Watch For Near Term Choppy Action Ahead In Stocks

Steve Miller | Nov 17, 2019 07:00AM ET

The stock market edged out some gains last week, as the S&P 500 (SPX) rose 27 points to 3120, an increase of 0.9%. For this week, market cycles suggest choppy price action, as I pointed out in the latest Market Week show.

In last week’s testimony to Congress, Fed Chair Jerome Powell identified debt as a source of risk but noted, “I think possibly the day of reckoning could be quite far off.” Thanks for that opinion, but our view is that the Fed does not have a good record of assessing when such risks will manifest.

S&P 500 (SPX) Daily Chart

S&P 500 (SPX) Daily ChartOur approach to technical analysis uses market cycles to project price action. Our analysis is that the S&P 500 is in the rising phase of its current cycle. For this week, we expect it to chop around before it approaches the declining phase of its new cycle, which could bring a brief drop in to early December.

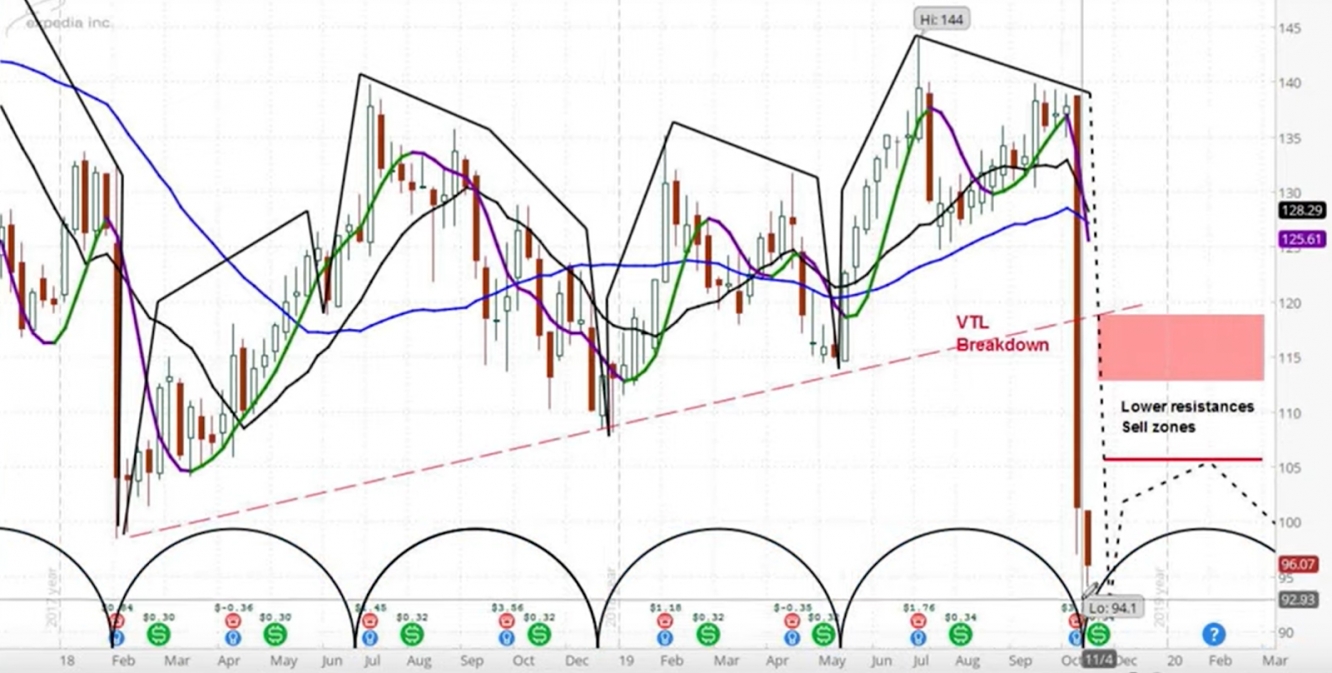

Let’s also look at Expedia (NASDAQ:EXPE), which fell 26% in the previous week after missing on earnings - and continued to fall last week.

Expedia (EXPE) Stock Weekly Chart

Expedia (EXPE) Stock Weekly Chart Based on its market cycles, we believe EXPE has nearly bottomed here. Our expectation is for the stock bounce in the near term future. This would begin the rising phase of its next market cycle, for which our upside target is around $105. This is a sell zone, before the next downwave hits.

For a more detailed analysis of both of these charts, check out the latest episode of the askSlim Market Week show.

选择“Disable on www.wenxuecity.com”

选择“Disable on www.wenxuecity.com”

选择“don't run on pages on this domain”

选择“don't run on pages on this domain”