09/09

昨晚日经指数破天荒地涨了7.7%,中国上证综合指数也小涨2.29%,亚洲股市指数普遍上涨。使得欧市继续上涨,也使得今日美股市大盘继续上涨。

俺觉得G20 会议之后,欧美日中股市似乎稳定下来,危机和暴跌的可能性大为减少,市场普遍倾向利多的情绪。当然这不表示修正已经结束,盘整还得继续一段时间。

美大盘上涨或许对今日的原油价格有支撑。然而今日收盘后的API和明日的EIA原油总库存报告会继续对原油价格下压,有可能先涨后跌。

EIA今日也会发布短期能源展望(STEO),原油多头似乎期待EIA的报告可以带来利多消息,如8/31的月底报告一样,大涨10%。 不过,这可能性很小,情况已经不同。当时原油是卖超非常严重,原油价位在40元以下,现在原油价位已经稍微偏高,没有超卖情形,所以要暴涨很难。

最近对原油不利的消息有:

1. 中国8月进口的原油大为减少,没有像7月份一样超买。这令人迷惑,8月份的原油价格是最低,WTI达到38元。为何中国不继续购买囤货?有没有可能中国的三桶油,囤油的资金已用完?

2. Exxon Mobile在路易桑拿的炼油厂关闭,减少了每日50万桶油的炼油厂能,这有可能将使得未来原油库存大增,油产品维持好价格。

Oil prices slips; stock market rally provides support

http://www.cnbc.com/2015/09/08/oil-markets-remain-weak-as-oversupply-keeps-biting.html

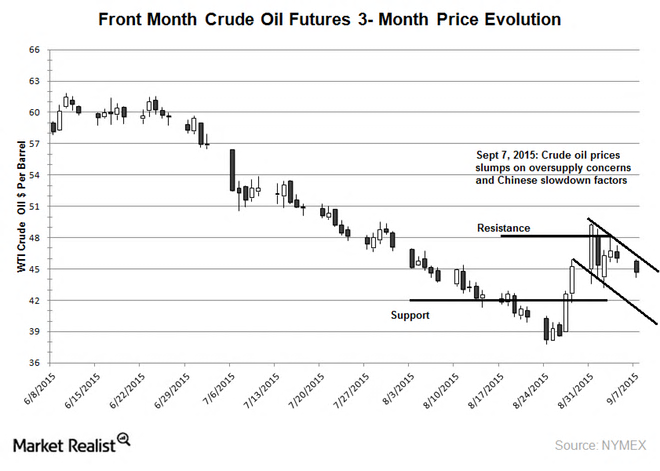

Crude oil price fall due to oversupply concerns

http://marketrealist.com/2015/09/crude-oil-prices-fall-due-oversupply-concerns/

The latest data from Chinese customs reported that crude oil imports from China fell in August 2015. The government data showed that Chinese crude oil imports fell by 13% in August 2015—compared to August 2014—to 26.59 million tons. Meanwhile, the Chinese exports fell worse than the market estimates in August 2015. The Chinese exports fell by 5.50% in August 2015—compared to August 2014. The slowing Chinese demand for crude oil in the oversupplied market will continue to fuel pessimistic sentiments in the crude oil market. The Chinese equities market also fell in Monday’s trade. This added more to the global oil market concerns.

http://www.cnbc.com/2015/09/08/asias-slowing-economies-and-oversupply-weigh-on-oil-markets.html

U.S. crude was weighed down by the closure of the largest crude distillation unit at ExxonMobil Corp's 502,500-barrels-per-day (bpd) Baton Rouge, Louisiana, refinery.

On Monday, Phillips 66 shut down a fluid catalytic cracker at its 314,000 barrel-per-day refinery in Wood River, Illinois. The gasoline-making unit is expected to restart within 48 hours, a source familiar with the plant's operations said.

In China, crude oil imports fell 13.4 percent in August to 6.29 million bpd from the previous month. But they rose 5.6 percent from a year earlier.