在市场处于历史新高时期,因为实际的股票买卖操作几乎没有,所以能够有更多的时间思考自己的投资策略,为未来的投资做好准备。

“If you’re an investor, you’re looking on what the asset is going to do;if you’re a speculator,

you’re commonly focusing on what the price of the object is going to do, and that’s not our game.” - Warren Buffett

既然参与市场,就是市场的一部分,当然或多或少会受到市场波动的影响,但是做为主动型集中模式的个股投资者,市场波动对投资的关联度并不大。如果接受市场短期不可精确预测,而且也不是投资的必要前提,那么整体市场的高低就不是思考的重点,也不是投资决策的重要因素。

The market is there to serve you, not to inform you.

you should not be in the stock market.” - 巴菲特

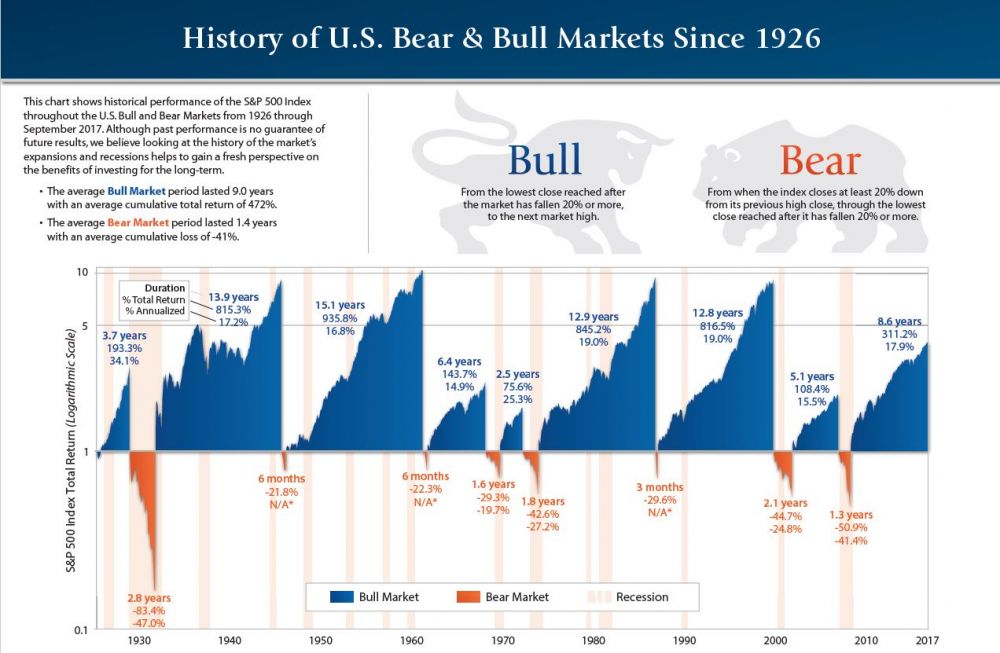

老巴根据自己几十年的投资经验,告诫大家要有面对50%Down的心理准备。股市短期价格波动,受投资者情绪影响很大,所以大幅度的价格波动在股市中是一件极其平常的事。

"The very liquidity of stock markets causes people to focus on price action. If you buy an apartment house, if you buy a farm, if you buy a McDonald's franchise you don't think about what it's going sell for tomorrow or next week, or next month, you think about how is this business going to do. But stocks with this huge liquidity suck people in and they turn what should be an advantage into a disadvantage." - 芒格

个股与整体市场波动的对比, 基本上一个投资者一生经历的最大级别的市场波动都比不上个股年均50%以上的波动。这也说明了整体市场的波动对个股的影响有限。

个股的市场波动为投资者提供了非常充裕的投资机会,年年都有,不像熊市的波动要许多年才有一次。

2011年,老巴印度之行的谈话

“If you look at the typical stock on the New York Stock Exchange, its high will be, perhaps, for the last 12 months will be 150 percent of its low so they’re bobbing all over the place. All you have to do is sit there and wait until something is really attractive that you understand.”

“There’s almost nothing where the game is stacked more in your favor like the stock market”

“What happens is people start listening to everybody talk on television or whatever it may be or read the paper, and they take what is a fundamental advantage and turn it into a disadvantage. There’s no easier game than stocks. You have to be sure you don’t play it too often”

个股投资者每年都可以有较大的概率找到合适的投资机会,即使是在股市处于高位时期。我觉得这一点比较重要,这说明无论我是在哪一个年代开始投资, 我都可以在短期内(1年)寻找到合适的投资机会。

假设我的投资组合有12个股票,那么在2018年平均每一个月我都有可能遇到一次合适的投资机会(50%的波动幅度),这样的投资机会就发生在我非常熟悉的投资标的之中。我不可能成功抓住每次的机会,但是一年一二次还是有可能的。

How many insights do you need? Well, I'd argue: that you don't need many in a lifetime. If you look at Berkshire Hathaway and all of its accumulated billions, the top ten insights account for most of it. And that's with a very brilliant man Warren's a lot more able than I am and very disciplined devoting his lifetime to it. I don't mean to say that he's only had ten insights. I'm just saying, that most of the money came from ten insights.

So you can get very remarkable investment results if you think more like a winning pari-mutuel player. Just think of it as a heavy odds against game full of craziness with an occasional mispriced something or other. And you're probably not going to be smart enough to find thousands in a lifetime. And when you get a few, you really load up. It's just that simple. 芒格的演讲 ART OF STOCK PICKING

一个投资者并不需要频繁的成功投资交易,才能取得满意投资回报。

“真正的大机会,把握住一次足以改变境遇;把握住两次将开启全新的人生;把握住三次整个家族都会不同。“ - 水晶苍蝇拍

2016年成功重仓DRG一次,可以获得相当于一个普通加国工薪家庭收入的现金流,这个投资成果可以享受许多年。

在2016年初的股市低位之后,下半年加国市场的一,二线的蓝筹股中出现大幅度涨幅的有

MFC, SLF,POW, DRG, AX。。。。。。

2017年同样的

BMO, CM, REI-un。。。。。

这些都是加国市场上大家最熟悉的蓝筹股。

我想信在2018年,在这些加国市场上大家最熟悉的蓝筹股中,一定会出现与2016,2017类似的投资机会。

对投资者而言,无论市场在何种状态,投资机会永远存在 。