NY Fed Treasury Spread Model: Probability Of Double-Dip Recession Is Zero

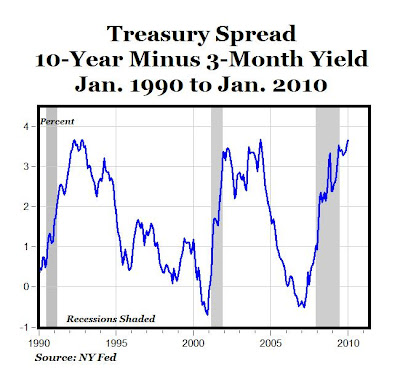

Tuesday the New York Federal Reserve updated its “Probability of U.S. Recession Predicted by Treasury Spread” with data through January 2010, and the Fed’s recession probability forecast through January 2011 (see top chart above). The NY Fed’s model uses the spread between 10-year and 3-month Treasury rates (3.67% spread in January, the highest since May 2004) to calculate the probability of a recession in the U.S. twelve months ahead (see details here).

The Fed’s model (data here) shows that the recession probability peaked during the October 2007 to April 2008 period at around 35-40%, and has been declining since then in almost every month. For January 2010, the recession probability is only 0.82% (less than 1%) and by a year from now in January 2011 the recession probability is only .043%, the lowest reading in more than 26 years (since September 1983).

Further, the Treasury spread has been above 3% for the last nine months (since May), a pattern consistent with the economic recoveries following the last two recessions (see bottom chart above), and the 3.67% spread in December is the highest since May 2004, five-and-a-half years ago. Finally, the pattern of the recession probability index last year (going below double-digits and declining monthly) is very similar to the patterns that signalled the end of the 1990-1991 and 2001 recessions.

According to the NY Fed model, the chances of a double-dip recession in 2010 or 2011? Zero.