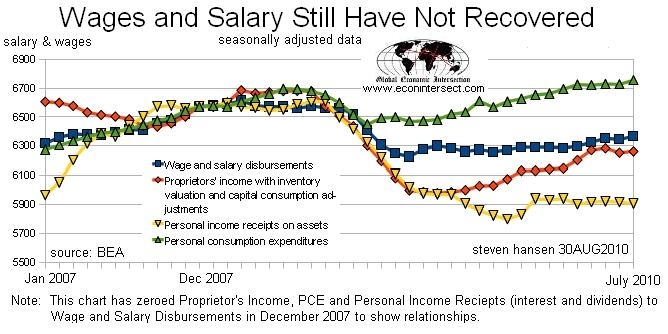

http://seekingalpha.com/article/222955-why-it-is-income-not-expenditures-that-are-limiting-economic-growth Daily, economic articles state that the “recovery” from the Great Recession is constrained by consumer spending. Keep this in mind when reviewing the July 2010 release of "Personal Income and Outlays." This is the headline: Personal income increased $30.0 billion, or 0.2 percent, and disposable personal income (DPI) increased $17.6 billion, or 0.2 percent, in July, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $44.1 billion, or 0.4 percent. In June, personal income decreased $2.7 billion, or less than 0.1 percent, DPI decreased $0.2 billion, or less than 0.1 percent, and PCE decreased $4.0 billion, or less than 0.1 percent, based on revised estimates. Real disposable income decreased 0.1 percent in July, in contrast to an increase of 0.1 percent in June. Real PCE increased 0.2 percent, compared with an increase of 0.1 percent. This release is a summary of an update to the National Income and Product (NIPA) tables, which provide 32 lines of breakdown and analysis for each month. You have read the headlines, and now we will look at the analysis. From a shear numbers point of view, consumer expenditures (personal consumption expenditures) are no longer in a depression – and are at the highest level since this data series began. Only per capita spending still has not fully recovered but is trending up. The total $30 billion gain in personal income came from private sector wages and private sector benefits on wages. Incomes have not recovered to pre-Great Recession levels. Picking a few elements of income, you can see the weakness: (Click to enlarge) At this point, it is more likely that it is income, not expenditures, which are limiting economic growth. The consumer is doing his job in supporting the economy. But this is where low interest rates become a double-edged sword, reducing income, and furthering poor economic conditions, which hurts mom and pop businesses. This comes on the heels of the second GDP release, which was analyzed in More Monetary Policy Stimulus Cannot Correct Poor GDP Growth. Without higher incomes, this recovery will continue to be stagnant.