, let’s stick with my conservative revenue estimates that are just 5.5% higher QoQ and are below last year’s Q4’s results by nearly 8%.

The key factor to consider here is the increased efficiency. As Tesla grows and optimizes its production processes, its economies of scale are likely to continue to improve. Just look at some of the numbers from the last few quarters, which are rather remarkable in my view.

In Q1 2019, overall gross margin was only about 12.5%, in Q2 2019, gross margin was roughly 14.5%, but then in Q3, we see a sharp spike to nearly 19%.

Why is this happening?

Because efficiency is improving across the board. Let’s look at individual segments. EGS gross margin went from 2.4% in Q1 2019, to 11.6% in Q2, to 22% last quarter. We can see that Tesla’s EGS unit is becoming increasingly more profitable, thus I expect Q4 gross margin can come in at about 25%. Automotive leasing is likely to remain extremely profitable with a gross margin of around 45-50%. Services and other is becoming far less unprofitable, as gross margin has improved from -39%, to -23%, to -21.7% last quarter. We are likely to see a continuation of this trend here as well, thus, gross margin in this segment may improve to about -19% in Q4.

Automotive sales gross margin has been somewhat inconsistent, but this is largely due to several transitory factors. We saw it hit a high of 25% in Q3 of last year due to robust Model S/X sales, and extraordinarily high Model 3 ASPs. Then there was a slight dip, and we saw a low of just 17.2% in Q2 of this year. Now, this was likely due to relatively weak demand for Model S/X vehicles, the introduction of the base Model 3 version, as well as other transitory factors. However, we saw a very nice bounce back to 21.8% in Q3 (last quarter), and Q4’s automotive sales gross margin should improve further to around 22-23% in my view.

Now, let us look at the other side of the equation, Tesla’s operating expenses. Despite the higher number of vehicles being sold overseas, and more products entering the pipeline SG&A and R&D expenses have been falling substantially, once again pointing to increased efficiency, better management, economies of scale, etc.

For instance, Tesla’s Q2 2018 revenues were roughly $4 billion, yet in Q2 2019, Tesla’s revenues were nearly 60% higher. If we look at operating costs, in Q2 2018, Tesla’s operating costs totaled roughly $1.137 billion. Despite a revenue surge of nearly 60%, Tesla’s Q2 2019 operating costs came in at just $971 million, a YoY decrease of 15%. So, quite remarkably, we see revenues spike by 60%, and operating costs drop by 15% YoY simultaneously.

In fact, substantial improvements in operating costs has been an ongoing trend at Tesla in recent quarters. Operating expenses last quarter were only $930 million, with SG&A expenses at just $596 million. This is a decrease of over 18% in SG&A expenses YoY, quite extraordinary, especially considering the increased number of vehicles being shipped to Europe and to other parts of the world.

Therefore, the evidence is in the numbers, and it seems quite clear that Tesla is becoming a much more efficient company with scale, is continuously optimizing operations, and this trend will likely continue to lead the company to a path of increased profitability going forward.

Here is a preview of what Q4 numbers could look like:

Source: Author's Material

Despite my revenue forecast being slightly lower than the consensus on the street, I expect that Tesla will continue to show improved efficiency and that its automotive gross margin can come in at around 23%. Furthermore, the company’s overall gross margin should come in at around 20% in my view.

This should provide Tesla with a gross profit of around $1.38 billion for the quarter. On the operating side, continued improvements in efficiency should enable the company’s operating costs to remain around where they were last quarter, or possibly even decrease slightly. Thus, I am projecting an operating income of around $457 million, with an operating margin of roughly 6.8%. I factored in about $50 million in ZEV credit income, thus the company’s pretax income could be around $333 million. Minus income tax, Tesla should deliver roughly $263 million in net income or $1.46 per share. This is essentially what the analysts on the Street are looking for as consensus estimates for Q4 are for $1.40 per share.

Source: Finance.Yahoo.com

Nevertheless, I believe that many analysts are still asleep at the wheel for next year’s estimates, as consensus figures are looking for only about $5.40 per share. Yet, some estimates do go as high as $14.40. My estimate for next year is roughly in the middle at $9.50 per share, putting Tesla’s current forward P/E at just around 42.5 (by my calculations). This is relatively cheap in my view as the company is likely to increase revenues and profits dramatically over the next 5-10 years. It is no secret that long term (5-15 years) I expect shares to go much higher.

Factors That Will Drive Future Revenues and Profits

The Model Y

Model Y production is scheduled to begin in 2020 and the vehicle should be available sometime in the summer of 2020. This is a crossover vehicle that shares many of the same parts with the Model 3. This implies that it will likely be extremely profitable, relatively easy to produce in large scale, and could be enormously popular.

The consensus now is that the vehicle will be constructed at Tesla’s Fremont factory as well as at Tesla’s factory in Shanghai. Company insiders, including Elon Musk, have also expressed that due to the popularity of the crossover vehicle across the globe, the Model Y is likely to experience substantially higher demand than the Model 3 vehicle, perhaps double. This implies the Model Y could sell around 500K units or more annually in the early 2020s (2021/2022).

Tesla’s Gigafactory in Shanghai

The Gigafactory in Shanghai has been a remarkable construction marvel, as in just around a year the factory went from zero to now rolling out Model 3s across China. Additionally, the factory is expected to eventually produce Model Ys as well. The Gigafactory in China is expected to produce roughly 500,000 vehicles annually when production reaches full capacity in future years.

Next Gigafactory in Germany

Tesla is already making plans to start production on its next Gigafactory. This one will be in Europe, Germany to be more precise. Construction is expected to start in 2020 and end in 2021. Judging by the record time Tesla brought its Chinese Gigafactory online, the company’s plans for Germany seem completely plausible. This factory is also expected to produce around 500,000 vehicles annually at full capacity. It appears that its main production goals will be Model Y and Model 3 vehicles for the European market.

Strategic Production

With production facilities in the U.S., China, and in Europe, Tesla will be in a prime position to construct and deliver roughly 1.5 million vehicles annually within the next several years. Moreover, the three main Gigafactories will make Tesla’s logistic channels much more efficient and the company should be able to deliver vehicles relatively inexpensively to most parts of the globe. This is about a quadrupling in production over the 360,000-400,000 vehicles Tesla projects to deliver this year.

This essentially means that in vehicle revenues alone we could see about a 4x increase by around the year 2025. Now, this is only counting the Model S/X, Model 3, and Model Y vehicles. This is not including Tesla’s plans for its Semi, Roadster, and Cybertruck production.

Nevertheless, if we figure annual worldwide demand could be for around 150,000 Model S/X vehicles by 2025, about 500K Model 3 vehicles, and for roughly 850K Model Y vehicles, we can expect core vehicle revenues as follows:

- Model S/X: 150,000 units x $100,000 ASP = $15 billion

- Model 3: 500,000 units x $42,500 ASP = $21.25 billion

- Model Y: 850,000 units x $45,000 ASP = $38.25 billion

- Total Automobile Sales 2025 (estimate) = $74.5 billion

This year Tesla’s automotive revenues will be roughly $19.24 billion, thus an increase to $74.5 billion by 2025 will be a rise of roughly 3.87 times, or about 287%. Of course, these are estimates, and they will require efficient execution, scale, demand, and other factors to align to materialize. Nevertheless, Tesla’s past performance and its ability to overcome significant obstacles imply that the proposed scenario is fully plausible within a 5-year time frame.

The Bottom Line: Expect a Strong Q4 and a Solid 2020

Tesla’s shares have appreciated by about 125% since hitting a bottom in late May, around the time of my Tesla is in the Buy Zone article. After what many market participants thought was a troubling start to the year, Tesla delivered an extremely strong quarter in Q3, beating EPS estimates by a whopping 543%. Furthermore, Tesla is illustrating a distinct ability to be remarkably efficient in both the production and operational sides of its businesses.

The company’s Gigafactory in China is already functioning, and the company is wasting no time by announcing plans for its next massive plant to be constructed in the heart of European automobile production, Germany. The company is about to begin construction of its long-awaited Model Y vehicle which should be available as early as the summer of 2020.

Ultimately, Tesla is likely to substantially increase automotive and other segment revenues over the next several years. Through improved efficiency and its implementation of economies of scale, the company should also grow to be increasingly profitable going forward. I expect Tesla to deliver another strong quarter in Q4 2019, 2020 should be a solid year, and shares should appreciate well beyond $500 throughout 2020.

Want the whole picture? If you would like full articles that include technical analysis, trade triggers, portfolio strategies, options insight, and much more, consider joining Albright Investment Group!

- Subscribe now and obtain the best of both worlds, deep value insight, coupled with top-performing growth strategies.

- Receive access to our top-performing portfolio that returned 38.5% in H1 2019.

- Don’t hesitate, click here to find out more, and become a member of our investment community for fewer than just $20 per month!

Disclosure: I am/we are long TSLA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article expresses solely my opinions, is produced for informational purposes only and is not a recommendation to buy or sell any securities. Please always conduct your own research before making any investment decisions.

选择“Disable on www.wenxuecity.com”

选择“Disable on www.wenxuecity.com”

选择“don't run on pages on this domain”

选择“don't run on pages on this domain”