在价值投资学习中,巴爷是绝对的榜样,但是在加国的市场中, Power集团的Paul Desmarais

是我非常崇拜的人,因为他从一家一元本钱的破产运输公司起家,成为了加国的最大富豪之一,而且他还曾经雇佣过5位加国总理,是加国政坛的幕后教父。

这是一篇旧文章,但是解释了我为何对投资POW有兴趣。因为我今天买了些POW, 所以又把这篇旧文再读一遍。

Power Corp Of Canada: Great Dividend Yield, And Significant Discount To NAV

Summary

Power Corporation of Canada has a rather complex structure.

Break up value provides a deep discount to the NAV.

Juicy Dividend makes it a better choice than one of the underlying companies.

Power Corp of Canada (OTCPK:PWCDF) is an international management and holding company with interests in financial services, communications, energy, and other business sectors throughout America, Europe and Asia.

It's complicated structure makes it hard to value, which builds a steep discount to the underlying businesses. I will briefly go through the different segments. In weeks to come, you can expect to see follow up articles analyzing the underlying securities.

I also thought I'd try out the new Powerpoint tool on Seeking Alpha, here are a few slides with the key points of this article.

Power Corp has a 65.7% interest in Power Financial Corp, a 100% stake in Square Victoria Communications, a 100% stake in Power Energy Corp, and full ownership of the Sagard Funds.

Sounds straightforward? Well not quite.

BREAKING UP POWER FINANCIAL

Power Financial also holds interests in a bunch of companies, although only financial service companies.

You can break it down to:

- A 62.7% stake of Great West Lifeco (OTCPK:GWLIF).

- A 58.8% stake of IGM Financial (OTCPK:IGIFF).

- A 50% stake in Parjoncto.

And it gets more complicated:

Great West Lifeco fully owns:

- The Great West Life Assurance Company.

- London Life Insurance Company.

- The Canada Life Assurance Company (which in turn owns Irish Life Group Limited).

- Putnam Investments.

- And The Great West Life & Annuity Insurance Company.

IGM Financial owns:

- 100% of Investors Group.

- 100% of Mackenzie Financial Corporation.

- 97.1% of Investment Planning Counsel.

And Parjoncto which has a 55% interest in Pargesa which in turn has a 50% interest in Groupe Bruxelles Lambert (OTCPK:GBLBF) which in turn owns:

- 56.5% of Imery's (OTC:IMYSF).

- 21.1% of Lafarge Coppee (OTC:LFGEF)

- 3% of Total S.A. (NYSE:TOT)

- 15% of SGS S.A. (OTC:SGSOF)

- 7.5% of Pernod Ricard (OTCPK:PDRDF)

- 2.4% of GDF Suez.

I will do my best over the weeks to come to write articles about as many of these stocks as possible. If you like this one, I encourage you to subscribe. After having analyzed as many of the stocks mentioned above as possible, I will rewrite an article with a total SOTP value for Power Corp.

OTHER ENTITIES

Victoria Square Communications owns all of Gesca which happens to own the francophone newspaper Lapresse.

Power Energy Corp has a 62.8% stake in Potentia Solar Inc as well as a 14.4% interest in Eagle Creek Energy.

Finally Sagard funds include Sagard Capital, Sagard Europe, and Sagard China.

So there you have it, an overview of the Behemoth I'm trying to tackle.

QUICK SOTP VALUATION

To calculate the real breakup value of Power Corp, you would have to break up all the underlying companies, which I won't do today. I will however come to a value from adding up the bigger components from Power Financial together.

- The Groupe Bruxelles Lambert stake has a market value of $1.63bn. (When I will write up about Groupe Bruxelles Lambert, I will calculate another SOTP value)

- The Lifeco Stake has a market value of $21.8bn

- The IGM stake has a market value of $5.17bn

So Power Financial's breakup value is around $28bn.

Since Power Corp owns 65.7% of Power Financial, Power Corp's interest is worth $18.76bn. If you subtract around $4bn of net debt, you're left with a $14.76bn SOTP value.

Yet Power Corp's market cap today sits at $12.8bn. This is a 15% discount to NAV assigning a value of zero to all other business segments. Yes that's right, get them for free.

RECENT PERFORMANCE.

Power Corp's income has been improving, and historically its stock price pretty much tracked it's net income. However since July, despite net income zigging, the stock price has zagged.

POW data by YCharts

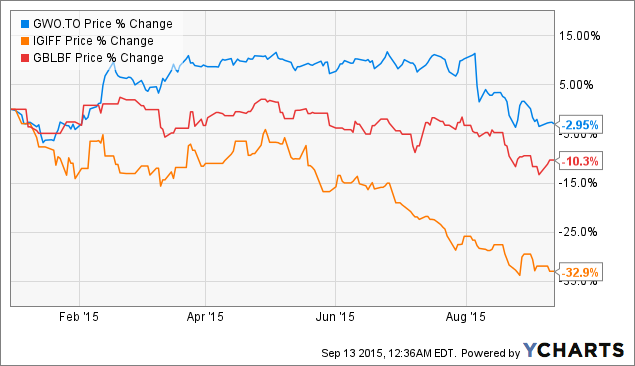

The securities of Power Financial have also been oversold making them a lot cheaper.

GWO data by YCharts

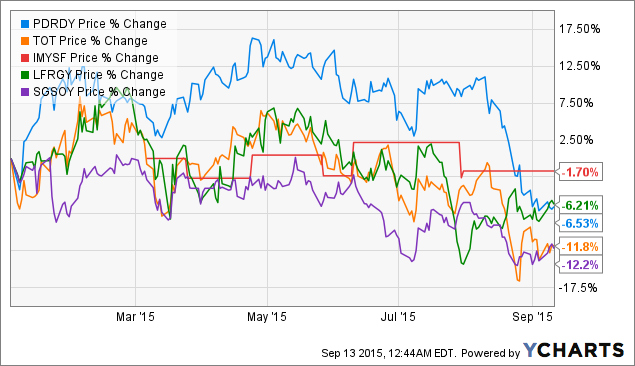

Furthermore Groupe Bruxelles Lambert's positions haven't had stellar performance either, this year.

PDRDY data by YCharts

Ultimately, this means everything you are buying now is cheaper than it was earlier this year. Now all we need to decide is whether we prefer investing in Power Corp or Power Financial.

POWER CORP OR POWER FINANCIAL?

Over the last five years, Power Financial has performed better than Power Corp, adding a further spread to Power Corps discount.

POW data by YCharts

Investors have also preferred PWF for the slightly higher dividend. I like POW, because a few hundred bp difference in dividend yield doesn't equate to the exposure you can get to other segments through PWF such as energy, and newspapers (Last year, La Presse increased their digital subscriptions by 45%).

If you were considering an investment in Great-West lifeco, Power Corp is probably a better way to get exposure to them. Power Corp's stake in lifeco has a market value equivalent to Power Corp's market cap, and you get a bigger dividend (4.48% vs. 3.8%) and you have all of the other holdings as a margin of security.

CONCLUSION

Power Corp is an interesting company to rip apart, compounding the discounts to NAV bakes in a margin of safety, and also increases exponentially the chance of a break up somewhere along the line. As always with conglomerates, you need a catalyst to unlock the value. In the meantime 4.5% yield is probably better than what most stable companies are giving, n'est ce pas?

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in PWCDF, PDRDF over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: If possible, I would advise you to invest directly on Canadian markets even if just for liquidity reasons.