macro01 china fx reserves us high yield hyg bond tlt

12

We are once again entering interesting times in the credit and equity markets. While large hedge funds and other institutional money managers are in a better position to take advantage of some of the opportunities from dislocations and volatility, the question remains how smaller investors can potentially profit. The answer lies in a long/short trade I am affectionately going to call 'Twist & Shout.' Twist, because the Fed's Operation Twist and market fear will likely flatten the yield curve more than we anticipate (not to mention institutional investors looking for more duration); and Shout, because the guys about to lose money in high yield bonds will be shouting loudly until that market sees its bottom. Ultimately, it is a play on credit spread expansion and yield compression in the credit market.

Twist - Long TLT

The Federal Reserve is attempting to force money into risk assets. Since short-term rates are as low as they can go, they must now focus on the long end of the curve. When yields decrease, the value of bonds increases. Yields on bonds decrease when their prices are "bid up" by buyers seeking to own them. In this case, the buyer is the largest one on the planet - the US Federal Reserve - and the Fed wants to own the bonds pretty badly (i.e. they are willing to pay high prices).

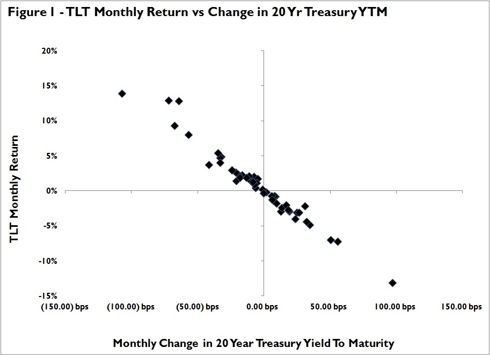

Looking back over the four year period ending June 30th, 2011, we can see the relationship between returns on TLT (y-axis) versus changes in the Yield to Maturity (YTM) on 20 Year Treasuries.

Looking at the returns for TLT versus changes in the YTM on 20-Year Treasuries, we can see that returns are negative when changes in YTM are positive and positive when changes in YTM are negative. In the case of the Fed's Operation Twist, we can expect that changes in YTM will be negative. While the Fed is buying, smaller investors can take advantage of the same opportunity larger institutional investors and hedge funds are taking advantage of. It is important to understand that once the Fed completes its program, there is much less certainty about the direction of yields - but more on that later.

Shout - Short HYG

The high yield bond market, formerly called the "junk bond" market, is the bastion of the sophisticated credit investor. High yield bonds are typically issued by two types of companies: good ones that are too small or untested to access cheaper credit or ones whose credit standing has deteriorated because of leverage or uncertainty that must pay for expensive credit. In either case, the yields in this market can move quickly and are typically directly related to the volatility, or price variation, in the equity market. This is because a company's implied leverage decreases with equity price increases and increases with equity price decreases. Since increased volatility is typically associated with declines, yields on these securities can widen very quickly. A prime example of this occurred in 2008.

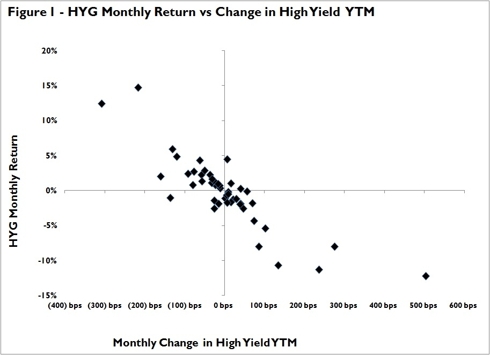

Looking back over the four year period ending June 30th, 2011, we can see the relationship between returns on HYG (y-axis) versus changes in the Yield to Maturity (YTM) on a benchmark high yield index.

As with TLT versus the 20 Year Treasury YTM changes, looking at the returns for HYG versus changes in the YTM on high yield bonds, we can see that returns are negative when changes in YTM are positive and positive when changes in YTM are negative. High yield bonds are a little bit different than Treasuries because change in YTM can occur because of changes in interest rates or because of changes in credit spreads (i.e. the premium paid over a reference rate for a company of a given credit quality). It is important to understand that markets are a discounting mechanism and that the dynamics of the high yield market are unique in some regards - but more on that later.

Trade Rationale

The Fed is buying 20-year Treasuries which should make the YTM go down, meaning the price for TLT is likely to increase. Given the crisis in Europe and concerns about the spillover effects, compounded by the economic weakness we are experiencing that is expected to worsen, the YTM on high yield bonds is likely to increase. This is because in environments of higher uncertainty, investors want to earn more money for the risk they are taking than when there is less uncertainty. We can all say that uncertainty abounds today!

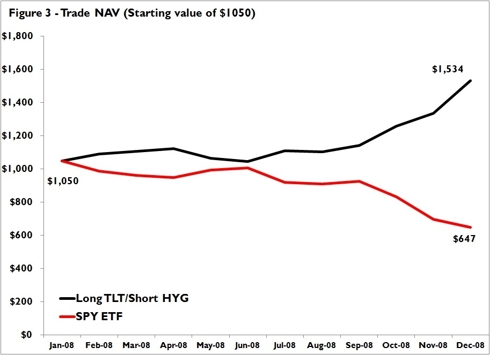

The rationale behind this trade is that one wants to take advantage of the expansion in yields in the high yield market and the downward price pressure it creates, while taking advantage of the Fed's appetite for longer duration bonds and the upward price pressure it may create. To do so, you sell or "short" HYG and buy or "long" TLT. By investing an equal dollar amount in both, you will have a neutral trade. Not including transaction costs and market friction effects, this trade earned a total return of 51.1% assuming a 50% initial margin requirement for each position (10 shares short of HYG, 11 shares long of TLT), initiating the trade on 12/31/2007 and closing it on 12/31/2008. Over the same period of time the SPY ETF returned negative 38.28%. That's a difference over 80%!

Trade Risks

An 80% return does not come without risks. Credit markets, especially the high yield market, move very quickly, making and losing investor money along the way. A one basis point move on a 20-Year Treasury can wipe away equity very quickly as well. Inexperienced investors should not pursue this type of trade and experienced investors should understand all the risks. Right now, there are two things working in your favor: the Fed is a buyer with a large appetite and the markets are growing fearful, repricing credit risk along the way. The uncertainty lies in the transition period when the Fed is no longer a buyer if demand drops and investors sell 20-Year Treasuries, and in the relative speed of the repricing of high yield risk. In the case of high yield, once the market perceives improvement, spreads can tighten almost as quickly as they widen. All of the above said, if you watch the market and can stomach the risks, it makes for an interesting trade, in particular at times like this!

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in TLT over the next 72 hours.

Additional disclosure: While I have no position in these ETFs currently, I intend to initiate the trade I am describing early next week. I am not investing with enough size to materially move the market, nor am I attempting to cause manipulation. Both ETFs have average daily volume in excess of 2 million shares per day.

You may also like

-

Print

-

In the last 5 days (I wrote article on 9/28 but had to change from my 'alias' to real name to get it posted), HYG is down 4.88%; JNK is down 5.18%. TLT is up 1.17%.

In the last 5 days (I wrote article on 9/28 but had to change from my 'alias' to real name to get it posted), HYG is down 4.88%; JNK is down 5.18%. TLT is up 1.17%.

TLT is up where it was in late 2008; I think the difference here is potentially Twist, which some believe may not be fully priced in. Second, let's assume you treat the difference between a 10 yr zero and the market value of the HY bonds behind HYG/JNK as the price you'd pay for a down and in put that would pay you the difference between the market price and face (i.e. give you a riskless bond). Implied recovery rates (the value of the barrier) were less than 40%. They're higher than that now, or put another way, spreads are tighter. If you think we're hitting another credit event such that spreads would expand (my view), then HYG/JNK have some room to go. In 2008, at the same period, HYG was trading at around $69; it's at $81 now.

You have some duration risk embedded in this but: a) if you think Twist isn't fully priced in, and b) if you think HY spreads are going to expand; it's a reasonable trade. I'm not saying hold it indefinitely, or for a year, just that it's an opportunity that exists now. -

Dieuwer - fair point; markets are definitely discounting mechanisms. I think the unknowns remain the evolving Euro crisis as well as the appetite on the part of pension funds and others that are extending duration in their fixed income portfolios. To the extent Twist is priced in, it's not a good trade, to the extent it's not you have room to run. I clearly think the latter is the case.

Dieuwer - fair point; markets are definitely discounting mechanisms. I think the unknowns remain the evolving Euro crisis as well as the appetite on the part of pension funds and others that are extending duration in their fixed income portfolios. To the extent Twist is priced in, it's not a good trade, to the extent it's not you have room to run. I clearly think the latter is the case.

Peter - credit spreads are widening at a faster rate than treasuries are declining. I'm assuming that you think high yield YTMs are going to come in and Treasuries are going to expand. If so, I'm definitely wrong. But that's how markets get made.

Thank you both for the comments. -

high yield trades on price...it isn't quoted in spread and doesn't really move with rates at all - particuarly not in times of stress...

today was perfect example, all day, hyg and tlt moved in opposite directions. in a spread trade compression or decompression trade, you would expect both assets to move in same direction, just at varying speeds, like LQD vs TLT or BAB. Your trade is going to both move for you or against you for the exact same reason. -

Peter,

Peter,

HYG moved down, TLT moved up (until late in the day). I think Treasury spreads can come in a bit more and that credit spreads have some room to expand. You're taking on duration risk to some extent, but I think HYG is overvalued. Implied recovery rates are trading at a high relative to where I think they should be given the market stress that exists but that's correcting. If borrowing costs for HYG are prohibitive, you could look at JNK. I'm not paying 5% for the borrow; not sure why IAB rates are so high <per quote below>.

I take your point on high yield not being quoted in spread; whether you think of it as a derivative of price or not, looking at the implied spread vs Treasuries, I think they're a bit too tight. Implicitly I'm saying that spreads will widen more than levels tighten (presuming I'm directionally right on Treasuries). -

I don't think the profit from the 2007-2008 time period is realistic in this case. High Yield was overvalued in 2007 -- spreads were way too tight. It seems more reasonably valued now. Also, treasury yields are near historic lows. How much lower will they go?

To evaulate the potential profitability on this trade, you must determine how wide high yield spreads will go and how low long-term treasury rates will go. You must also factor in your cost of carry, as you will get far less interest from owning treasuries than you will pay in high yield interest and borrowing costs. From there, you can evaluate what your profit potential is.

Myself, I think over the neat term treasuries can go anywhere (and could well rally further per your investment thesis), but over the long term they are overvalued. Would you want to lend Uncle Sam at less than 2% for over 10 years and less than 3% for over 30 years given how much debt this country continues to accumulate???

For that reason, if you are bearish on markets you might just look at shorting the Rusell 2000. It tends to be pretty highly correlated with high yield and the cost of carry is lower.

"Buy back Tuesday?"

40 Comments - Show Original PostCollapse comments

C says'

I'd like no recession please,BUT do I always get what I want?

No offence TMM as I've noted on more than one occasion ,you appear to have this penchant for trying to be rational/logical and thus finding a case for being contrarian.

Sorry old son,the markets full of dicks that couldn't spell rational never mind do it.So being contrarian is one of those things I prefer to hold for moments of true desperation and this isn't it really. Mr Markets a bit preoccupied with capital preservation and i doubt it cares much whether yesterdays data was just not that bad which I also noted. Indeed quite a lot of data globally hasn't been that bad and if you pushed me to be rational I'd say the worst interpretation of it was mildly recessionary ,but not swimmingly so.Trouble is that's me doing a one hand is clapping with not enough people listening.

On balance be the herd just remembering not to follow them off their most recently established cliff.

Bon chance with the buyback.

12:29 PM

Oh and I spotted that French 'guarantee' as well and given I hold some bank debt,not there's my eyebrows rose.Trouble is how do I square that with remarks about renegotiating Greek haircuts? Let's be frank here,these Eurocrats couldn't find the same hymn sheet never mind sing from it.

12:33 PM

30 year old man child... hey wait a minute...

I'm making the shopping list today. At some point the reach for yield will come back in after the momo guys have sold everything.

If you are a long term holder (+5 years, not +6months which seems like the contemporaneous definition) of equities, and you didnt sell in 2008, didnt sell in August, why are you gonna sell now?

I'm looking for signs of bottoming in Hang Sang b4 i get greedy.

Also I think a theme next year will be higher than expected inflation in EM, any idea how to play that? I know brazil has some inflation linked bonds, but any ideas on a more general macro punt

12:51 PM

Many times have I concurred with the folly of buying such CDSs, often in the context of French banks, but now we can safely add MS, BAC et. al. to the mix. I have no problem with their credit risk (although equity may be another story).

Hysteria is definitely overdone, and a bounce due. The question is today or later.

For is it not written that we are to wait for the Day of Atonement to buy back our positions?

12:55 PM

C says'

Simply observing what markets do like rather than being rational.Markets do like to test and retest the resolve of directional positions.Which is why technical breaks rarely get away free and clear.

I won't be joining you in a buyback because rallies are to be sold until there is a reason not to.I've banked my short to reset for that because the probabilities after 90% days with double digit drops in large caps don't favour continuation days unless there is a very specific trigger and I have not seen one at this time.

1:11 PM

never understood why more peopel dont sell CDSs on countries with their own currencies. Where is AIG FP when you need them! There are millions to be made thanks to people who dont understand the power of having your own printer.

1:39 PM

Just throwing in my couple pounds, I wonder if theres any old timers out there that remember the last time they heard their broker say, 'well, it is a bear market ya know"

1:41 PM

I too am tempted to join the buyback crowd, but I am afraid the A-team is going to stick with its 'only compass' and will pussyfoot around in the face of 3pc upside "surprise" in EZ inflation. Unless these guys get it and capitulate, no equities for this 30y old man child, who'd rather keep playing in US credit (HY and securitized in particular look like decently re-priced, relatively policy/Eurostriches-independent picks on a 12m view)

1:53 PM

I like the idea of a yom kippur rally!

C - I agree rallys are to be sold, but if you are looking for bargins in equities, and not technical trading, at some point you have to start building your position. If you wait for the trend to change you miss a good chunck of it. I prefer to be cautious like you but at some point you have to grind your teeth and get involved

there are some equity names trading pretty cheap

2:00 PM

C says'

Abee ..you tell me when you see a building position market and If I agree my teeth will be ground to the gums.

Make no mistake I have not seen that market in equities for most of this year neither do i expect to for quite some time to come.Meanwhile I have problem with trading the market I think I am in and doing so for the most part from the side where I see the bias.

I bought the 'knife' long on the Aug capitulation move adn i'd be happy to do that again.I'm just asking ,give me the capitulation first.This isn't it. Anyway someones got to be out here providing the liquidity to get you and TMM out of positions that you've built ;)

2:10 PM

TMM,

You obviously do not understand what China's reserves are. They do not have $3T in equity. There are massive liabilities on the other side of their balance sheet that funded the purchase of those reserve assets. The very simplistic explanation is that they essentially borrow from their citizens at their short term int rate and use those $ to buy US treasuries (mostly). They made a big net interest spread on this for years but now with US rates well below their funding cost they have a huge neg net int spread (which makes pegging their currency very costly). Also, they are short RMB and long US $ (a massive losing bet). So, if the CNY appreciates 10% against the $ the PBOC's net indebtedness goes up by $300B (6% of GDP). I'm not saying you should buy their CDS, but don't use their fx reserves as an argument against buying it.

2:27 PM

TMM have clearly become students of Bottoms over the last few years.

Today is indeed the kind of ridiculous capitulation day that makes US high yield credit (especially) and dividend paying equities irresistible, even while hedge funds and even real money may be throwing the toys out of the pram. This is a classic pre-earnings panic, complete with downgrades and warnings of slashed dividends etc. By and large, this is not going to happen. Earnings season might even see some panic buying.

Europe? We are in wait and see mode there, but a furious squeeze is always on the cards in a heavily shorted market. Europe likely to remain a fantastic trading market for a while with high volatility the rule not the exception. Today's prices probably reflect a 50% haircut, now the question is: can it be worse? More likely not, but for the time being there is no transparency.

3:07 PM

Excellent post.

Best comment on twitter today: In 2008 we worried illiquid banks were insolvent, in 2011 we worry insolvent banks are illiquid

3:17 PM

mjm123, I think you took TMM's 3 trillion reserve argument to the wrong direction. China gov borrowed less than $2 billion from foreigners, and China gov has $3 trillion of foreign currencies in the bank. This is not about the funding cost and balance sheet deficit. My understanding is that China has clost to zero chance to default its foerign gov debt, simply because it has the cash, more than enought to pay back the money.

Internal debt is another matter.

3:31 PM

Pippa's bottom - love it!

Pip! Pip! Tally ho! "Fockers" at 1 o'clock high!

"I wonder if theres any old timers out there that remember the last time they heard their broker say, 'well, it is a bear market ya know"

Yes indeed! January 1975 when the FT 30 had fallen 70% plus and then doubled by the end of February!

3:37 PM

TMM, you dissapoint me. What's with you wanting guarantees from governments on bonds. Let markets clear!

3:51 PM

Anonymous,

My first point is that China's fx reserves are not a source of strength for the Chinese govt, they are actually a huge source of risk.

The second point is that China cannot use their $3T of reserves to repay their govt debt, or be used to recapitalize the banking system for that matter; they can only be used to buy foreign assets. These reserves are not cash hordes, they are actually liabilities themselves (but don't get counted as govt debt). There are numerous examples of countries defaulting that still had huge fx reserves at the time b/c fx reserves cannot be used to fund deficits or repay debt.

THE reason China won't default is b/c their debt is denominated in their own currency and they are the monopoly issuer of that currency and can print all they wish, not b/c of fx reserves. I'm just pointing out a common misconception over what fx reserves really are.

4:18 PM

mjm123,

excellent comments re: China's fx reserves. This is something I'd like to delve further into, gain a greater understanding of per se. Would you mind providing a resource as to where this view is expounded upon? I've tried Pettis's blog but to no avail. Cheers.

5:07 PM

What if they gave a recession and nobody came?

5:32 PM

Today has elements of an intermediate term bottom. Sentiment extremes, remorselessly negative media noise, longs throwing in the towel, definite signs of capitulation by some bulls, and very low 10y yields that have now reversed strongly. Most of the ingredients.

I know what Anon @ 5:32 is thinking. Nothing like the Street whipping up a faux recession to shake weak hands out of their positions in income-producing securities and into the slow death of 1% yielding 5y Treasuries.....

5:45 PM

Anti piss-taking bill has protectionist implications. It's probably best if this doesn't get very far:

Currency Piss-Taking Bill Being Discussed

Reminds me of the Buy British campaign, instead of cheap Japanese things that didn't work (this is the 70s, before the rise of China and before Japanese quality) we got expensive British things that didn't work. It wasn't a success. The German stuff was ten times better at twice the price. The French and Italian stuff was beautifully designed and very chic but broke immediately and couldn't be repaired. It was all a bit dire, really.

6:07 PM

mjm123, in case of external public debt of China, FX reserve helps since 1) gov is the monopoly issuer of RMB; 2) RMB is not freely convertible yet; 3) fx exchange and capital movement are still highly controlled in China; 4) most of the FX are effectively in pboc's hand.

Since I only talked about external public debt, the huge reserve+control over capital movement and transfer would be a pretty effective buffer for an external debt crisis. And could you give some examples of countries defaulting with large fx reserve ?

6:18 PM

"Significant, but not a game changer", say Bernanke about the 'Twist' -theglobandmail.com/report-on-business/economy/economy-lab.

"We think this is meaningful, but not an enormous support to the economy". Recovery,"close to faltering".

OT expected to lower int. rates by 0.2%. Is BB preparing the market for QE3?

6:45 PM

A few thoughts on various topics.

I think the Twist has been misunderstood, or perhaps not understood at all, especially by those players whose understanding of the Treasury market approximates that of a pond snail (most momo traders, all commodity traders, a vast army of financial media hacks). Allow me to elaborate...

Bernanke knows that a QE3 is to some extent unnecessary at present, as it has already been done for them! Eurostrich activity has triggered enormous panic buying of US Treasuries by European banks and pension funds etc...

This has been a fantastic boon to the US Treasury, which has been able to sell a lot of cheap debt, and to the FED, which owned the short-term Ts and was able to start selling at a profit. The FED can now achieve a couple of objectives over the next few months:

1) Slowly sell 1-5y USTs. This will gradually drive investors out of Treasuries and into higher yield short-term US corporate debt, thereby stabilizing the economy ahead of what is known to be a large debt rollover bulge that is looming in 2012. This will initially look like a mini version of 2009's credit squeeze. We recommend front running this trade by buying junk bonds.

2) Buy 30y USTs and MBS. This FED action will offset selling by other market participants (Voldemort) and prevent the housing market from being smashed by higher mortgage rates. The aim here is simply to keep things stable at the long end.

So, given our base case scenario of a mild US recession only, we don't think the steepener (long front end, short long end) is going to be the best trade in credit, as much as the tightener (long junk, short 5y Treasuries).

Note that this model doesn't predict a lot of dollar weakness, so carry traders would have to jump back to selling the yen, so look for a revival of AUDJPY etc, and only modest strength in the commodity complex and emerging markets, which would only be revived in full by a sizable QE3.

As always feel free to throw rotten tomatoes....

7:02 PM

This youngster is still putting on the spread widener. I think he is a bit late to the party on this one, but it does show the diversity of opinion.

Credit Spread Trades

8:38 PM

Looks to me like there will very soon be a perfectly appropriate soundtrack for this chap

http://www.youtube.com/watch?v=R8AOAap6_k4&feature=related

8:49 PM

Or this old chestnut:

Squeeze Box

8:56 PM

You gotta love the fellows at TinFoilHatMagazine.com

"Reverting back to short. The sell-off this morning felt overdone, in HYG in particular. We bounced on Bernanke, but it wasn't with much conviction. Although BAC and MS bounced nicely off their lows, BAC hasn't been able to get green on the day, although MS has, but barely. With such weak performance from ideal short squeeze candidates, it seems clear that we are not out of the woods yet. I think the failure to trade up significantly means we go through the morning lows."

As their namesake would put it: a question of etiquette - as I pass, do I give you the ass or the crotch?

9:00 PM

I think that Mr Cold Steel and the Anonymous Proctologist will be only too delighted to pay Mr Shorty a visit in the very near future. If the European fudge factories are busy overnight we might be in for a gap up at the open.

Some of the tin foil hat brigade might find themselves waking up to a very sore posterior indeed.....

We dumped the last of our Treasuries today, and we're thinking, you know that's a nice bit of business you've done there, for a daft Scouse lad.

9:06 PM

Same as with the parabolic expansion in gold a few weeks back, there will be great opportunities to be long TLTs and the like in the future. This is not it.

Or, for LB: "At the end of a storm is a golden sky, and the sweet silver song of a lark. Hold your head up high, and don't be afraid of the dark"

9:11 PM

That's it, Humberside.

Sing it, Gerry. This one is for battered longs and long suffering Reds fans everywhere:

You'll Never Walk Alone

I think that's me Mam in the video, there....

9:16 PM

C says'

Dee Dee

Are you an old soul man by any chance? Northern?

9:19 PM

Let's try this fitting anthem for the reflationistas and the inevitably upcoming "everybody else lost even more than we did" quarterly letters

When you write your 10-Q form

Hold your head up high

And don't be afraid of the marks.

When you write in your form

Gold not to the sky

And the sweet SILV thrust in your arse

Sell oooon through the wind

Sell oooon through the rain

Your '10 gains be tossed and blown

Sell oooon

Sell oooon

With hope in your heart

And you'll never sell alone

You'll never sell alone

Sell oooon

Sell oooon

With hope in your heart

And you'll never go bust alone

You'll ne-eee-eee-e-ver go bust alone

9:40 PM

nice ones guys. Financial songs for the terraces.. Now there's a whole new field of fun.

mjm123 .. thanks for your comments. And we get your point and you made us stop and think .. dunno what yet .. but we are thinking .

Right as for les marches , lets hope that Italian downgrades don't screw it all up by tomorrow morning. Thanks for Foxy back .. now wear this ..

10:10 PM

Anonymous,

I read the argument as, "China will never default b/c they have $3T in fx reserves". Whether the default is on domestic or foreign obligations is irrelevant for a CDS event. I agree that foreign borrowings are not the problem, the domestic RMB debt is. And in this case fx reserves actually increase the likelihood of a domestic debt issue b/c, as Pettis says, "financial crises are always caused by mismatched and highly inverted balance sheets, and the central banks accumulation of reserves is exactly that kind of balance sheet". Fx reserves only protect countries from a foreign debt or currency crisis not a domestic one.

10:38 PM

willem,

Most of my knowledge on the inner workings of China's fx reserves have come over time from several books, sell side research notes and presentations, as well as conversations with certain individuals with intimate knowledge of this process. One of which (chief strategist at a major investment bank who used to be head of their fx and his close friend and biggest client was the head of SAFE) I just talked with and briefly discussed this topic. But Professor Pettis does have a couple great posts on this subject, unfortunately it doesn’t delve into detail on the mechanics of the fx reserves.

http://mpettis.com/2010/02/what-the-pboc-cannot-do-with-its-reserves/

and

http://mpettis.com/2010/02/never-short-a-country-with-2-trillion-in-reserves/

10:51 PM

excellent, thank you again.

11:17 PM

@LB, mjm123,

Along with TMM's posts, your comments are very informative. Thanks

11:20 PM

mjm, the point we made is that you aren't buying into the probability of China having a general default, you are buying into their USD OFFSHORE BONDS defaulting. That is very different. Those bonds can be redeemed using reserves. Why?

USD Account:

Assets: 3trn

Liabilities: 1.2bn

Net: ~3 trn

Redeem the bonds and no FX changes hands.

Now, RMB account:

Assets: Useless SOEs that couldn't make money without subsidies if they tried, banks that lends to them.

Liabilities: Just about everything.

Which admittedly isn't great. But remember you ARE BUYING USD CDS. If you want to bet on likelihood of China devaluing, selectively letting local governments default, or having insane inflation to make the bad go away by all means go ahead and do it but those are:

1) Onshore bond shorting (hard)

2) Shibor payers

3) CNH options

They are not China CDS.

3:17 AM

And as for "obviously not understanding what China's reserves are" - ***** please. When you can understand that countries with their own currency and limited external debt are a different game to the Argentinas and Greece of this world let know.

3:20 AM