- 人眼对灰度变化的感觉比对色调变化的感觉来得敏锐

- 人眼對低亮度變化的感覺比對高亮度變化的感覺來得敏銳 人眼对低亮度变化的感觉比对高亮度变化的感觉来得敏锐Gamma Γ

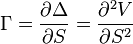

Gamma,[7] Γ, measures the rate of change in the delta with respect to changes in the underlying price. Gamma is the second derivative of the value function with respect to the underlying price. All long options have positive gamma and all short options have negative gamma. Gamma is greatest right at-the-money (ATM) and diminishes the further out you go either in-the-money (ITM) or out-of-the-money (OTM). Gamma is important because it corrects for the convexity of value.

When a trader seeks to establish an effective delta-hedge for a portfolio, the trader may also seek to neutralize the portfolio's gamma, as this will ensure that the hedge will be effective over a wider range of underlying price movements. However, in neutralizing the gamma of a portfolio, alpha (the return in excess of the risk-free rate) is reduced.

- gamma=vix

- vxz=vega

- Vega ν

Vega[7] measures sensitivity to volatility. Vega is the derivative of the option value with respect to the volatility of the underlying asset.

Vega is not the name of any Greek letter. However, the glyph used is the Greek letter nu. Presumably the name vega was adopted because the Greek letter nu looked like a Latin vee, and vega was derived from vee by analogy with how beta, eta, and theta are pronounced in English.

The symbol kappa, κ, is sometimes used (by academics) instead of vega (as is tau (τ), though this is rare).

gamma01 gamma=vix vega=vxz 人眼对灰度(st vol)变化的感觉比对色调(fa)变化的感觉来得敏锐 人

所有跟帖:

•

Planck量子理论认为, 辐射能的发射或吸收是不连续的,而是量子化的。 ... 电磁辐射就其能量高低可分为γ射线区、X 射线区

-marketreflections-

♂

![]()

![]() (16169 bytes)

()

09/12/2011 postreply

21:10:46

(16169 bytes)

()

09/12/2011 postreply

21:10:46