Buyback reduces share number, so even if PE remains the same, the stock price will go up gradually. This is understandable, because earnings belong to shareholders and buyback is one way to delivery the earnings to shareholders' hands, beside dividend.

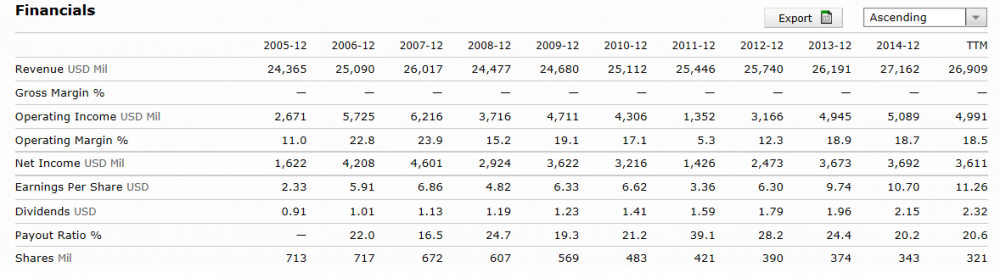

In the example below, TRV's share number in the past 10 years changes from 700+ to 390, roughly halved. During the same period, PE fluctuates around 10 and earnings fluctuate around 3+ Billion--that is to say, no apparent growth. But the stock price still manages to double ($50->$100), thanks to the effect of buyback. Adding dividend, this roughly equals a total of 10% per annum.

Conclusion:

In a non-growth stock, if PE=10, in the long run it creates 10% annual return to shareholders, from stock price appreciation plus dividend.

选择“Disable on www.wenxuecity.com”

选择“Disable on www.wenxuecity.com”

选择“don't run on pages on this domain”

选择“don't run on pages on this domain”