On Friday, Apple (AAPL) closed at $343.26, up $7.59 on the day and up $16.91 or 5.2% on the week. Although the week's share price advance was impressive, Apple remains significantly under valued based on the company's current rates of revenue and earnings growth. In the first six months of the current fiscal year Apple's revenue has risen 76.2% and earnings per share has gained 83.2%. In contrast, since the first trading of Apple's current fiscal year on September 27, 2010, the share price has responded with only a 17.9% gain.

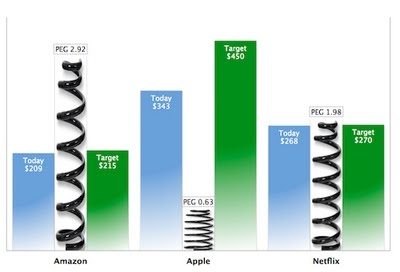

Last week in a post titled AAPL: The Coiled Spring, I compared the median price targets for three popular equities: Amazon (AMZN), Apple and Netflix (NFLX) and the share prices for each. Apple is trading at a price-earnings multiple of 16.35 times trailing 12-month earnings of $20.99 per share and at only 76.3% of the median Wall Street price target of $450 per share. In comparison, both Amazon and Netflix are trading at much higher price earnings multiples and at or near their respective median price targets.

Apple's PEG Ratio: More Share Price Gains Ahead

For this post, I asked Jeff Fo*****erg of the Apple finance board to adapt his popular "coiled spring" graphic to reflect not the price-earnings multiples of the above-referenced companies but the PEG ratios of the companies at Friday's closing prices.

[Click to enlarge]

Simply defined, the PEG ratio represents the price-earnings multiple divided by earnings per share growth. The lower the PEG ratio, the lower the current valuation relative to rates of earnings growth. Apple's current PEG ratio is 0.63 versus 2.92 for Amazon and 1.98 for Netflix. Compared to high-flying stocks such as Amazon and Netflix, Apple is bargain priced and the company's current PEG ratio signals more share price gains ahead.

Because Amazon, Apple and Netflix operate in different product and service markets, the PEG ratio is a more effective way to compare and contrast the current market valuations of the three popular equities than a comparison of price-earnings multiples alone. This comparison accentuates the deep discount to growth at which Apple currently trades.

Apple's Price Targets and EPS Growth Expectations

Although the median Wall Street price target for Apple is presently $450 per share, my price target for Apple is $590 and is based on strong revenue and earnings growth expectations. For the three-month period that ended in late June (FQ3 2011), I expect Apple to report revenue growth of about 70% to $26.219 billion and eps growth of about 90% to $6.67 per share. For the fiscal year that ends in late September, I forecast earnings per share of at least $27.50 and an eps growth rate of no less than 81.5% on revenue of at least $112 billion. At Friday's closing price AAPL is trading at a multiple of only 12.5 times this FY 2011 eps estimate.

The Apple iPhone has been in the market for only four years and the Apple iPad is in a nascent stage of global market development. The two products combined will sustain impressive rates of revenue and earnings growth for Apple over the next several quarters. The Wall Street consensus revenue estimate for FY2012 is only $125.13 billion or 11.7% above my FY2011 revenue forecast of $112 billion and the FY 2012 Wall Street eps estimate is only $28.86 per share or 4.95% above my FY 2011 estimate of $27.50. Wall Street FY 2012 revenue and earnings estimates will rise dramatically over the next several months and significant revisions in analyst estimates will occur soon after the release of the June quarter numbers later this month. Today's highly discounted valuation for AAPL will appear even more obvious following the release of the June quarter results.

Conclusions

No matter last week's 5.2% rise in Apple's share price to $343.26, the shares continue to trade at a significant discount to current rates of earnings growth. At Friday's closing price AAPL is trading at 16.35 times trailing 12-months earnings per share and at only 12.5 times my current eps forecast for the fiscal year ending in September. Apple's PEG ratio of 0.63 signals more share price appreciation ahead. Compared to other popular equities such as Amazon and Neflix, Apple's current valuation renders the shares dirt cheap.

Disclosure: Long AAPL

Using PE ttm / Actual Growth ttm

I will use Goog, AAPL and AMZN as example.

AAPL Stats: 16.60 PE / 78.10% 4qtr/4qtr actual growth = $0.21

GOOG Stats: 20.67PE / 17.15% 4qtr/4qtr actual growth = $1.21

AMZN Stats: 92.22 PE / 1.32% 4qtr/4qr actual growth = $69.86

This ratio states, what are you buying $1 of current or actual growth for? If you buy AAPL today your paying 21 cents for $1 growth, AMZN paying $69.86 for $1 growth, etc.

The FY2012 revenue and eps estimates for Apple remain remarkably low. Actual results trump estimates and both the June quarter and September quarter results will be catalysts for significant share price appreciation.

The point I intended to make was in support of his argument.

Apple does best what Apple does best. The company's focus is on innovating and monetizing hardware devices. Apple became the world's largest music distributor because the company needed to create an efficient distribution system to provide inexpensive content for the company's devices.

For the distribution of movies and TV shows to be consumed on Apple's hardware devices, Netflix has done an amazing job. There's no reason for Apple to compete with or acquire Netflix because it would be challenging for Apple to create greater efficiencies.

Apple's focus on the company's core markets provides gross margins in the range of 40% and an ability to limit operating expenses to less than 10% of reported revenue.

This strategy results in net income closes to $.25 on each revenue dollar and this fiscal year will produce revenue growth of over 70%.

My 12-month price target for Apple is $590 per share.

One point to add to your thoughtful comment is when Apple was trading in the $100 per share range deferred revenue accounting on the iPhone obfuscated the company's rates of revenue and earnings growth. That trading range occurred during the depths of the recession and prior to the retrospective adjustment to the historical results following the elimination of the deferred revenue rules on iPhone sales that occurred with the release of FQ1 results in early 2010.

Having said that, a careful observer at the time, could have noted that Steve Jobs, himself, brought clarity to the situation in the Oct 2008 conference call by detailing Apple's release of Non-GAAP figures. I considered the opportunity as good as an arbitrage. Two years later, the stock had tripled. Now, as you and others have noted, Apple is essentially as cheap as it was back then in the depths of the recession. I don't expect Apple to triple again from here, but a strong upward move is definitely in the cards.

First of all, I'd like to thank you for participating in the discussions on my Seeking Alpha articles. I appreciate your comments here and enjoy reading your comments at online publications we both visit.

I spent more than two years explaining the intricacies of deferred revenue accounting on the iPhone. With the exception of those who had a strong background in accounting or closely followed Apple as an enterprise, few were able to fully understand the impact of the deferred revenue on the company's quarterly results.

In my view the iPhone 5 will be a revenue and earnings catalyst on a scale not seen before.

Understanding the history of the share price performance is among the reasons I'm comfortable with a $590 price target.

Responding with facts and responding with references to source data are in my view among the most respectful and polite ways to respond to a question asked in earnest.

Forgive me but I am disgusted with people who say Apple is under valued.

Are you suggesting the Street's median price target of $450 per share isn't justified for a company with an eps growth rate exceeding 80%, more than $70 in cash standing behind every share and is currently trading at a multiple of only 17 times trailing 12-month earnings?

Googles quarterly earning about $9.

Google's share price about $600.

Apple's 3rd quarterly eps about $6. its share price should be 600X6/9= $400. Question: what could you do? Nothing. I want to know that are you just a book economist or practice what you preach. No offense, I hold you high regard and also the AFB.

Apple's 2% rise today is in anticipated of next Tuesday's June quarter numbers and my posted eps estimate is $6.67 per share. I maintain a 12-month price target of $590 on AAPL.

Please let me know what questions you believe I have left unanswered.

I use the PEG ratio as a corroborating metric and I have provided you with references to a large body of my work in support of my $590 price target for Apple.

Again, the rise in Apple's share price since the publication of this article on July 5th indicates the market has responded to AAPL's low valuation relative to current earnings growth by moving the share price significantly higher.

My valuation models indicate continued share price appreciation in the months ahead.