一分钟看懂川普希拉里税收计划

ABC新闻2日报导,税收计划是两位主要政党候选人的重要竞选政策,在川普1995年报税单被披露后,更突显其重要性。川普和希拉里的税收计划对美国人的改变,整理如下。

高收入者

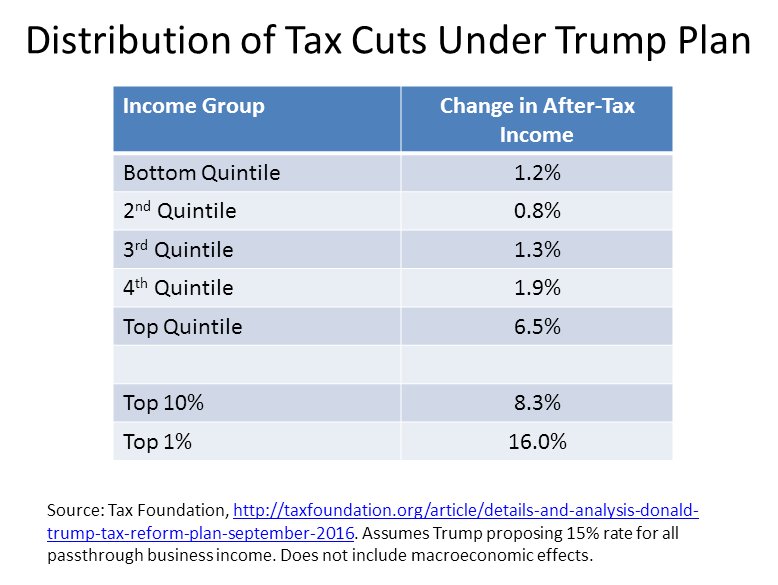

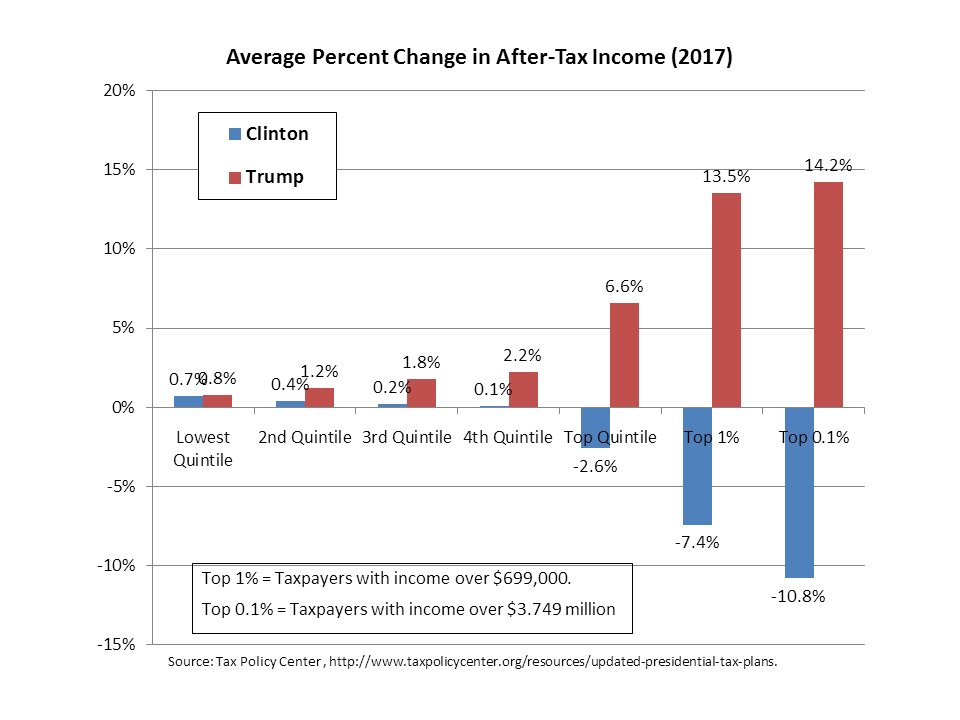

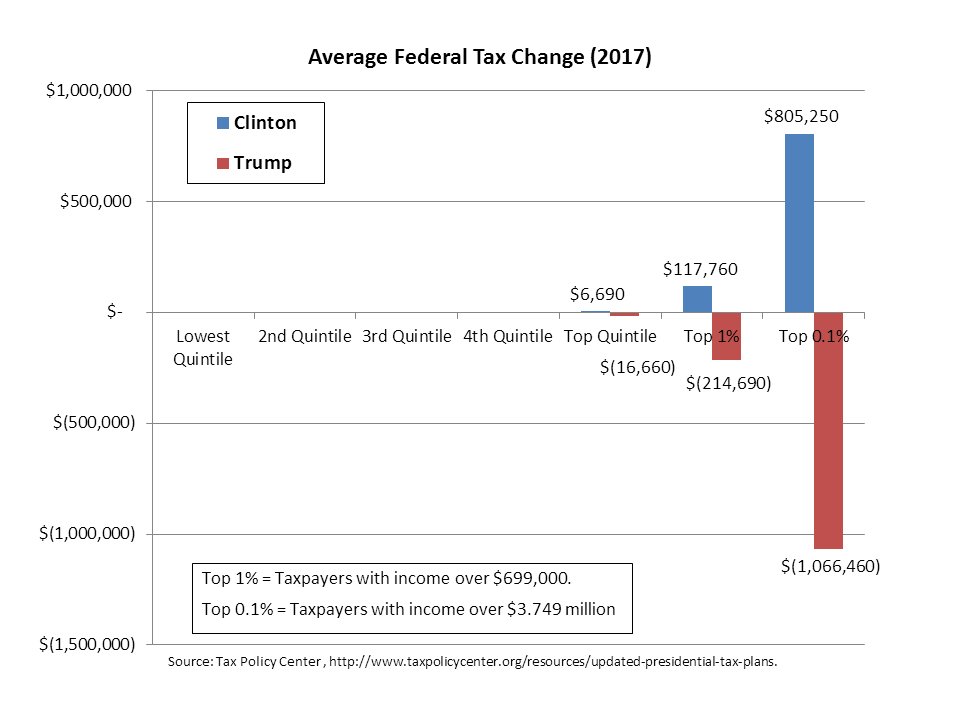

川普:将目前最高的个人所得税级距由39.6%削减到33%,根据税务基金会(Tax Foundation)的估计,顶端1%富人将因此增加5.3%的税后收入。川普同时将每户家庭的应税所得减免金额最高限制在20万美元。

希拉里:针对富人提出许多增税项目,包括年收入逾500万美元者增收4%附加税,增列个人所得税级距43.6%,年收入超过100万美元者至少要缴30%的所得税。另外,限制富人适用的多项减税金额。根据税收政策中心(Tax Policy Center)的估计,顶端1%的富人将因此多缴税78,284美元,税后收入减少5%。

中等收入者

川普:将现行所得税级距由七个减为三个:12%,25%和33%。另外将提高标准扣除额,单身为1.5万美元,家庭为3万美元。

希拉里:不会对中产阶级增税。根据税收政策中心的估计,95%美国人不会受希拉里税收计划的影响。

公司税

川普:将公司税由现行的35%减为15%。川普发言人史蒂芬?张(Steven Cheung)2日表示川普的这项政策是让“纳税中间实体”(pass through entity,即合伙人以个人所得税的方式缴纳公司税)适用15%的公司税。根据税务基金会的估计,此将造成税收减少1.5万亿美元。

希拉里:不会改变公司税。

“附带权益”(carried interest)漏洞

川普:消除对冲基金和私募基金经理人适用的“附带权益”漏洞。不过,此等经理人未来可能转为“纳税中间实体”而适用15%的公司税,缴纳更低的税率,对此,川普团队尚未提出说明。

所谓“附带权益”漏洞系指目前私募股权公司和对冲基金的经理人可以将投资利润归类为“附带权益”,并适用资本利得税,其税率最低仅为个人所得税率的一半。

希拉里:消除漏洞,使“附带权益”的税率适用一般的个人所得税。

遗产税

川普:取消遗产税。(目前规定单身遗产税免税额为545万美元,夫妻为1,009万美元)

希拉里:将遗产税的最高税率由现行的40%增加到65%,并降低免税额,单身为350万美元,夫妻为700万美元。

税负倒置

川普:主张其15%公司税可以有效减少公司税负倒置(inversion)的情形,此外对回流美国的企业,将仅课征10%的公司税,吸引美国企业回到美国。

税负倒置系指美国公司收购外国公司,并将总部转移到海外,以逃避支付美国现行35%的公司税。

希拉里:将提高美国企业归类为外商独资的难度,以避免税负倒置。另外,为了阻止美国企业转移海外,将采离开税(exit tax)以及保持对公司海外收益的课税。

托儿负担

川普:主张托儿费免税,减免幅度根据各州的收入和平均育儿成本而定,全职在家父母(stay-at-home parents)也可适用。此外,将扩大低收入户的薪资收入税金抵免(Earned Income Tax Credit )。目前育有二名以上孩子的家庭,可获得的减免最高为6,000美元。

希拉里:将透过扩大政府开支和税收抵免,将每户家庭的托儿费用限制在家庭收入的10%。

Families Facing Tax Increases Under Trump's Latest Tax Plan

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2842802

September 24, 2016

Abstract:

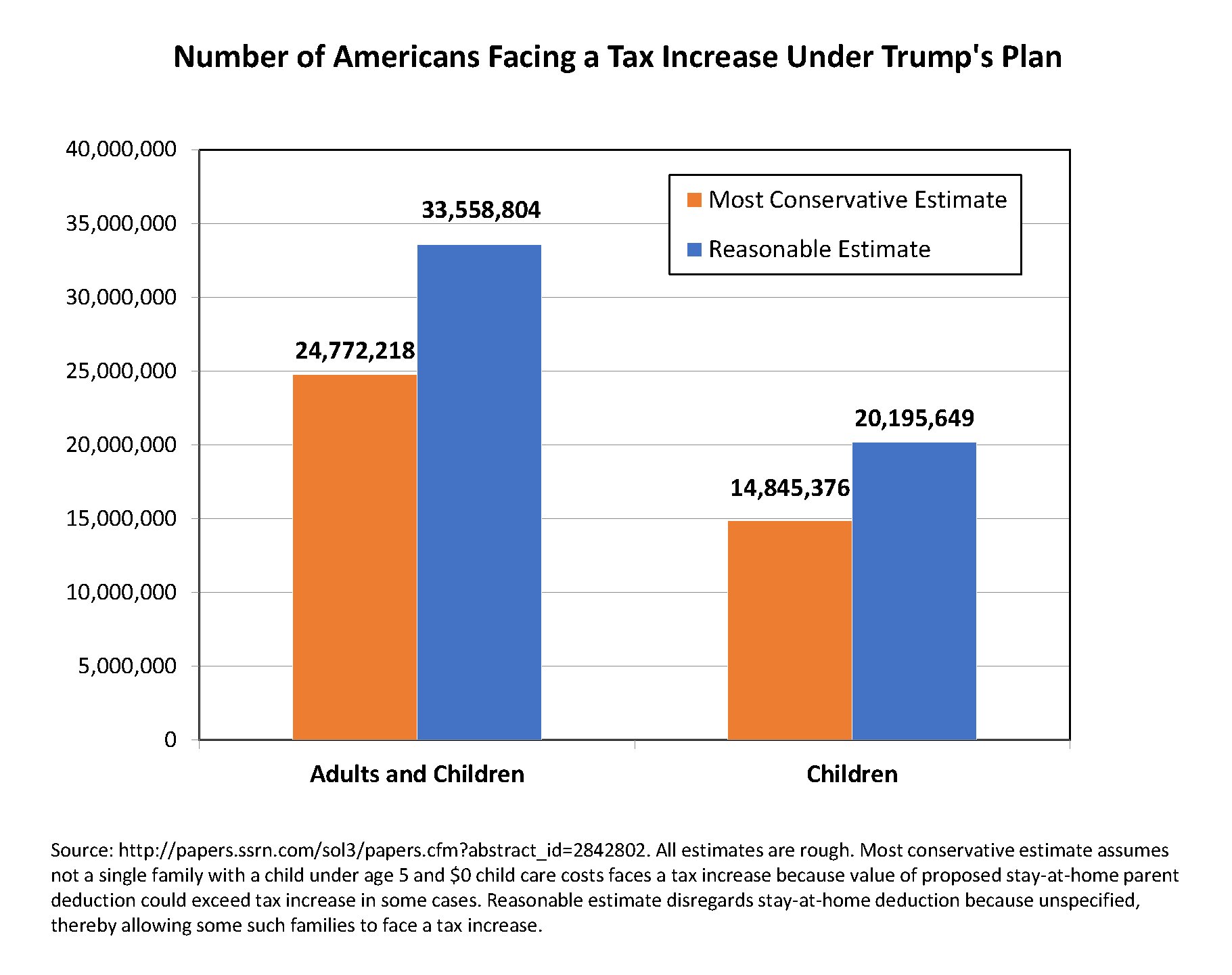

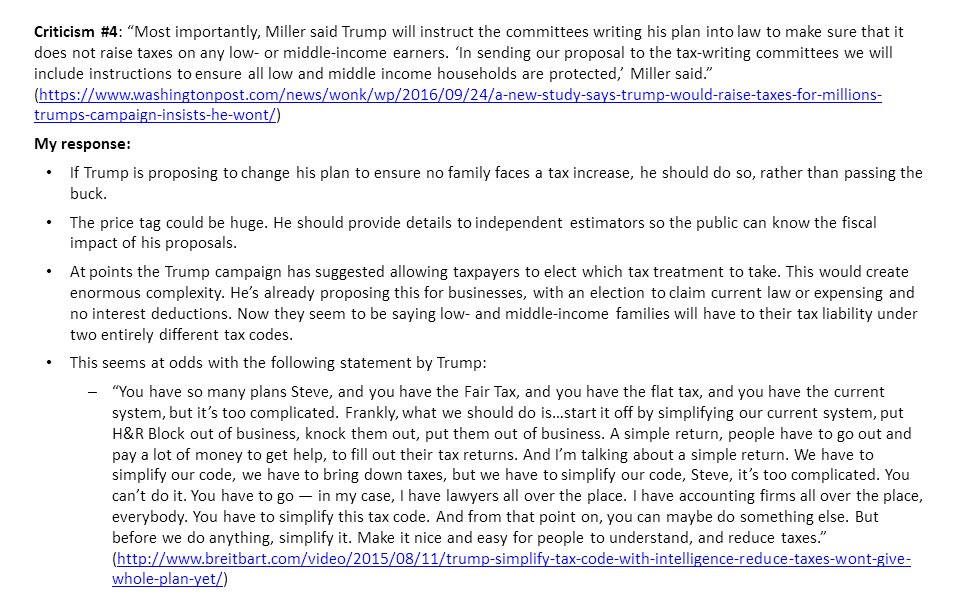

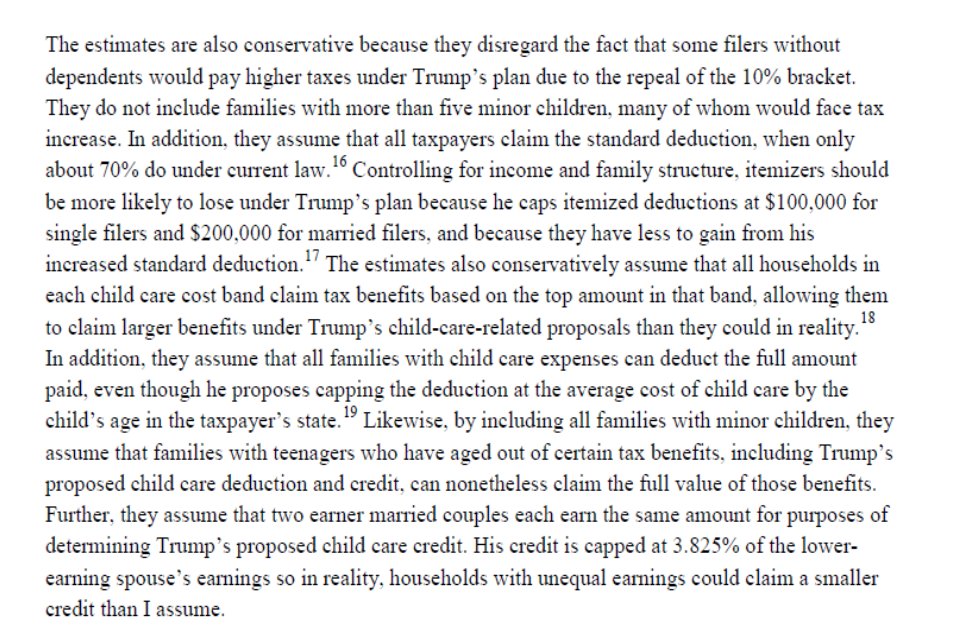

This paper explains why Trump’s latest tax plan raises taxes on so many families and provides examples of how large these tax increases would be. I conservatively estimate that Trump’s plan would increase taxes for roughly 7.8 million families with minor children. These families who would pay more taxes represent roughly 20% of households with minor children and more than half of single parents. They include roughly 25 million individuals and 15 million children.

Study: Donald Trump would raise taxes on millions of middle-class families

http://www.vox.com/2016/9/26/12991790/donald-trump-tax-hike-middle-class

Updated by

Why Trump’s plan raises taxes on certain middle-class families

Batchelder’s analysis is only valid because of a number of relatively recent changes to Trump’s tax plan, all taken with the goal of bringing down its extravagantly high price tag:

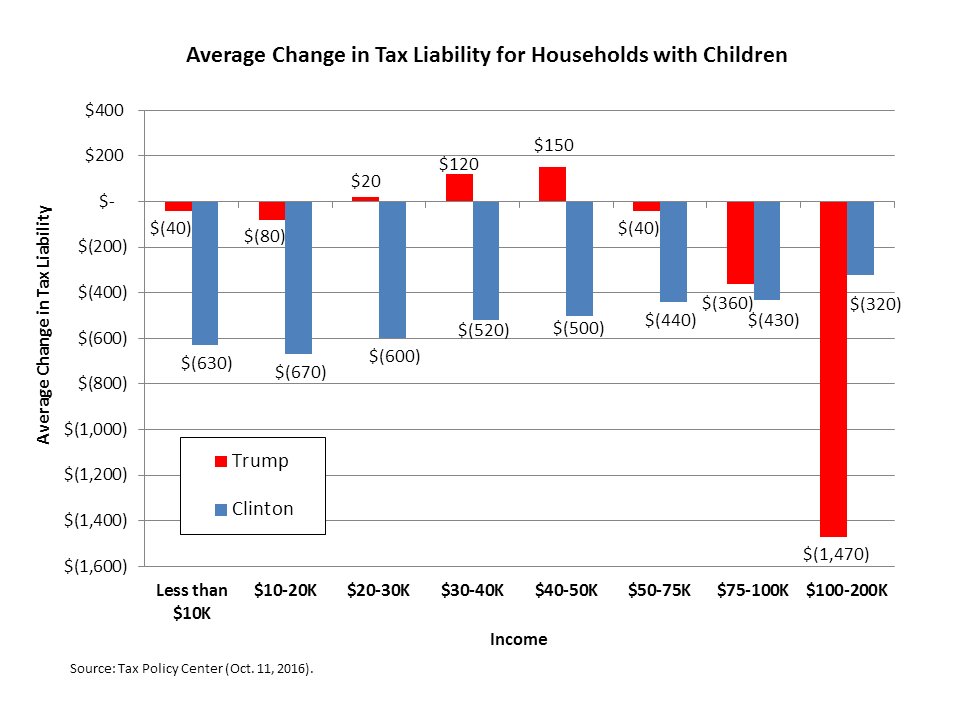

- The first tax plan kept the bottom income tax rate at 10 percent, the same as under current law. But Trump then changed it to make the bottom rate 12 percent. That raises taxes on everyone with a positive tax burden, all else being equal. This is offset — and then some — for rich families by lower rates higher up the income scale (like a 33 percent top bracket, down from 39.6), but it's hardly offset at all for many middle-class families.

- Trump's initial plan also saw a dramatic increase in the standard deduction, from $12,600 to $50,000 for married couples. Trump would've kept the personal exemption, an additional deduction that all taxpayers can claim for themselves and their family, at its current level of $4,050. But his updated plan not only cut the standard deduction to $30,000 for married couples, it eliminated personal exemptions entirely. So a family of five claiming a personal exemption for each would actually be worse off under Trump’s changes, as five times $4,050 plus $12,600 is greater than $30,000.

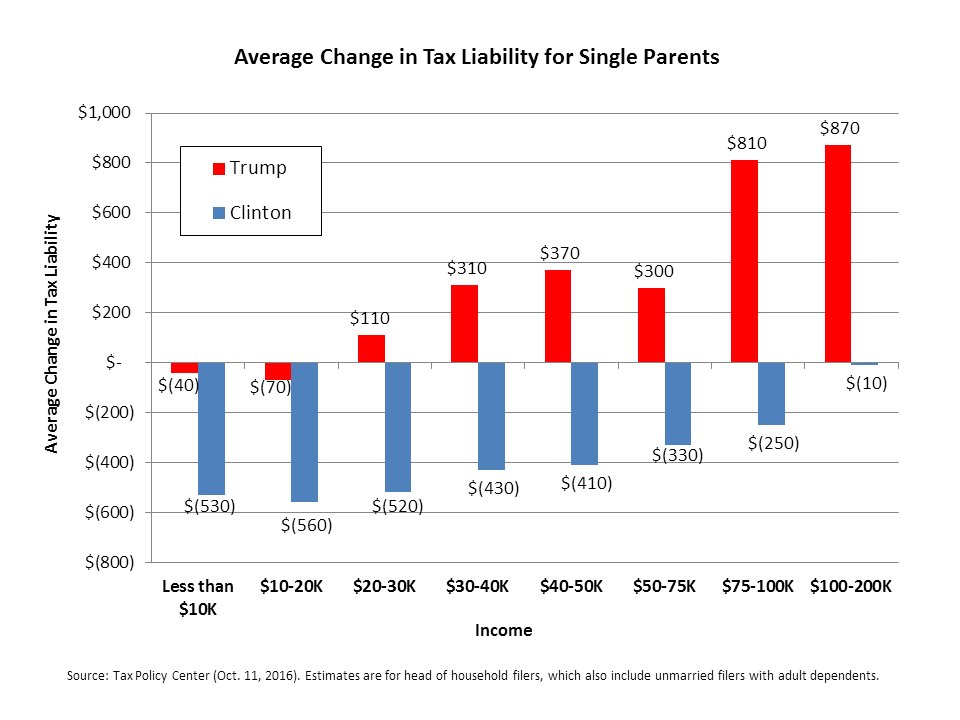

- Trump’s initial plan left head-of-household filing status, which effectively lowers taxes for unmarried individuals caring for an adult or child dependent, untouched. His new plan eliminates it. That puts middle-class single parents, and single adults caring for a parent or relative, in a bind.

You might think that Trump's proposed deduction for child care costs would mitigate some of these tax increases. But as Batchelder notes, that deduction isn't very valuable for nonrich people. It's less valuable the lower your tax bracket is, and you have to choose between it and the child and dependent care tax credit, which is more valuable for most middle-class families.

Batchelder provides several examples of families that would see their taxes go up under Trump’s plan. The biggest hikes number in the thousands of dollars, and are concentrated among single parents:

- A single parent with $75,000 in earnings, two children in school, and no child care costs (because the kids are in school) would pay $2,440 more.

- A single parent with $50,000 in earnings, three children in school, and child care costs of less than $6,000 would pay $1,188 more.

- A married couple with $50,000 in earnings, two kids in school, and no child care costs would pay $150 more because of the bottom bracket's increase from 10 to 12 percent.