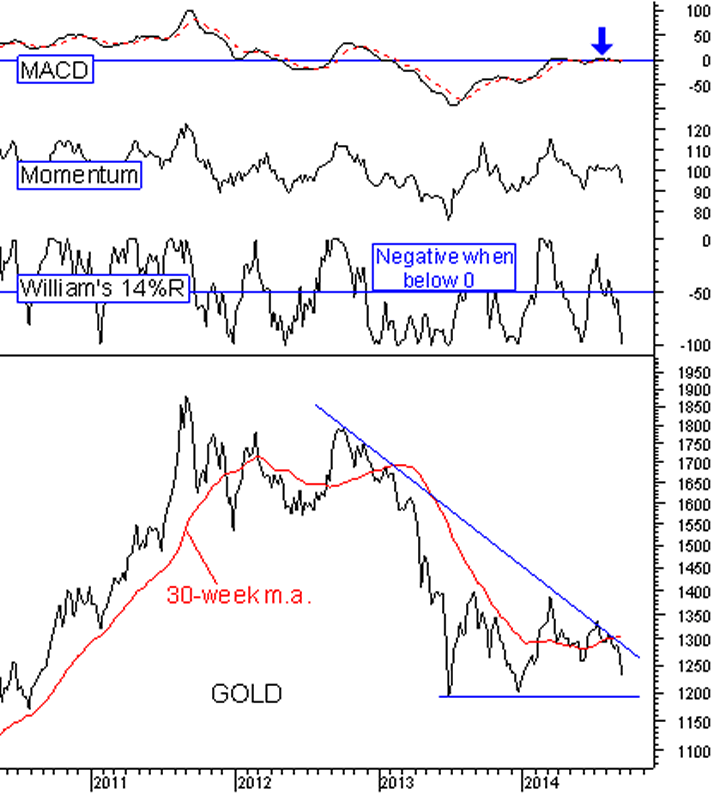

Its most recent rally attempt, beginning in January, looked to have a better chance of succeeding. On the technical side, gold was oversold beneath its important 30-week m.a. again, and it was rising from a frequently bullish double-bottom formation. On the fundamental side, situations usually bullish for gold were on the rise at the beginning of the year. Several areas of global unrest were heating up again. The low gold prices had resulted in mining companies cutting back production, closing less productive mines, delaying exploration, and so forth. So a supply crunch was expected to put upward pressure on gold prices this year. However, even as those situations worsened, particularly the areas of global unrest, gold’s attempts to rally this year ended even more quickly, and at even lower highs.

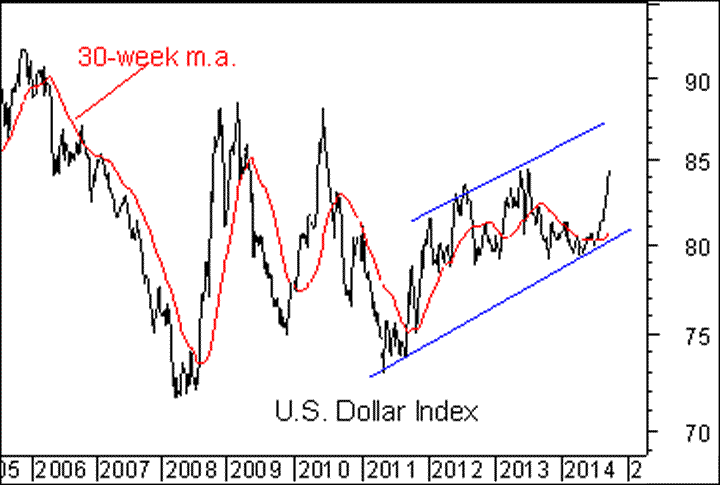

Meanwhile, the stubbornly low inflation in Europe (actually concerns about deflation), and worries about the economic recovery in the euro-zone, has the U.S. dollar surging higher against the euro and most other global currencies. That is a serious negative for gold if it continues. Gold tends to move opposite to the dollar.

Gold is now approaching a critical juncture, at its lows of 2013, at just under $1,200 an ounce. Market technicians will be watching those levels closely. A break below them will put gold at new multi-year lows and in uncharted waters, likely to bring on more pronounced selling. With gold now down 36% since its 2011 peak, buy and hold investors may even be ready to give up if the last stand support gives way.

Gold bugs will have to try to hold that line. It may be difficult. Our intermediate-term technical indicators remain on a sell signal.