阿椿下厨

放开心情,细细品味生活6 Reasons High-Earners Should Love Their Roth 401k

https://www.mountainriverfinancial.com/6-reasons-high-earners-should-love-their-roth-401k/

The question you need to ask before deciding whether you should make Roth or Traditional contributions is this: Is it more important to minimize how much I pay in taxes this year OR minimize how much I pay in taxes over my lifetime?

1. Tax rates are going to go up.

2. The current TCJA tax cuts are scheduled to go away in 2026.

3. You expect your income to grow throughout your career.

4. You already have a large balance in your Traditional IRAs & 401k/403b accounts.

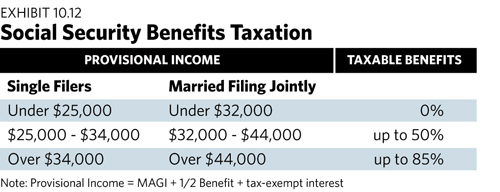

5. You’re RMDs & other taxable income will determine the taxability of your Social Security benefits.

6. You want greater control of your taxes in retirement.

3 Reasons to Perform Roth Conversions in 2021, 2022, and Beyond

Be careful of hitting IRMAA ($182k for MFJ 2022 tax year) first within 22% marginal tax braket, which will increace Medicare part B two year down the road, if older than 63.

C: There's another important consideration that is not mentioned in the explanation. If you have a $1,000,000 IRA - you're likely (all in) paying about 2% in costs, fees, and commissions. That's $20,000 a year. But if you only own - say 70% of the balance (Uncle Sam owns the rest - you're just his custodian), then you're paying $6,000/year to have money you don't own - managed. Over a 20-year retirement, that's well over $100,000 of wealth that could be yours - but won't be unless you convert. My belief is that we have to look as closely at the cost of not converting - as we do the cost of converting. Fees are just one of 6 factors I think bear consideration.

Q: IRMAA surcharge is based on MAGI. Is MAGI before or after after the standard deduction for MFJ? >

A: Before the standard deduction!

Q: What happens if in the future the government decides to change Roth IRA's into taxable account if it's over a specific amount? After we change most off our tax account into Roth none taxable. Just Hypothetical.

A: there would surely be some advance warning that such legislation was coming down the pike - in which case I'd just take it all out and collapse the Roth account. There are other things you can then do to tax-protect the corpus.

C: That's exactly what we are planning to do with our early retirement (except no military or pension). Roll some over, and use the rest during the 55-65 age timeframe. Not only no RMD's but get "poor" 2-3 years before full SS age of 67 as they look back 3 years at your "income" to increase Medicare premiums and the like. It's a minefield....but when you have the right information you can at least plan.

Should you Convert your IRAs to ZERO? | Roth Conversions

C: We’re trying to convert our 401k/tIRA to Roth accounts before 2026 taxes revert to the old brackets. At 65 we’re only seven years from RMDs that would push us into the upper brackets if we did nothing. We’ll take the IRMAA hit now for a few years to hopefully lessen it later. We’re also concerned about paying taxes at a single rate when one of us passes. I don’t want to leave my wife or our kids with excessive tax burdens.

C: I would love to convert to Roth but the numbers are challenging. I’m 66, I pay the max penalty on Medicare irmaas , I pay 3.8% penalty on investment income. 3.8 million mine/ 1.2 million wife. Make sense to try to convert any?

R: in your case I'd be tempted to do a few years of very large conversions. One of Eric's videos has a greater-than : less-than chart that indicates which strategic moves are more beneficial when two are in conflict, e.g., your issue of Roth conversions vs. triggering higher steps of IRMAA and NIIT. If I remember correctly his chart has Roth conversions > avoiding IRMAA and NIIT charges.

===

Important clarification for the 5 year Roth Conversion Rule:

There are a few exceptions to this five-year rule. The important one for most retirees watching this video will be the 'over 59.5 exception". If you perform a Roth Conversion and are over 59.5, you can access the converted money immediately.

====

C: Tax torpedo explanation is very confusing and after watching it over several times it occurs to me that this is just for people to worry about if their income falls in a certain window. Those of us who are already paying 85% on 1/2 of our social security don’t need to worry about this and if we are trying to do Roth conversions then we should focus on staying in our tax bracket and converting as much as possible right up to that point. I could not figure out why the torpedo dropped off dramatically at the far end. You might want to include an explanation for that in your next video. Again, your information is super valuable. I would like a video on Roth Conversions and why you would want to stay in your original tax bracket and why or how you would calculate why you would want to go up to the next tax bracket. I know you already touch on this from several angles, but I would want to know how to calculate or how to do a forecast.

===============

The Roth IRA 5 Year Rules Explained: Navigating Three Confusing 5 Year Roth IRA Rules

I find one of the most confusing set of rules for retirees are the three 5 year Roth IRA rules. Often they each are referenced as 'The 5 Year Roth Rule' as if there is only one rule. However, there are three and each carries a different penalty for non-compliance. The worst part about these penalties is that they destroy wealth in your most valuable retirement account: Roth IRA. The confusion around these rules has been compounded in recent years. As recent as 2020, the estate planning rules have changed thus changing one of these rules. In this video, we simplify and explain these rules in layman's terms.

We cover:

1. The 5-Year Contribution Rule

2. The 5-Year Conversion Rule

3. The 5-Year Inheritance Rule

C: One item you didn't mention was the the five year rules are eliminated with a "qualifying event". One of which is the turning 59 1/2. Is this correct for all 3 five year rules. Thanks, J.

R: Thanks for the clarification questions. I included it as a pinned comment. Turning 59.5 is an exclusion for the 5 year conversion rule. It is not, however, an exclusion to the contribution rule or the inheritance rule.

Safeguard Wealth Management

CLARIFICATION ON THE 5 YEAR ROTH CONVERSION RULE:

Every Roth Conversion has a separate 5-year clock that begins at the time of that conversion. There are a few exceptions, however, that let you bypass this rule. Here are a few of those exceptions:

- You have reached age 59.5

- You are totally and permanently disabled

- You use the distribution to buy, build, or rebuild a first home (to a limit)

- The distribution was made to a beneficiary after your passing

I'm 65 Years Old With $1.4 Million In IRA's - Should I Do A Roth Conversion?

C: My father ended up converting his tradition IRS's to Roth when he was in his 70's. He ended up more or less holding onto the funds and ended up spending it all on LTC when my mom suffered dementia. I believe he would have been better off not converting as he ended up with over 100,000 a year in LTC expense related to my mom, which would have more or less written off on taxes. If you have not secured LTC insurance, it may be worth a careful look. I like a balance of Roth and tradition. I will spending down traditional until I draw Social security; I take a mix of traditional and ROTH to keep the amount of taxes on Social Security at a minimum. Hold some traditional for when health care expenses get high again where I can write off the high medical bills.

C: Another complication is ACA credits. Doing a Roth conversion shows up as income and could eliminate your ACA credit if you qualified before the conversion. How much that impacts your results will vary by each case.

(What is ACA credit? A tax credit you can use to lower your monthly insurance payment (called your “premium”) when you enroll in a plan through the Health Insurance Marketplace. Your tax credit is based on the income estimate and household information you put on your Marketplace application.)

C: First, I’m stealing “tax-infested”; that’s brilliant. Secondly, I’ve started to think about significant conversions at the death of the first spouse to avoid the single filer penalties. Even converting the full value of the tax-deferred account in the same year as the spouse’s passing would likely result in a lower total tax bill assuming the surviving spouse survives five or ten years. Finally, I’m not sold on leaving a large legacy, but my last check shouldn’t bounce either. Therefore, passing on tax-free money would be my preference.

C: I would suggest that converting a portion, say 75% or so, early in the year and finish once you know what your tax position will be at year end. This works when the market is up and is less effective when the market declines for the year. As mentioned, there are other considerations such as IRMAA.

C: I’ve done 2 years of Roth conversions. I converted an amount that kept me in the 24% tax bracket (with the converted amount added to my regular taxable income. The 24% limit is about $326,000 for married filing jointly. So if you converted $100,000, you would need to have $24,000 in reserves (unless you took it from the 100k and paid a penalty) to pay the irs. My state (Illinois) doesn’t tax retirement income (yet, it’s coming), which was another incentive to convert now, while federal tax rates have been the lowest in over 100 years.

C: I am someone who is in the 24% tax bracket and over 10 years away from retirement. I started contributing to an Traditional 401k and later to an Roth 401k. I have a large amount of money I want to convert to Roth. If I only convert the amount up to the max of my tax bracket, it will take until retirement before I am done so I am converting up to the max of the 32% tax bracket. I am paying a huge tax bill now but I am hoping with all my money in Roth when I retire, it will be worth it.

C: I have 2.3 million in a 401K, 67 and no longer working. I will have several years with no income so I am planning on doing a partial roth conversion. I will take out 60K a year, put it in my roth and pay the taxes with the cash I have. I have about $330K cash so enough to support myself until I hit age 70 and start my social security which should be about 50K. Then at 72 1/2 I will start my RMD's which should be about $100K. I won't have a lot in my roth, maybe $250K that I don't plan to take out unless there is an emergency.

C: I am not clear about how the $11.7 million exclusion applies. Most estates will be way below that. So then when money is taken out of a inherited traditional IRA, it is probably not going to be subject to federal income tax?

R: I think estate tax is different and you will still have income tax on the ira.

R: Yes, those that inherit a traditional IRA have to pay taxes as ordinary income when it is removed from the IRA. With the new laws all the money will have to be removed within 10 years. So if you are 55 and inherit a $1,000,000 IRA from your parent you will have to remove that money on average of $100,000 per year plus growth and will be taxable at your tax bracket. If this is during your peak earning years you will likely be pushed into the 24% tax bracket.

C: "Convert while the market is low so the balance grows tax free" is a fallacy. Assuming the tax rate is the same on both ends (25% for example), your ending balance ends up exactly the same. If you have $1m that you decide to convert, you pay $250k and have a balance of $750k. if the investment doubles you have $1.5m ending balance. If you decide not to convert, you end up paying $500k on $2m for an ending balance of $1.5m. Therefore the bulk of the analysis should be whether or not your tax rate will go up or whether you think they will end up taxing the Roths somehow.

R: You are correct in that, if all other factors are equal, it doesn't matter if you pay the tax now, or pay it later. You end up with the same amount of money. However, there are at least 2 factors which make converting to a Roth now advantageous:

1) It's likely that tax rates will increase in the years ahead (they are currently at an all-time-low, following the Trump years). If that happens, then you may pay more tax in the future (particularly if you grow a large retirement portfolio).

2) With a Traditional IRA or 401K, you will need to pay RMDs starting in your 70s, and if your IRA portfolio is large those distributions may be at a much higher tax bracket.

3) A 3rd factor, in some cases, is if you are married now, but widowed in the future, you may pay higher taxes in the future. There are, of course, many other factors (many of these comments mention them), but if you expect to live well into your 80s or 90s, and have a reasonably large portfolio, it's likely to be beneficial to have at least some of that in Roth IRAs.

C: RMDS dont bother me as much as estate taxes.

R: it is graduated and you don’t pay a penny on the first $ 23.4 million per couple then caps out at 40% when you hit $1 million over that.

C: What he doesn't talk about is-- where you get this money [$250kish] to pay for the up front taxes due when converting! Unless you have other after-tax accounts to withdraw from, you would be foolish to convert in this case.

R: No, he did, it is coming from your 401k funds. You see in his chart when the conversation is done there is less money in the Roth, the difference went to pay the tax. Now if you had a significant amount of cash and you wanted to add it to your retirement but were already at the maximum contribution a Roth conversion with you paying the taxes from other funds could be a great way to accomplish that. The “crossover point” he mentions would on day 1 (he’s comparing money in Roth to money in traditional and they’d be the same). But most of us would not be in that situation.

C: I got $250,000 by doing a cashout refinance on my home mortgage. This was hugely beneficial for two reasons: 1. I used some to pay taxes on my conversions to my Roth IRA, and 2. I used some of this to live off of, thereby allowing my retirement $, more time to grow. I'm age 60 and retired. p.s. I also got $100,000 in an inheritance, at the same time. I'm doing my conversion to my Roth over 9 years (2 years remaining).

Financial advisors are reluctant to recommend my strategy to the 'average investor', as the average investor is poorly disciplined/educated. I'm a degreed accountant & retired after 26 years as a corporate accountant. My Roth IRA will soon have a $1,000,000 balance. My 401K has a $1,000,000 balance. To further scare you: I plan to buy a new home in 4 years with a 30 year mortgage. After 18 years of payments, I'll take out a reverse mortgage, and my mortgage payments will end. Historically low interest rates provide a lot of opportunities. The high interest rates of the 1980s are over. No guts, no glory.

Most people are lazy. I abhor lazy. I don't invest in individual stocks. I simply invest in index funds. I went to school for 17 years (kindergarten thru college) to learn math, budgeting, excel spreadsheets, etc. Is it really that awful to do a little addition and subtraction? You're retired, not dead. I used to manage a team of 20 accountants. Managing a single mortgage payment takes a little planning, but isn't really that complex. After all, Jeff Bezos is 3 years younger than I. He built a huge company, is an astronaut, etc. I suppose you think Jeff is too ambitious. Do you have all your money in fixed income accounts earning a 2% return?

Doing my cashout refinance was just being prudent and disciplined. Storing cash in a home is a horrible waste of utility in a low interest environment. Once you quit your job, you'll be amazed at how easy it is to handle things like a cashout refi, etc. While working, our free time is extremely limited. I'm single with no children, so that provides me a big advantage (in all things financial).

C: If this couple is on Medicare, please tell me how they are not getting killed by IRMAA. The Modified Adjusted Gross Income level for a couple filing jointly is $176,000. This couple's MAGA is certainly above that level. Are you taking that penalty into account and has the couple decided that paying the penalty for Medicare is worth it for the Roth Conversions over four years?

IRMAA surcharge is based on MAGI. Is MAGI before or after after the standard deduction for MFJ? > A: Before the standard deduction!

C: The small investment add up over time don’t underestimate the compounding effect Index funds are boring but index funds build wealth. Boring works!

C: You show him paying $67k in taxes each year for 4 years. Does that mean he is converting 1/4 of the 1.4 million each of those years?

R: It looks like they withdraw only up to the max 24% tax rate and do that each of the four years. Makes sense to do it that way.

R: Yes, it looks like it. The Married Filing Jointly 24% tax bracket cap is $329,850. So if they convert that amount each year for 4 years, they'll pay $67,200 in tax each year. Over 4 years they'll have converted a total of $1,319,000 and payed $269K in tax.

C: Raising taxes to a really crazy level is very unpopular with most Americans. No govt is foolish enough to try that route. In any case, if you think taxes going up by 2% will make sense to do a very costly Roth conversion now when you are fit enough to do many things and reap the benefit when you are pretty immobile, I think it is crazy. Many studies show that Roth conversion after 65 is not beneficial at all, unless you are just focusing on making it easy for your kids. Let us say you spent 200,000 in taxes to convert to Roth now, and you see the benefit when you are 85 or so and that too small benefit......why do it? If you invested that 200,000 in good stocks, you will have more benefit that you can enjoy while you are still healthy. Roth conversion after 65 should only be considered if you are thinking of leaving tax free money for kids. Remember, average life span in America is 82.

C: I get all you discuss pay now at lower rate... what is the impact on you monthly insurance cost for Medicare.. that could be 300 or more a month.

R: Could be temporarily, but doing nothing could permanently put you into those brackets when Medicare taxes are possibly much higher. It's all part of the calculation and planning process.

Roth Conversion Window of Opportunity is Closing! - Roth Conversion 2021

If you have tax-deferred assets, Required Minimum Distributions or RMDs are going to be a problem you need to address. Required Minimum distributions are forced withdrawals from your tax-deferred accounts. The troubling part is you will be forced to take these IRA Required Minimum Distributions whether you need the money or not. Now, this forced income can create some obvious problems like pushing you into the next tax bracket. But the biggest problems with RMDs are not all that obvious...

RMDs create a cascading tax effect that can push you into other tax hurdles like the Social Security Tax Torpedo or Capital Gain Bump Zones. What can retirees do to overcome this problem? For many, Roth Conversions are an ideal solution. Using sound Roth Conversion strategies, you can minimize or entirely eliminate RMDs by converting your tax-deferred balances to Roth IRAs. Luckily, there are no mandated withdrawals from Roth IRA accounts. Watch this video as we explore this Cascading RMD Tax problem that can cripple your tax situation and how a 2021 Roth Conversion can provide a solution.

The “tax torpedo” refers to the sharp rise and then sharp fall in marginal tax rates caused by the taxation of Social Security benefits. For many middle-income households, this tax torpedo causes their marginal tax rate within a wide range of income to be 150 percent or 185 percent of their tax bracket.

===============================

Avoiding The Social Security Tax Torpedo

Having more income can uniquely generate a need to pay taxes on Social Security benefits. Up to 85% of Social Security benefits can be counted as taxable income. The rules for Social Security benefit taxation create what is known as the “tax torpedo.” Once benefits begin, each $1 of additional income from qualified plan distributions and the like will require taxes on that income as well as taxes on up to 85% of a corresponding $1 of Social Security. Wealthier individuals may find that avoiding taxes on 85% of Social Security benefits is impossible, but those with relatively more modest resources might be able to set into motion a plan that can reduce or even completely avoid the tax torpedo for life, while following conventional wisdom strategies could leave them mired in paying more taxes through the torpedo. Presently around 50% of Social Security beneficiaries will pay taxes on at least a portion of their Social Security benefits.

Provisional income is an IRS threshold above which social security income is taxable.

For the 2019 tax year, 15% of all social security benefits remain tax-free. The remaining 85% is also tax-free unless the taxpayer has provisional income above a base amount set for the taxpayer’s filing status.

Calculating Provisional Income

Although IRC §86 does not use the term “provisional income,” it is commonly used to refer to this sum. To calculate provisional income, the taxpayer must add together their gross income, tax-exempt interest and one-half of the taxpayer’s social security benefits.

To determine provisional income, the taxpayer must compute their gross income without Social Security benefits, or the amount of income they collect before drawing Social Security. Then, they should add any tax-free interest they receive from investments, and finally, add one-half of Social Security benefits reported on Form 1099.5?