Once, at a lecture, he was asked if Wall Street professionals were better at forecasting what would happen to market, and if not, then why, and here's what he said:

"Well, we’ve been following that same question for a generation or more, and I must say frankly that our studies indicate that you have your choice between tossing coins and taking the consensus of expert opinion and the result is just about the same in each case.

Everybody in Wall St. is so smart that their brilliance offsets each other. And that whatever they know is already reflected in the level of stock prices for the much, and consequently what happens in the future represents what they don’t know." - Benjamin Graham

在过去一二周里,我已经知道我所投资的企业的盈利又一次的大幅度提高,对股东的现金回报又一次的增加了,它们对市场竞争能力又增强了,这就可以了。

市场长期上涨的根本原因是市场本身是个优胜劣汰的系统,其它都是次要因素。

zt: Thursday, December 8, 2016

Back in my technical days when I was doing a lot of research on technical indicators, the irony was that when a short term oscillator like the RSI or MACD was in 'overbought' region where most books tell you that the market is overbought and therefore must be sold, the markets tended to do even better. Of course, over time, all of this nets out to a random result as buying overbought markets made you tons of money in trending markets and vice versa. The key was trying to figure out whether the market will be range-bound or trending in the future. Without knowing that, the indicators were basically useless.

But anyway, the overvaluation, rising interest rates and short-term overbought-ness of the market got me thinking about what really matters in calling major turns. People have been calling for a bear market since the crisis and they've been wrong. The stock market has been called a bubble too. Maybe it's a bubble. In any case, people have been saying the market is overbought for a long time, even when the market just rallied back to where it was pre-crisis. Is something that goes from $100 to $50, and then back to $100 really overbought? Or is it just flat?

Predictions

And by the way, I just want to reiterate how useless predictions are. I remember on a Markel conference call Thomas Gaynor pointed out how oil prices went from $100 to $50 in just a few months, proving that "nobody knows anything" or some such.

This year has again really reinforced this idea. First it was Brexit, and then it was the U.S. election. People were wrong about Brexit (UK voted 'out') and then the markets rallied hard after an initial dip. The same thing happened with the U.S. election.

People say that the market is getting overly optimistic and is likely discounting more than Trump can actually deliver. This is probably true to some extent.

But my feeling is not so much that Trump is going to get the economy going strong; it's that the heavy cloud hanging over the economy and banks has sort of been lifted. Elizabeth Warren will probably have less influence, and the cabinet seems to be filling up with billionaires including Goldman Sachs people and Jamie Dimon too, to head the Business Roundtable.

Long-Term Overbought

Anyway, for long term investors, we don't care if the market is short-term overbought or oversold. We'll leave that to the daytraders. Short-term overbought means nothing, usually. It either means the market will take a break, correct, or will keep going up. Useful, right?

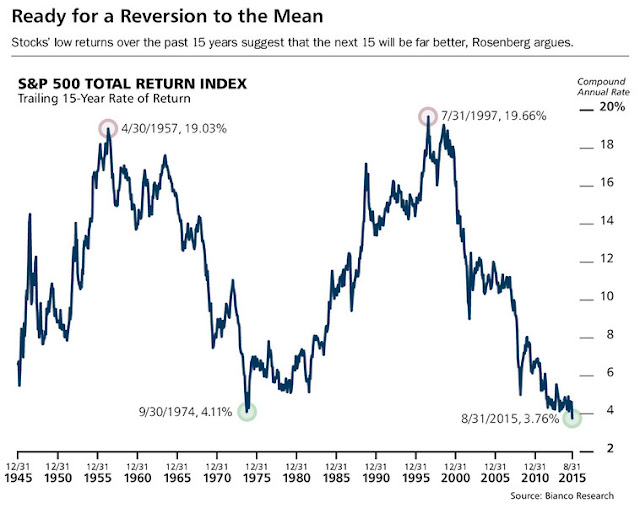

But seriously, if you want to look at overbought oscillators, there is one that is sort of interesting. There was a chart in Barron's last year that was interesting to me. It was in an interview with Joe Rosenberg, the chief investment strategist at Loews. He was calling for higher returns in U.S. stocks over the next 15 years. This was in contrast to most long term bearish views at the time (and even now).

I admit that when I saw this, I scratched my head a little. The chart looks like it should revert back to 10-12%, implying 10-12% trailing total returns over 15 years at some point in the future. That is not the sort of equity market return that I would expect over time. Of course, this may happen 15 years after the 2008/2009 low; this would give that 15-year return a little bump due to the low starting point.

But never mind that, the more important point for me was that despite what people were saying, that the market is overvalued, that the market is overbought (looking at the S&P return since the crisis low) and all that, I just wasn't feeling like the market was in a bubble ready to collapse.

I've seen some bubbles, and one of the key indicators in my mind of a real bubble is not only valuations, but trailing returns. When you see the Nikkei 225 in 1989, U.S. market in 1929 and 1999 and the recent gold bull market, they all had spectacular 1,3, 5 and 10 year (and maybe more time period) returns. This sort of high return pattern over many time spans reinforces the bull story and gets everybody participating.

To me, that sort of thing sets up the bubble; people chase returns, everybody jumps on board, that makes the market go up more, improving trailing returns in a self-reinforcing, virtuous circle of ever-rising stock prices.

This is not something that we see now. I haven't seen it at all in the rally since the crisis low either. It's been more of a grudging rally with doubts and deniers all along.

Updated Chart

So naturally, I updated the above chart to include the S&P 500 rally after the election through now (the Novemeber S&P figure is 2240).

If you notice the previous peaks, we are far away from that. We are in no way set up for a 1929 or 1999-type top in the stock market.

Of course, as usual, this doesn't mean that we can't go into a bear market. We can enter a bear market at any time for any reason. And the only people who are going to call it correctly are going to be the people who have been calling for one for years or decades (and those broken clocks will be right then).

Putting this together with my other post about interest rates, there doesn't seem to be a threat of an imminent, 1929/1999/Nikkei 1989-like top in the stock market. Sure, it can happen, but to me, the setup just isn't there.