China’s Capital Outflow Surges to Highest Since 2016 in April

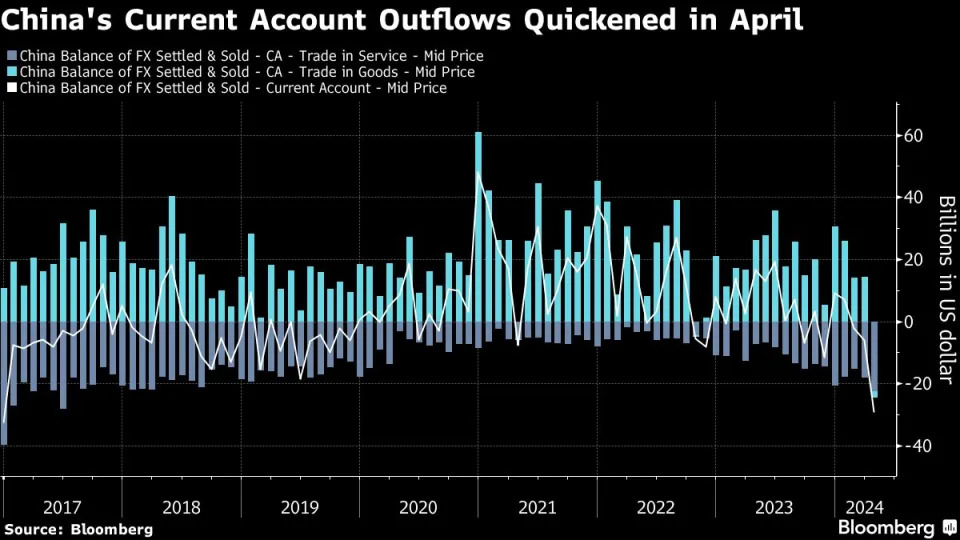

(Bloomberg) -- China’s capital outflows worsened in April, underscoring headwinds for the yuan amid a weak domestic economy and uncertainties over the Federal Reserve’s rate trajectory.

Local firms purchased the largest amount of foreign exchange from banks since 2016 in April, while exporters held back dollar conversion and residents snapped up foreign currencies for overseas travel, official data released on Friday showed.

These factors indicate a cautious view on the yuan, as China’s relatively low interest rate versus the US favors the dollar. And while the People’s Bank of China has stepped in to keep the yuan in a tight range, uncertainties on the timing and extent of Fed rate cuts this year are making its job harder.

“We expect policymakers to maintain tight control to fend off depreciation expectations” via a strong yuan fixing and offshore liquidity management, given the elevated capital outflow pressures, Goldman Sachs Group Inc. economists and strategists including Xinquan Chen wrote in a note.

Here’s a snapshot of China’s capital flows in April:

Chinese banks sold a net $36.7 billion of foreign exchange to their clients last month, the most since December 2016, according to data released by the State Administration of Foreign Exchange.

Investors favored foreign-exchange assets under the capital account in April, a sign they are more optimistic over securities that are not denominated in the yuan. The current account was also not supportive of the yuan as it showed net purchase of foreign currencies, which is a rare occurrence as China has long enjoyed a surplus from its exports. Service deficit linked with outbound travel picked up.

“Exporters have a higher tendency to hold foreign currency instead of yuan, given the weak expectation of China’s economic growth and continuous capital outflow,” said Dan Wang, chief economist at Hang Seng Bank China Ltd.

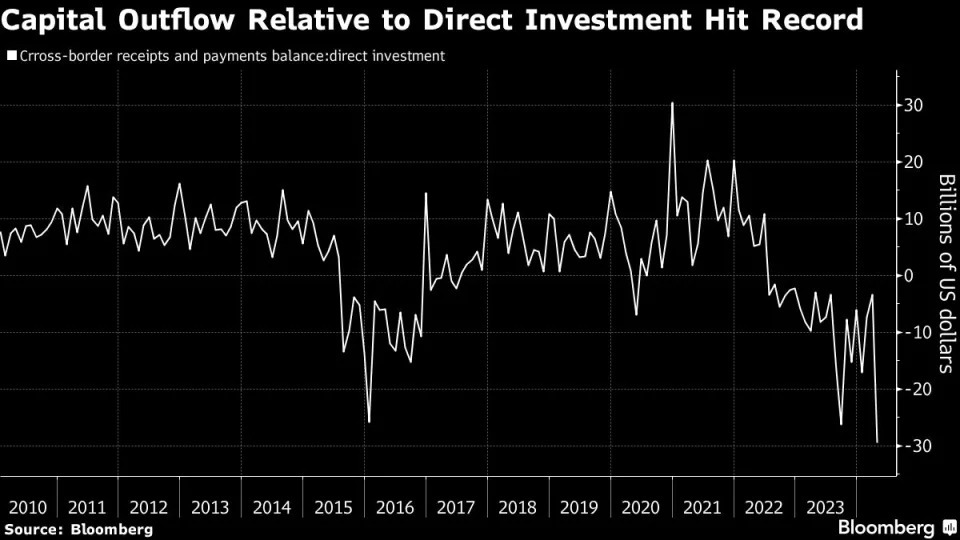

Chinese banks wired a net $29.5 billion worth of funds overseas on behalf of clients for direct investment, which was a record high. This measure includes both foreign investment into China and China’s outbound investment overseas.

The collapse in China’s foreign direct investment inflows may be more a reflection of comparatively higher interest rates in the US than of foreign firms losing interest in China, Bloomberg analyst Gerard DiPippo wrote in a note last week. Non-resident firms — including Chinese firms with Hong Kong offices — may have moved their cash offshore to benefit from higher yields, he wrote.

--With assistance from Ran Li.

选择“Disable on www.wenxuecity.com”

选择“Disable on www.wenxuecity.com”

选择“don't run on pages on this domain”

选择“don't run on pages on this domain”