January 31, 2012 | includes: BIDU, CHL, CHU, DANG, GA, MOBI, NTES, RENN, SINA, SOHU, SPRD, YOKU

The world's largest funds or mega funds, managing between $100 billion and over a trillion dollars, such as Fidelity Investments, Goldman Sachs, and Vanguard Group, together control almost a third of the assets invested in the U.S. equity markets, but number just over 30 out of the tens of thousands of funds that invest in the U.S. equity markets. Individually, and collectively, they pack enough firepower to move stocks based on their trading activities. In this article, we examine based on our research of their latest available institutional 13-F filings, the stocks in the Chinese technology group that they are most bullish and bearish about.

Most of the information is based on the latest available Q3 filings, but when Q4 filings are available, as in the case of three mega funds that have filed Q4's to-date, (Vanguard Group, Bank of New York Mellon and Eaton Vance, all of which we have recently analyzed), we have instead used the more recent Q4 data for those funds. Taken together, these mega managers were bullish on the group, adding a net $520 million in Q3/Q4 to their prior $13.05 billion prior quarter holdings in the group.

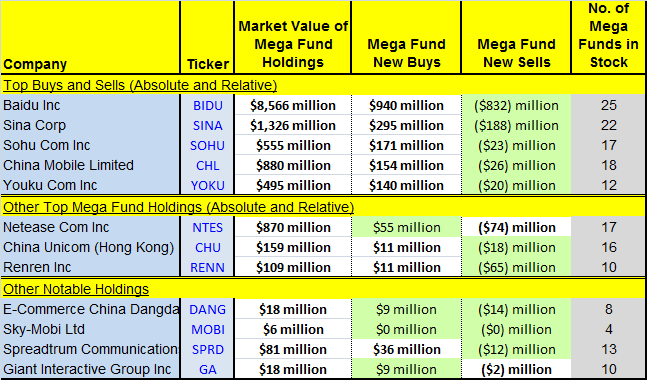

The following are the Chinese technology group companies that mega fund managers are bullish about (see Table):

Baidu Inc. (BIDU): Often toutted as the Google (GOOG) of China, BIDU is a leading Chinese provider of internet search, targeted online advertising and other internet content services. Mega funds added a net $108 million in Q3/Q4 to their $8.46 billion prior quarter position, and together they hold 19.2% of the outstanding shares, well above their 10.9% weighting in the group. The top buyers were T Rowe Price ($318 million) and Oppenheimer Funds ($253 million), and the top holders were T Rowe Price ($2.69 billion) and Fidelity Investments ($1.58 billion). We too are firm believers in the long-term value of BIDU, and recommended buying BIDU in our coverage of Chinese equities on October 3rd when it traded at $105, identifying it as the best opportunity among Chinese equities; it is now up 25% from that price after rising as high as 40% during the month after our recommendation. BIDU is set to report its Q4 later today, on Monday; currently it trades at 28-29 forward P/E and 22.1 P/B compared to averages of 89.7 and 3.3 for the internet services group.

Sina Corp. (SINA): SINA is a Chinese internet portal offering media content and services for China and global Chinese communities. Mega funds added a net $107 million in Q3/Q4 to their $1.22 billion prior quarter position, and taken together mega funds hold 29.6% of the outstanding shares, greater than their 10.9% weighting in the group. The top mega fund buyers were Morgan Stanley ($78 million), T Rowe Price ($70 million) and Capital Research Global Investors ($63 million), and the top holders were T Rowe Price ($420 million) and Capital Research Global Investors ($283 million). SINA trades at a premium 48 forward P/E and 4.4 P/B compared to averages of 26.1 and 3.3 for its peers in the internet content group; its shares are expected to fare well in the short-term given the upcoming IPO of Facebook which is likely to positively impact SINA's valuation given its presence in social media with its twitter-like Weibo micro-blogging platform.

Youku.com Inc. (YOKU): YOKU, China's largest video-streaming company, is more popularly known as the YouTube of China. But in reality, it is more a combination of Netflix and YouTube; Netflix, because it offers mostly professionally-generated content licensed from movie studios and TV companies, and YouTube due to its reliance on advertising as a main source of revenue. Mega funds added a net $120 million in Q3/Q4 to its $375 million prior quarter position, and together they hold 18.7% of outstanding shares. The top buyers were Morgan Stanley ($57 million) and T Rowe Price ($47 million), and the top holders are Morgan Stanley ($175 million), T Rowe Price ($110 million) and Janus Capital Management ($98 million). YOKU currently generates losses every quarter, and it currently trades at 3.9 P/B and at 22.5 PSR versus averages of 1.7 and 3.3 for its peers in the internet content group.

The following are the China technology group companies that mega fund managers are most bearish about (see Table):

Renren Inc. (RENN): RENN, often called the Facebook of China, is a Chinese operator of a social networking platform that enables users to communicate and share information via Renren.com. Mega funds cut a net $54 million in Q3/Q4 from their $163 million prior quarter position, with the top sellers being Goldman Sachs ($36 million) and Fidelity Investments ($14 million). RENN is currently flirting near break-even, reporting 1c in earnings for the last two quarters, and it trades at 1.3 P/B and 19.5 PSR. Its shares have run-up over 50% in the last two trading days, the biggest beneficiary of the surge in social media stocks as reports emerged at the end of last week that Facebook would soon file its S-1 with the SEC, with a valuation of between $75 billion and $100 billion.

E-commerce China Dangdang (DANG): DANG is a Chinese online retailer offering books and other media, personal care and general merchandise via Dangdang.com. Often called the Amazon (AMZN) of China, DANG is the number two e-Commerce player in China, behind TaoBao. Its business model is similar to AMZN except that it employs a courier-based delivery system that collects cash on delivery. Mega funds cut a net $5 million in Q3/Q4 from their $23 million prior quarter position, and taken together mega funds hold 2.9% of the outstanding shares. The top seller was Morgan Stanley ($12 million). We recommended buying DANG in our coverage of Chinese equities on October 3rd when it traded at $4.80s; it closed Monday at $8.15, up over 70% from where we recommended it over three months ago.

China Unicom Ltd. (CHU): CHU is a Hong Kong-based provider of cellular, paging, long distance, data and internet services in the People's Republic of China. Mega funds cut a net $7 million in Q3/Q4 from their $166 million prior quarter position. The top sellers were Credit Suisse ($6 million) and Invesco Ltd. ($4 million).

Other Chinese technology group companies that mega funds are bullish on (see Table) include China Mobile Ltd. (CHL), is a Hong Kong-based of digital wireless voice and data services primarily in mainland China, in which mega funds added $128 million to their $752 million prior quarter position; Sohu.com Inc. (SOHU), the third largest internet portal and a leading brand in China, in which mega funds added $148 million to their $407 million prior quarter position; Spreadtrum Communications Inc. (SPRD), a Chinese fabless designer of baseband processor and RF transceiver solutions for wireless communications market, in which mega funds added $24 million to their $57 million prior quarter position; and Giant Interactive Group (GA), a Chinese developer and operator of internally developed and licensed online games, in which mega funds added a net $7 million to their $11 million prior quarter position.

Also, mega funds were bearish on Netease Inc. (NTES), a Chinese provider of an interactive online gaming community, internet portal and wireless value-added services, in which they cut a net $19 million from their $889 million prior quarter position. And, finally, mega funds kept unchanged their $6 million prior quarter position in Sky-mobi Ltd. (MOBI), a China based operator of Maopao mobile application store providing single-player games and mobile music and books.

Table

General Methodology and Background Information: The latest available institutional 13-F filings of over 30+ mega hedge fund and mutual fund managers were analyzed to determine their capital allocation among different industry groupings, and to determine their favorite picks and pans in each group. These mega fund managers number less than one percent of all funds and yet they control almost half of the U.S. equity discretionary fund assets. The argument is that mega institutional investors have the resources and the access to information, knowledge and expertise to conduct extensive due diligence in informing their investment decisions. When mega Institutional Investors invest and maybe even converge on a specific investment idea, the idea deserves consideration for further investigation. The savvy investor may then leverage this information either as a starting point to conduct his own due diligence.

Credit: Historical fundamentals including operating metrics and stock ownership information were derived using SEC filings data, I-Metrix® by Edgar Online®, Zacks Investment Research, Thomson Reuters and Briefing.com. The information and data is believed to be accurate, but no guarantees or representations are made.

选择“Disable on www.wenxuecity.com”

选择“Disable on www.wenxuecity.com”

选择“don't run on pages on this domain”

选择“don't run on pages on this domain”