Seth Klarman:“The single greatest edge an investor can have is a long-term orientation.”

Why Long-Term Thinking Works

Markets are made up of institutional investors; the ‘big fish’, and individual investors; the ‘little fish’. Institutional investors are judged on quarterly performance. As a result, they are biased toward thinking about short-term investment opportunities.

Trying to beat institutional investors with far more resources and connections at their own game is foolish. Instead, change the game. For individual investors, performance should be gauged over years, not quarters. The lack of an institutional imperative driving individual investors towards short-term investments is the individual investor’s greatest advantage.

在股市中,如果能将自己的投资思考的时间框架放长一些,你可能会过得轻松许多。我们之前讨论过的投资者B,他的投资决策的时间框架基础是20年,在整个二十年的投资过程中,B只是用非常少的时间来管理自己的养老金投资组合。我现在每个月只需要用一分钟的时间来管理自己的养老金帐户,但是我的长期投资回报要高出加国股指许多。

为什么,B和我都只用如此之少的时间管理自己的养老金投资帐户,却可以取得比较好的长期投资回报?

We don't get paid for activity, just for being right. - 巴菲特

B 与我投资在不同的国家,不同的市场,但是我们都使用相同的长期投资思维方式。B在二十年里只买不卖,我从二年多前开始,也是只买不卖(养老金帐户),在没有极其重大的变化前提下,我也打算坚持二十年只买不卖。

Seth曾经写过一本书Margin of Safety,是价值投资理论的经典之作,网上可以免费下载。

安全边际是整个价值投资思想的第一块基石,在接受了价值投资的思想以后,你的股市投资行为会自然而然的体现出追求安全边际这一重要的价值投资的特点,因为你所使用的投资策略和思想的最本质的目的就是为了追求合理的安全边际。

2011年,老巴印度之行的谈话

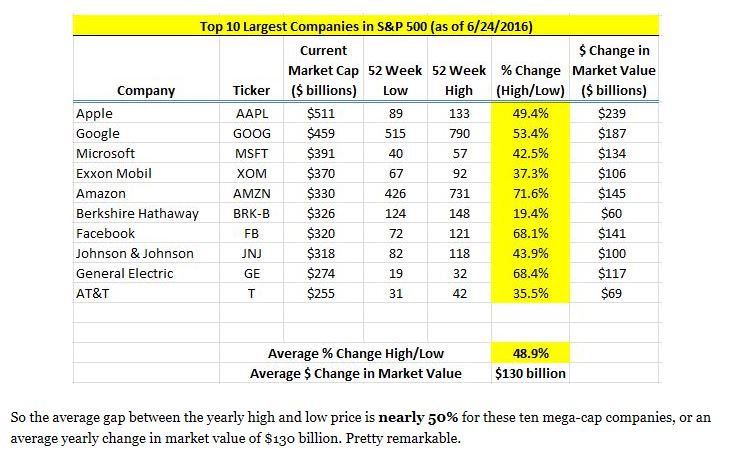

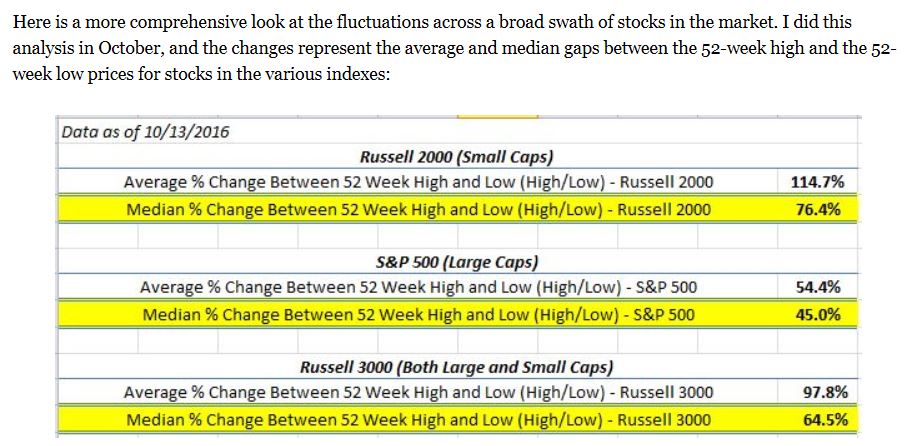

“If you look at the typical stock on the New York Stock Exchange, its high will be, perhaps, for the last 12 months will be 150 percent of its low so they’re bobbing all over the place. All you have to do is sit there and wait until something is really attractive that you understand.”

“There’s almost nothing where the game is stacked more in your favor like the stock market”

“What happens is people start listening to everybody talk on television or whatever it may be or read the paper, and they take what is a fundamental advantage and turn it into a disadvantage. There’s no easier game than stocks. You have to be sure you don’t play it too often”

如果你认真的学习思考上面老巴的谈话,你就可能意识到股市中有许多合理的投资机会。