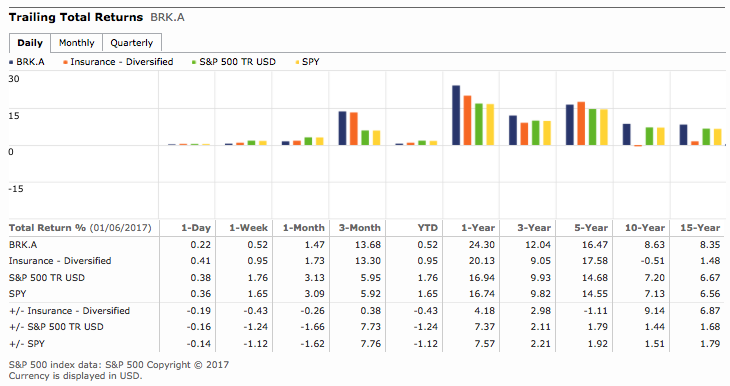

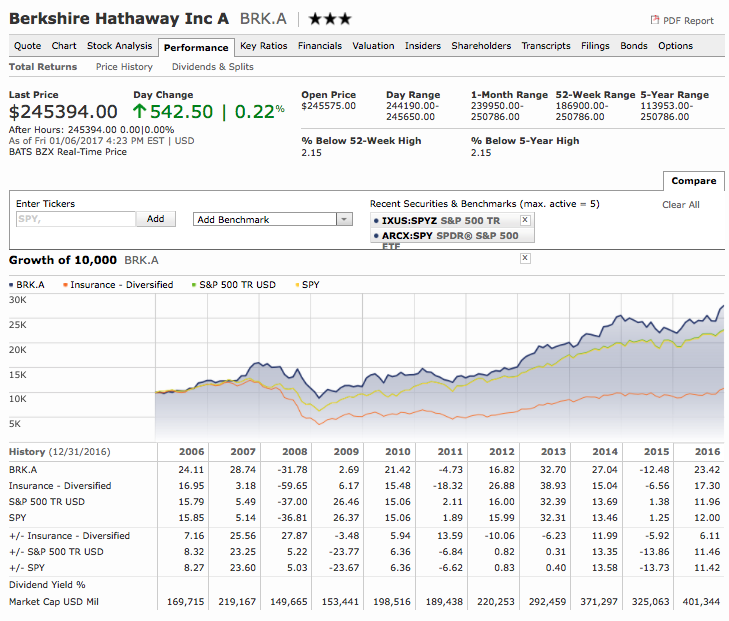

My data comes from morningstar, Berkshire beats S&P in 1 year, 3 years, 5 years, 10 years and 15 years period. Total return already includes dividend! The chart nonconfusion show from finviz is not wrong, but it is in 8 or 9 year period, and in this period S&P 500 TR beats Berkshire.

Size absolutely matters, holding more than 5% of a company will add a lot of restrictions. Holding more than 10% of a company adds even more restrictions of buying and selling. When you are trying to invest hundreds of billions, the number of companies you can pick is very small.

选择“Disable on www.wenxuecity.com”

选择“Disable on www.wenxuecity.com”

选择“don't run on pages on this domain”

选择“don't run on pages on this domain”