为什么韩国造船业会在2023年迅速崩溃? - 方世玉的文章 - 知乎

https://zhuanlan.zhihu.com/p/667833501

Quora上一位长期来中国出差的新加坡人,对2023年造船业的看法。

Because the companies I work for involve shipping investments, I am very concerned about the situation in the shipbuilding industry.

因为我工作的公司涉及航运投资,所以我非常关注造船业的情况。

In 2023, the global shipbuilding industry will indeed see surprising changes: the collapse of South Korea's shipbuilding industry and the crazy expansion of China's shipbuilding industry.

2023年,全球造船业确实会发生令人惊讶的变化:韩国造船业的崩溃和中国造船业的疯狂扩张。

I give two charts here

我在这里给出两张图表

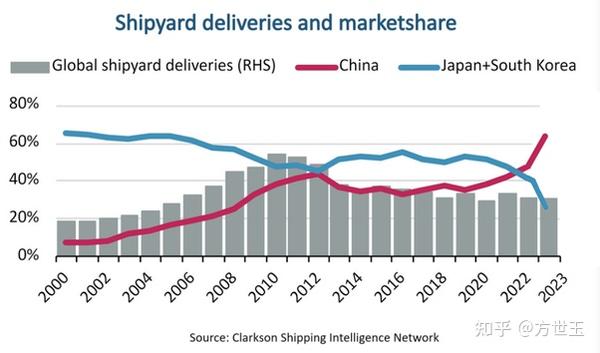

Have you noticed anything special this year? Yes, market share has changed dramatically this year. This is an epic, unprecedented change.

今年你有没有注意到有什么特别的事情?是的,今年的市场份额发生了巨大变化。这是一个史诗般的、前所未有的变化。

Although China's shipbuilding industry has been growing slowly over the past decade, its tonnage share has hardly exceeded 40%. Overall, there is fierce competition between the Chinese shipbuilding industry and the Korean shipbuilding industry. For most of the time, South Korea's shipbuilding industry held a larger share of tonnage than its Chinese counterparts. In fact, in the past ten years, South Korea's shipbuilding industry has not only surpassed China in terms of tonnage, but also has higher sales revenue. Koreans can build some higher-tech and more expensive ships, such as LNG ships.

尽管中国造船业在过去十年中增长缓慢,但其吨位份额几乎没有超过40%。总体而言,中国造船业与韩国造船业之间存在激烈的竞争。在大部分时间里,韩国造船业的吨位份额高于中国同行。事实上,近十年来,韩国造船业不仅在吨位上超过了中国,而且销售收入也更高。韩国人可以建造一些技术含量更高、更昂贵的船舶,例如液化天然气船。

But starting from 2020, China’s share began to surpass South Korea. Entering 2023, this change becomes very scary.

但从2020年开始,中国的份额开始超过韩国。进入 2023 年,这种变化变得非常可怕。

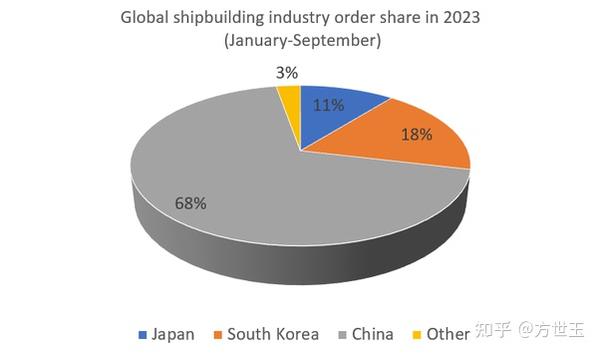

Starting from January this year, the Korean shipbuilding industry began to collapse rapidly; especially before entering the second quarter, the Korean shipbuilding industry was almost completely defeated, and the Chinese once occupied 80% of the share. It was not until the end of the second quarter that South Korea's data rebounded slightly as the Chinese's ability to undertake orders had been saturated and some orders began to overflow. By September this year, China accounted for 68% of the global market, while South Korea accounted for only 26%. Even the LNG ship orders, which have always been the most advantageous in the Korean shipbuilding industry, have been completely surpassed by Chinese counterparts for the first time.

从今年1月开始,韩国造船业开始迅速崩溃;尤其是在进入第二季度之前,韩国造船业几乎完全被打败,中国人一度占据了80%的份额。直到第二季度末,由于中国承接订单的能力已经饱和,部分订单开始泛滥,韩国数据才出现小幅反弹。截至今年9月,中国占全球市场的68%,而韩国仅占26%。就连一向在韩国造船业最具优势的LNG船订单,也首次被中国同行完全超越。

What caused the rapid decline of South Korea's shipbuilding industry and the rapid expansion of China's shipbuilding industry in just one year?

是什么导致了韩国造船业的迅速衰落,而中国造船业在短短一年内迅速扩张?

Have the Chinese mastered more advanced technology? No, shipbuilding is not rocket science, and there is not much difference in technology between China and South Korea. Even the technology and efficiency of Korean shipyards are still slightly ahead.

中国人掌握了更先进的技术吗?不,造船不是火箭科学,中韩在技术上没有太大区别。即使是韩国造船厂的技术和效率也略有领先。

Is it because the Chinese shipbuilding costs are lower? No, after years of development, the shipbuilding industry has made costs very transparent, and the actual manufacturing costs in China and South Korea are very close.

是因为中国造船成本较低吗?这不,经过多年的发展,造船业已经把成本做得非常透明,中国和韩国的实际制造成本非常接近。

This is why China and South Korea have had almost the same share over the past decade.

这就是为什么中国和韩国在过去十年中所占份额几乎相同的原因。

But something unexpected happened in the past year: an interest rate hike

但在过去的一年里发生了一件意想不到的事情:加息

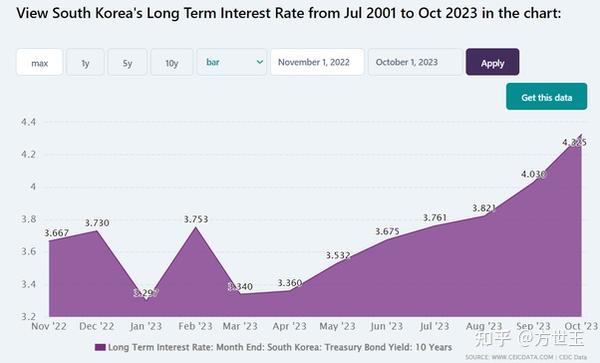

Along with the Federal Reserve’s interest rate hikes, the Bank of Korea has continued to raise interest rates. In the third quarter of 2023, South Korea's interest rate has reached three times that of two years ago. Actually, it's not just South Korea. Major countries around the world have raised interest rates significantly in the past year. After all, in the context of US dollar interest rate hikes, raising interest rates is almost the only option for governments.

随着美联储的加息,韩国央行继续加息。2023年第三季度,韩国利率已达到两年前的三倍。实际上,这不仅仅是韩国。过去一年,世界主要国家大幅加息。毕竟,在美元加息的背景下,加息几乎是各国政府唯一的选择。

But the situation in China is different. In the past two years, China has not followed the Federal Reserve in raising interest rates. Instead, they keep cutting interest rates. Currently, China’s interest rates are only 2.7%, down 50% from two years ago.

但中国的情况不同。过去两年,中国没有跟随美联储加息。相反,他们继续降息。目前,中国的利率仅为2.7%,比两年前下降了50%。

We will not discuss here why the Chinese not follow the United States in raising interest rates. You can learn more through this link.

我们在这里不讨论为什么中国不跟随美国加息。您可以通过此链接了解更多信息。

We are talking here only about the consequences of this situation for the shipbuilding industry.

我们在这里只谈论这种情况对造船业的影响。

A huge cargo ship requires a huge amount of steel, equipment and labor. From the procurement of raw materials to the launch of the ship, it can take as little as a few months or as long as two years.

一艘巨大的货船需要大量的钢材、设备和劳动力。从原材料采购到船舶下水,可能只需要几个月或长达两年的时间。

The materials, equipment, and labor required to manufacture ships often require shipbuilding companies to pay in advance.

制造船舶所需的材料、设备和劳动力往往需要造船公司提前支付。

In fact, no shipbuilding company can afford such a huge bill, especially when they are undertaking orders for dozens of ships at the same time.

事实上,没有一家造船公司能承受得起如此巨额的账单,尤其是当他们同时承接数十艘船的订单时。

Therefore, the shipbuilding industry The shipbuilding industry is a highly leveraged industry.

因此,造船业 造船业是一个高杠杆化的行业。

The basic way they operate is:

它们的基本操作方式是:

1. The shipbuilding company receives an order and receives a part of the down payment.

1.造船公司接到订单,收到部分首付款。

2. The shipbuilding company uses the order as a guarantee to borrow a sum of funds from the bank to purchase materials and equipment and pay for labor.

2、造船公司以订单为担保,向银行借款购买材料设备,支付人工费。

3. The ship is launched and delivered, and the shipbuilding company recovers the payment.

3、船舶下水交付,由造船公司收回货款。

4. Shipbuilding companies repay bank loans.

4.造船公司偿还银行贷款。

Because large shipbuilding companies tend to build many ships at the same time, they keep billions of dollars in loans in the bank at any one time.

由于大型造船公司倾向于同时建造多艘船,因此他们随时在银行中保留数十亿美元的贷款。

These loans accrue interest every day, which becomes one of the important costs of shipbuilding: the cost of capital

这些贷款每天都会产生利息,这成为造船业的重要成本之一:资本成本

Before the Korean government raised interest rates, the Bank of Korea had lower interest rates, and Korean shipbuilding companies had lower funding costs than their Chinese counterparts. It is enough to offset part of the labor costs of the Chinese. Therefore, the quotations of Korean shipyards are close to those of their Chinese counterparts. In search of lower capital costs, some Chinese shipyards have been seeking dollar loans outside China.

在韩国政府加息之前,韩国央行的利率较低,韩国造船公司的融资成本低于中国同行。这足以抵消中国人的部分劳动力成本。因此,韩国造船厂的报价与中国同行的报价接近。为了寻求更低的资本成本,一些中国造船厂一直在寻求海外美元贷款。

But in the past 24 months, after multiple rounds of interest rate increases in South Korea and multiple rounds of interest rate cuts in China, the situation has been overturned.

但在过去的24个月里,在韩国多轮加息和中国多轮降息之后,局面发生了翻天覆地的变化。

The current interest rate of the Bank of China is 50% lower than that of the Bank of Korea.

中国银行目前的利率比韩国银行低50%。

Chinese shipyards can apply for RMB loans from Chinese banks and use them to purchase materials and equipment domestically.

中国造船厂可以向中国银行申请人民币贷款,并用它们在国内购买材料和设备。

The selling price of an LNG ship is approximately US$250 million, assuming a construction period of approximately 2 years. Let’s also assume that the shipyard needs to borrow $200 million to complete the ship.

一艘液化天然气船的售价约为2.5亿美元,假设建造期约为2年。我们还假设造船厂需要借 2 亿美元来完成这艘船。

Now, Chinese shipyards use RMB loans, and Korean shipyards use Korean won (or US dollars) loans. The loans are all borne by their respective domestic banks.

现在,中国造船厂使用人民币贷款,韩国造船厂使用韩元(或美元)贷款。这些贷款均由各自的国内银行承担。

In 2020, Chinese shipyards will need to pay an additional US$6 million in interest rates, and by 2023, Korean shipyards will need to pay an additional US$4 million in interest rates.

到2020年,中国造船厂将需要额外支付600万美元的利率,到2023年,韩国造船厂将需要额外支付400万美元的利率。

After two years of interest rate changes, costs at Korean shipyards have risen by US$10 million. This means that the commercial offer will increase by at least US$15-20 million.

经过两年的利率变化,韩国造船厂的成本增加了1000万美元。这意味着商业报价将至少增加1500万至2000万美元。

For customers, such a price difference means that Korean shipyards have completely lost their competitiveness, which has a devastating impact on the Korean shipbuilding industry. In the first quarter of 2023, the Korean shipbuilding industry had almost no new orders, and all orders went to Chinese shipyards. The situation in the second quarter was not much better.

对于客户来说,这样的价格差异意味着韩国造船厂已经完全失去了竞争力,这对韩国造船业造成了毁灭性的影响。2023年第一季度,韩国造船业几乎没有新订单,订单全部流向中国造船厂。第二季度的情况也好不到哪里去。

Because Chinese shipyards have too many orders and exceed their production capacity, the delivery period of their new contract has been extended to three years later. Some orders began to overflow, and in the third quarter, orders received by Korean shipyards began to pick up.

由于中国造船厂订单过多,超出了生产能力,新合同的交付期延长至三年后。一些订单开始泛滥,第三季度,韩国船厂接到的订单开始回升。

Therefore, the root cause of the collapse of South Korea's shipbuilding industry does not lie in China or South Korea. It actually lies in the United States. If the United States maintains its current high interest rate status or even continues to raise interest rates, the difficulties of the Korean shipbuilding industry will not stop.

因此,韩国造船业崩溃的根源并不在于中国或韩国。它实际上因为美国。如果美国维持目前的高利率状态,甚至继续加息,韩国造船业的困难不会停止。