什么是引力的速度?

关于这个问题,有另外一个比较长,然而也比较明白的提法。这就是:假若

太阳突然不复存在,并且消失得无影无踪的话,地球要在多久以后才不再受到太

阳引力场的吸引呢?

还可以提出一个类似的问题:当太阳消失以后,地球什么时候才不复得到它

的光?

对于第二个问题,答案是大家熟知的。我们都知道,太阳离开地球有一亿五

千万公里。我们还知道,光在真空中以每秒300,000公里的速度传播。太

阳消失前的最后一束光线在离开太阳后,要用8.3分钟的时间才到达地球。换

句话说,我们将在太阳消失8.3分钟后才会知道这件事。

这第二个问题之所以容易回答,是因为我们有好多种测量光速的方法。由于

人们能够察觉自遥远星体射来的微弱光线的变化,也由于人们自己能发射出强大

的光速,这些测量方法就成了切实可行的事情。

在与引力场打交道时,我们就没有这些有利条件了。研究微弱的引力场的微

小变化是十分困难的,而且,我们也无法在地球上产生强大的引力作用,让它们

传播很远的距离。

因此,我们只好局限于理论上进行探讨了。目前,已知宇宙间有四种相互作

用:(1)强相互作用;(2)弱相互作用;(3)电磁相互作用;(4)引力

相互作用。前两种是短程作用,随距离的增大而迅速减小,到了超过原子核直径

的地方,它们已经微弱得可以忽略不计了。电磁作用和万有引力作用是远程的,

它们反比于距离的平方而减弱。这就是说,即使是在天文距离上,也能感觉到这

两种作用。

物理学家相信,两个物体间的任何一种相互作用都是通过交换亚原子粒子来

实现的。所交换的粒子质量越大,相应的作用范围就越小。例如,强相互作用是

由于交换质量比电子大270倍的π介子而产生的,弱相互作用是由于交换质量

更大的W粒子而产生的(顺便说一下,这个粒子还未变发现)。

如果所交换的粒子根本就没有质量,那么,相应的作用范围就是无限大的,

这正是电磁相互作用的情况。这时所交换的粒子是没有质量的光子。这样一束没

有质量的光子就是一束光线,或一束辐射。引力相互作用也像电磁作用一样是远

程的,因此,它也应该交换一种没有质量的粒子——人们称之为“引力子”。

而且,物理学家有十分充足的理由假设,在真空中,没有质量的粒子只能以

光速运动。这就是说,速度约为每秒300,000公里,既不能大,也不会小

。

如果是这样的话,引力子就是以光子的速度前进的。这就意味着,如果太阳

消失的话,它所放出的最后的引力子将与最后的光子同时抵达地球。在我们最后

看见太阳的一瞬间,也同时失掉了它的吸引力。

换句话说,引力是以光速传播的。

阿西莫夫:《你知道吗——现代科学中的100个问题

23% All Goods and Services Since 1AD Produced from 2001 to 2010

This is obviously due to the exponential growth of people along with increased efficiencies in production. I would like to think that new discoveries in philosophy, mathematics and physics would take precedence over “things” in importance.

Possible Bottom as Key Sectors Breaking Out

Guest Post from Chris Vermeulen at the GoldandOilGuy

The past month we have seen stocks pick up momentum to the down side after an already very weak month prior (May – Sell in May and go away). This second wave of high volume selling in June was enough to spook the masses out of the market shifting the sentiment from bullish to bearish. But just recently we are starting to see big money accumulate stocks down at these oversold prices, which has me thinking we just may be headed higher sooner than later.

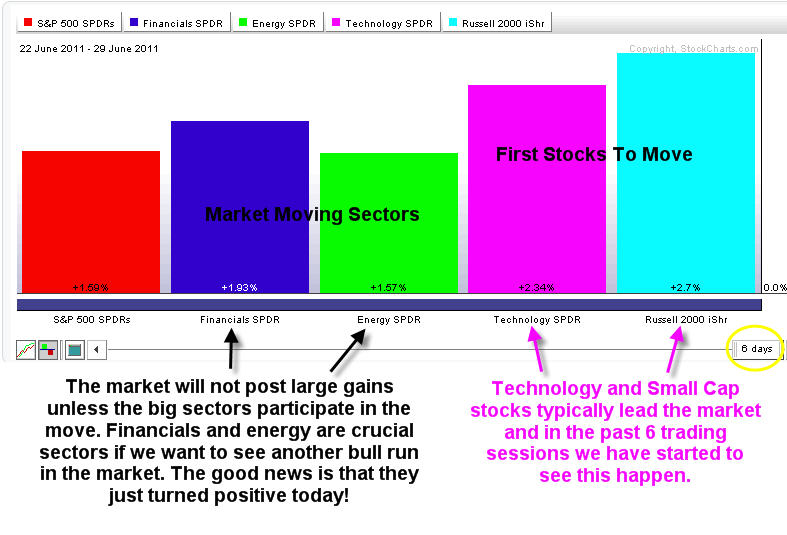

During market reversals we typically see the more sensitive stocks move first, which are the small cap and tech stocks. Then a couple days later we see the brand name stocks (big cap, energy and banking) follow. It’s these large sectors which provide the power in trends.

Taking a look at the graph below you can see on the far right both tech and small caps are leading the market higher and as of today the power sectors (energy and financials) started to move higher also. So if things play out I expect the SP500 which is a basket of the 500 largest companies to follow the small caps higher over the next 1-3 weeks. My trading buddy David Banister over atActiveTradingPartners.com focuses mainly on small cap stock trading combining crowd psychology and fundamental analysis. his focus is finding stocks ready to explode during bull market advances which may just be starting…

If we take a look at the charts to see how each of these sectors have been performing you will notice that the small caps (IWM) and tech stocks (XLK) broke out one day before the energy and financials did. This is very typical to see and it also works for playing gold. I have seen gold stocks lead the price of gold bullion up to 7 days before gold bullion started to move. It’s these little golden nuggets of info which can not only save you money but make you even more when put to work.

Mid-Week Trading Conclusion:

In short, I feel the market has been forming a base for almost 3 weeks. Just last week we saw the big sectors (financials and energy) reach their key support levels from several months back and that should trigger a sizable bounce and with any luck the start of another leg higher in the market.