在sun belt有些地方即使现在房价已经涨到高点,现金流还是不错,算了一下居然可以是正数。 例如以下四个随便挑的四个SFH都有正现金流,算上principal,cash on cash至少都有5%以上。如果假设每年房价升值4%,则总回报率可到20%以上。

| Offer |

$299,900 |

$429,000 |

$469,500 |

$385,000 |

| Asking price |

$299,900 |

$429,000 |

$469,500 |

$385,000 |

| Monthly Rent |

$1,883 |

$2,400 |

$2,495 |

$2,053 |

| Equity |

$74,975 |

$107,250 |

$117,375 |

$96,250 |

| Loan Amount |

$224,925 |

$321,750 |

$352,125 |

$288,750 |

| Loan Duration |

360 |

360 |

360 |

360 |

| Loan Interest % |

3.88% |

3.88% |

3.88% |

3.88% |

| Monthly Mortgage |

$1,058 |

$1,513 |

$1,656 |

$1,358 |

| 1st Month Principal Portion |

$331 |

$474 |

$519 |

$425 |

| 1st Month Interest Portion |

$726 |

$1,039 |

$1,137 |

$932 |

| Property Tax Rate |

1.0103% |

1.1600% |

1.1600% |

1.1600% |

| Monthly Property tax |

$253 |

$415 |

$454 |

$372 |

| Monthly Insurance |

$68 |

$68 |

$68 |

$68 |

| Monthly HOA |

$0 |

$0 |

$0 |

$0 |

| Reserve |

$94 |

$120 |

$125 |

$103 |

| Management Fee |

$132 |

$168 |

$175 |

$144 |

| Monthly Total Expense |

$1,604 |

$2,284 |

$2,477 |

$2,045 |

| Free cash flow |

$279 |

$116 |

$18 |

$8 |

| Free cash flow + principal |

$610 |

$590 |

$536 |

$434 |

| Cash on cash wo principal |

4.46% |

1.30% |

0.18% |

0.10% |

| Cash on cash + principal |

9.76% |

6.60% |

5.48% |

5.41% |

| Home Price Appreciation |

4% |

4% |

4% |

4% |

| Total Annual Return |

25.76% |

22.60% |

21.48% |

21.41% |

| Cap Rate |

5.35% |

4.56% |

4.28% |

4.26% |

| Annual rent / offer price |

7.53% |

6.71% |

6.38% |

6.40% |

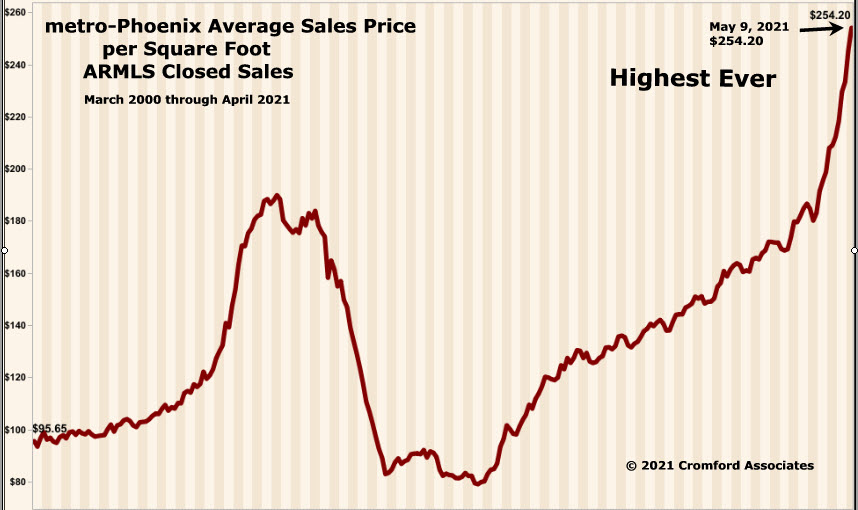

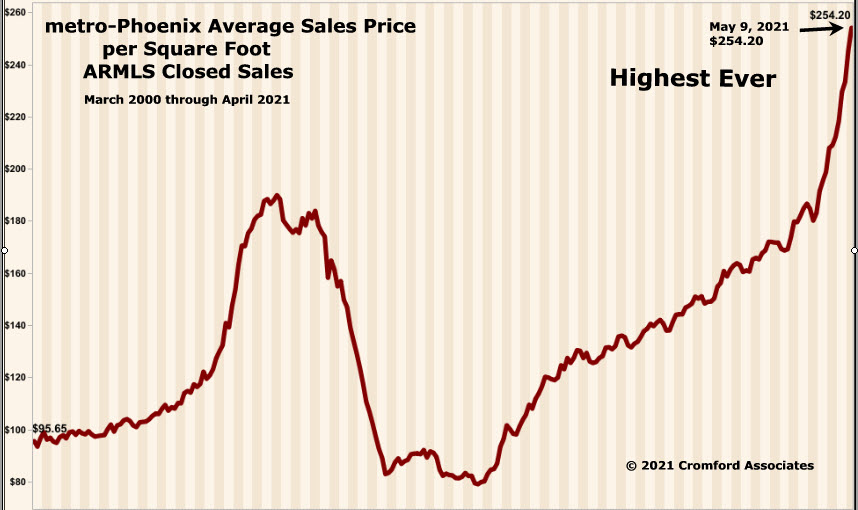

但是,但是,但是,它们现金流高是有它们的道理的。下图是Phoenix 从2000年到2021年房价图。在很短的时间里,单位房价曾从最高点的$190跌到过最低点的$80。这说明这里的风险非常高。因为这里有的是土地而且很容易申请到permit。房价从根本上是有供求关系决定的,一旦供不应求,房价就会飙升,建筑商就会涌入建新房;而一旦新房过剩,就会照成供大于求,房价就会迅速下降。

未来会发生什么,谁也不能预测。但是投资101,在一个高效的市场,各类投资的risk-adjusted-return都会完全一样。这个定理在这里也适用。在湾区和南加,基本没有土地,建筑商非常难找到大块土地建新房,所以房价相对稳定,风险也小很多,所以市场上基本很难找到有正现金流的房子。