Credit markets continue to trade poorly. They have struggled to perform well even during moments of equity strength and the conditions that give me the most concern have not been corrected.

HYG and JNK seem to be the best short candidates, and after the moves of the past few weeks, I actually prefer to be short those than SPY.

I remain surprised that IYR has been so stable in the face of distress in the CMBS market so would be short IYR. LQD is also ripe for a short term sell off, though I prefer to be short it on a spread basis so buy some TLH against the LQD short, but again, with outright yields so low a simple short of LQD is not a bad idea either.

click to enlarge images

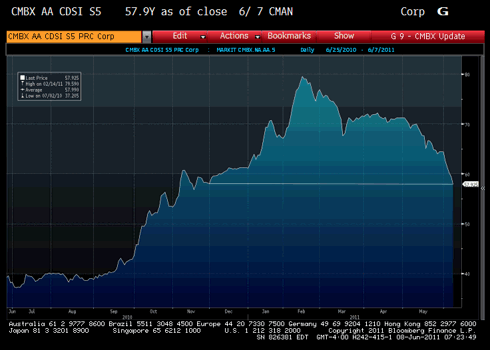

CMBX is worth paying attention to

While true that CMBX is one of the least liquid CDX indices, the move has been pretty dramatic. The CMBX AA is now at levels last seen in November. The performance of other components of the CMBX index (AJ, AM, AAA) is similar. The CMBX and CMBS markets are worth watching as they escaped the high level of defaults that hit the ABX market in the crisis. There continues to be talk of new issues in the CMBS space and (IYR) has performed well, but this move in CMBX has to be more than dealers (or clients) just hedging ahead of some new issues, otherwise, the state of liquidity in that market is even more abysmal than I thought.

Tuesday was the first day that I saw several notes from corporate credit traders blaming some of the weakness in their market on the pressures being felt in CMBS market. Once again, clients at some point, will sell what they can, rather than what they want or need to. CMBX stabilized at the end of the day, but definitely watch this market as weakness here is definitely starting to impact other credit markets.

Speaking of ABX, the almost forgotten ABX indices have also flashed a warning sign. The ABX AAA S7-2 is trading at 36 (according to Bloomberg) which is a price last seen in March of last year. While ABX is no longer a key driver of the market, it is worth noticing that this has dropped about 10 points (or more than 20%) in 3 months.

The moves in CMBX give me reason to short IYR and give me pause for concern about the broader markets and for the credit markets. I first pointed out the CMBX move last week and so far it has trickled into the corporate credit market but hasn't had much of an impact on IYR. I continue to believe it will.

IG16 and HY16 continue to trade poorly and remain very cheap to fair value

IG16 is currently trading at 96 ½ and IG15 is at 84, which is approaching its March wides, but still a fair bit away from its yearly high of 92. Last November, IG15 was trading at almost 100, implying that IG16 could get as wide as 113 if the IG CDX indices follow the CMBX indices back to November levels. I can almost hear the shouts of di*****elief at that statement – a result of so many investors having an overweight in the corporate bond sector.

According to Bloomberg, IG16 is trading 3.5 bps cheap to fair value. As I wrote last week, the longer this cheapness exists, the more risk there is that it starts a self reinforcing move wider as the pressure the arbs put on single name spreads has a greater impact than the support they give the index. One theory to explain the cheapness is that with single names rolling on June 20th, people have been reluctant to put on hedges in single name CDS, so the index has taken on a disproportionate amount of the hedging trades.

This makes some sense, as the markets are not in panic mode by any stretch of the imagination, so hedgers have tried to save themselves the pain of the roll by shorting only the indices. If that is the case, I would expect fair value to close post the roll, but likely with single names moving wider, rather than indices moving tighter.

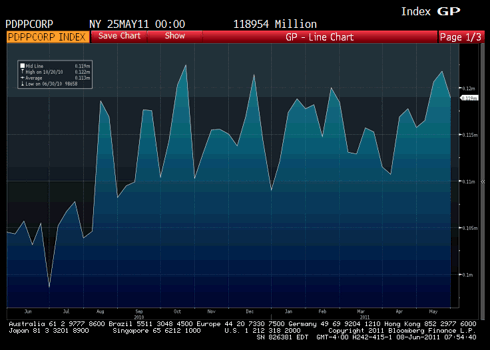

Some dealers may have sold single name CDS ahead of the roll hoping to capture some roll profit and are now stuck being long single name credit risk in the worst market during times of weakness. That positioning would also explain some of the cheapness but would be worse for the market technically than if dealers are only caught long bonds. Dealers are long corporate bonds with inventories close to the highest levels in years, and for the first time in awhile, that trade has not been profitable within days.

According to the NY Fed, here are the dealers’ outright level corporate security positions. Corporate spreads have been moving wider since mid may, and that move has accelerated in the past week, we may see additional selling pressure as market makers get the ‘tap’ and are told to lighten up. It sounds like more investors are now starting to inquire about selling bonds rather than buying them.

So far, all we have seen is the disappearance of the ‘buy the dip’ crowd, and have not seen fast money turn decidedly negative. That may happen as the news out of Greece indicates that almost the best case is kicking the can for a few months until the next IMF review, and the worst case is a more immediate problem.

Bernanke did not do enough to calm markets Tuesday and may have left enough of an opening to encourage shorts. With indices so cheap, and how difficult it seems for dealers to move large blocks of corporate bonds, any decision to push on this market by fast money could see a quick drop.

As I mentioned last week, the right trade, particularly in high yield, seems to be to sell actual corporate bonds rather than hedging. HY16 is trading about 1.5 points cheap according to my sources. It is currently trading at 100 ½ down from 101.5 last week. HYG is down to 90.50 from 91.24, so it has outperformed moderately but Tuesday was the first day it actually moved in line with HY16. I expect it has room to underperform. JNK has outperformed both HYG and JNK and I am trying to figure out why.

AMG flows were negative last week for HY mutual funds. HYG and JNK shares outstanding have experienced minimal outflows so far. Not enough to put much pressure on the markets, but a possible indication of the love affair with high yield nearing an end. HYG shares outstanding started the year at 81,700,000 shares and hit a peak 98,600,000 just last week. The slight decreases in shares outstanding may be a mere blip on the radar screen, but combined with the move in the indices, the cheapness of the index to fair value, and the anecdotal evidence of dealers having more difficulty moving bonds, it might be more than that, and losses would be likely to trigger selling pressure.

I don’t have the numbers, but there seems to have been a chase for yield and investors of all types (institutional and retail and hedge fund) all moving down the credit curve to pick up some yield. In the past, investors new to high yield overestimate their comfort with the credit quality and underestimate just how illiquid this market can become.

According to TRACE, 512 TRACE eligible high yield bonds had round lot trades on Tuesday. Of those bonds, only 79 bonds had more than 5 trades. I will track this as a way to help determine how liquid the market really is. Some of the bonds with 1 round lot trade did include dealers buying a million and moving them in smaller lots, but that doesn’t indicate a healthy market to me. The MGM 6.625% bond is a perfect example of why I don’t pay much attention to bonds with 4 trades. The 4 trades include a dealer hitting an interdealer broker at 96.75. That results in 2 trades. Then it looks like someone was able to cross a block of bonds (>1MM) for 3/8 of a point. Again that counts as 2 trades. If people think HFT makes volumes look bigger than they are in stocks, you will quickly find that TRACE does the same for corporates. The balance between bonds that were up and down on the day seemed okay, but more bonds moved down over ½ a point on limited volume than moved up by more than ½ point.

In the new issue market, FSL brought a new deal Tuesday. In theory it should have done well as the proceeds are to take out existing debt rather than adding to leverage. Early price talk had been in the 8% - 8.25% range. The bonds came with a 8.05% coupon at a price of 98 and are now down at 97.25. This is an indication that we have moved from recent new issues (from a couple of weeks ago) trading weakly, to current new issues trading poorly.

If this becomes common, it will drag the secondary market down as at some point investors will try and hit bids on bonds that allegedly haven’t decreased in price to buy some of these cheaper new issues. We will see if those bids truly exist. The FSL 10.75% bonds of 8/1/20 were trading at 114 for a YTW of 7.84% prior to the new issue. They are down almost a point from there.

Those old FSL bonds are worth looking at, if for no other reason than it shows the difficulty in pulling out yield and spread information from the high yield market. Clearly experts know the details, but it is not always clear what is used in various calculations presented to the public. Anyways, for clarity, the FSL 10.75% bonds trading at 114 had a YTC of 7.84%. That is to the 8/1/15 call date with a call price of 105.375.

If an ETF like HYG is paying out the full coupon, the current yield is overstated as the bonds will experience a pull to call effect and have prices deteriorate. I hope that HYG and JNK only pay the yield, but suspect that they pay as much possible in dividend, knowing that is what attracts investors, and hope that people ignore the pull to call or pull to par effect of high priced bonds. The spread to the call date is 6.65%. The YTM for the bonds is actually 8.5% but the spread to maturity is actually only 5.7%. If anything happens to make this bond trade to it’s maturity date, it will be bad news for current holders. I don’t expect anything to happen to this credit in particular, but it is a good example of showing how tricky it is to talk about yields and spreads for high yield bonds when so much of the market is trading so much above par and are callable.

I like being short HYG for a trade here (or buying SJB if you cannot get the borrow on HYG), as I think we could see a 2 to 3 point correction with risk of a 1 point rally. I actually think HYG short has better near term risk reward than SPY even though I remain bearish on that.

Since I wrote this article on Wednesday, HYG was down more than SPX on the day (-0.47% vs -0.42%). Nothing about yesterday's trading reduces my conviction that corporate bonds are due for a correction. I did cut my SPY short at the close, though I left my SJB position intact.

Disclosure: I am short SPY, HYG. I am long SJB which is similar to being short HYG.