相关的资产。一般来说,在市场低迷,悲观气氛浓重的时候,是因该认真考虑投资机会的时候。平时多学习思考,才有可能把握

好机会,就像FCR在市场最低点的时刻,会提出收购 AP 一样,虽然没成功,但是这种投资思维方式是非常正确的。现在加国

地产股下调蛮大的,可以认真考虑研究一下。

以下信息,仅供学习参考,不推荐任何具体投资操作。

Summary

- Pure Industrial REIT's yield is more than double the industry average, paying investors while they wait for value to be realized.

- Its exposure to the Canadian market is focused on the strongest areas, combined with US exposure for a solid risk profile.

- Execution has been very appealing; growth has resulted in the inclusion of many indexes in Canada, growing the REIT's investor and institutional profile.

- Internalized management may have been early, but this REIT is beginning to show fruit for that effort.

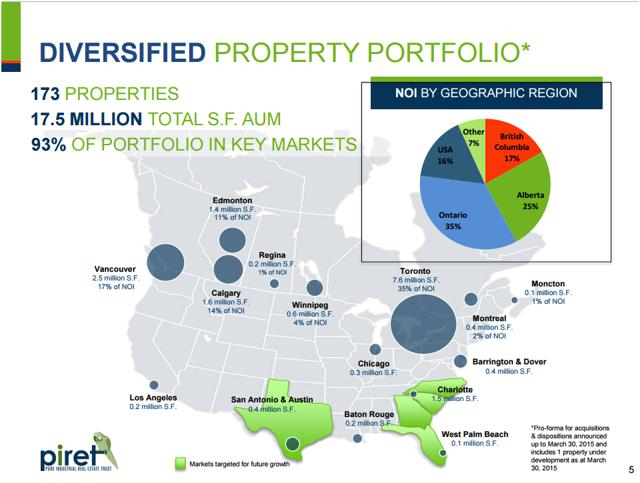

Pure Industrial REIT is a Canadian-listed industrial-focused REIT (OTC:PDTRF, TSE: AAR.UN). It is one of two pure-play industrial REITs in Canada, the other being the externally-managed Dream Industrial REIT (TSE: DIR.UN). Pure Industrial, or PIRET, has been growing its exposure to the US market, and has been actively managing its exposure to different markets in Canada. All told, the company has positioned itself well for Canadian and US-based investors.

(Source: All graphs with this theme are from the REIT's most recent investor presentation.)

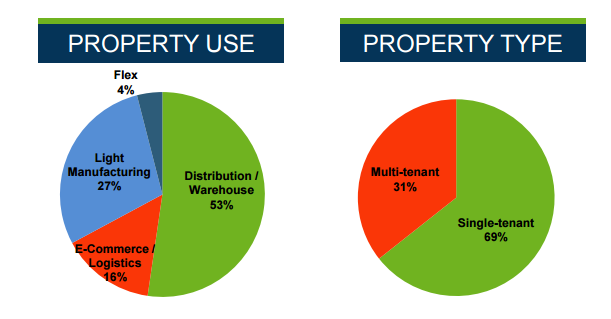

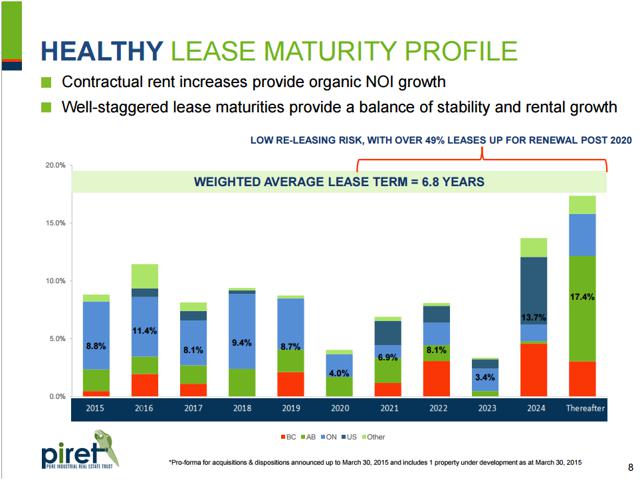

PIRET is focused on distribution and logistics (warehouses, e-commerce), which represents 69% of its leased properties. These are easier to lease, have solid growth prospects and are generally more liquid. The company also focuses on single-tenant properties (69%), which are generally full of more credit-worthy companies and easier to manage. It also has about 64% of its leases as NNN, where all work is completed by the tenant, reducing exposure to capital expenses and allowing rate increases to flow largely to the company's NOI. 49% of PIRET's leases extend past 2020, for an average lease life of 6.8 years. The company has a very evenly distributed lease profile, with the largest at 11.4% at 2016, as highlighted below:

Its top tenants include FedEx (NYSE:FDX), TransForce (OTCQX:TFIFF), and ContainerWorld (private), each representing less than 3% of NOI.

Geographic Exposure

PIRET has done an admirable job of spreading its geographic risk profile across Canada, with appreciable business in the US. The Alberta profile is the highest risk at the moment due to oil price weakness, but the strong tenant profile combined with the business type (light manufacturing is about 27% of total) means there is only a relatively small weighting towards the oil-heavy manufacturing industry and almost no exposure to oil services/rental companies, which, I believe, pose the greatest risk of default to investors.

The growing exposure (currently 16%) to the US market is a great step and should help diversify away from any home market weakness in the future. I believe the company is under-represented in Quebec and non-Alberta western Canada, but its expansion plans are targeted to further exposure to Texas, Florida, Alabama, Georgia and South Carolina. This focus should serve PIRET well as the company increases its exposure to the logistics industry, giving investors a way to play economic activity, while generating strong cap rates and low turnover.

Industry Exposure

PIRET has heavy exposure to the distribution/warehouse and e-commerce/logistics businesses, along with single-tenant facilities. Each poses its own risk profile, but I believe this exposure will help with the company's sustainability going forward.

The distribution and warehouse industries are generally core operating building for tenants. With just-in-time inventory controls, products generally spend very little time in a warehouse. This rapid turnover in goods and the efficiency that modern companies run with make what warehousing facilities there are core to the operation of the business, making it unlikely that a company will abandon them. They are also easy to transfer between different industries types with relatively inexpensive modifications. Finding strong tenants is very important to this type of industry, and PIRET has done an admirable job finding those tenants.

46.7% of the company's tenants are in the Wholesale Trade business, which is the business of selling to governments, institutions and other businesses, generally by amalgamating products into a main facility and sorting the orders for piecemeal distributions to the other businesses. In this type of business a warehouse facility is vital to the business structure as a place to accumulate the inventory necessary to sell to businesses as they need them.

Single-tenant facilities are generally riskier, allowing for a larger risk premium, but this can be mitigated by utilizing creditworthy tenants - a process most industrial REITs follow to minimize the risk involved in that business model.

The Mispricing of Canada

The biggest error in pricing, in my mind, is to do with REIT weakness in Canada generally. The global market has discounted Canada to a great degree due to its commodity exposure, but this has resulted in companies with little exposure to that part of the country largely unnecessarily discounted. Companies like Pure Industrial REIT benefit from a weaker currency, and are largely unaffected by the oil downturn in Western markets. Real estate prices have been high, and the market is pricing in a collapse in their prices, but demand is still high, particularly industrial demand from non-oil sources. You can read a full article about how I feel investors should consider going long Canada for a full analysis of the market mispricing, and investors can consider for themselves if there is a case for under-pricing Canadian assets. If there is any chance of this mispricing being proved unnecessary over time, there are suddenly many investments in Canada that will benefit from the resulting recovery, including companies like Pure Industrial REIT.

Valuation

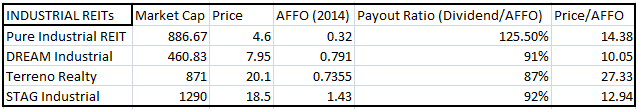

In my attempt to value this company properly, I will discuss the various competitors, and we can review the best proxies among them to arrive at our valuation model.

Possible valuation options include Dream Industrial REIT, DCT Industrial Trust (NYSE:DCT), Gramercy Property Trust (NYSE:GPT), Prologis Inc. (NYSE:PLD), PS Business Parks Inc. (NYSE:PSB), Rexford Industrial Realty (NYSE:REXR), STAG Industrial (NYSE:STAG) and Terreno Realty Corp. (NYSE:TRNO).

To begin with, we eliminated Gramercy Properties due to its exposure to commercial and foreign real estate. PS Business Parks focuses on multi-tenant commercial and industrial "parks," which have a different value proposition. Rexford Industrial has a focus on a particular market (Southern California) whose operating environment is very different from other REITs. Prologix is very comparable by building ownership, but its large international presence and a large development business separates it from the other REITs. DCT Industrial is similar, with a very large development focus.

The best comparisons derive from STAG Industrial, as a single-tenant, high-dividend industrial play, and Terreno Realty for its similarly small size and similar development focus. I have included Dream Industrial for illustration as a similar Canadian Industrial REIT, but it has different building weightings and an external management, which make comparisons less meaningful to the others.

Dream Industrial REIT

Has a 66%-33% multi-tenant to single-tenant distribution (opposite of PIRET), and has larger exposure to the Alberta market (32%) though similarly low oil resource weighting of about 3%. The REIT has no US exposure and has an aggressive dividend payout, and though it is undervalued, this is likely due to external management. It is very heavy on the warehouse and distribution side (41% of NOI) and what they refer to as "Flex Industrial", which is small combined office-warehouse buildings (42% of NOI). The remainder (17% NOI) is light manufacturing, where the tenant has invested in machinery and equipment in the building.

Terreno Realty Corporation

The second closest comparable, Terreno, is diversified among six major coastal markets, with a major focus on warehouse and distribution (90.1% of square footage). Concentration in just six markets simulates the same risk level as Pure Industrial, with its focus on few, but particularly high-quality, Canadian markets.

STAG Industrial

The closest comparable, STAG, is a single-tenant focused industrial property owner with properties throughout the US. It uses an acquisition model for growth, as opposed to greenfield developments, similar to Pure Industrial. 84.2% of its NOI is generated from warehousing throughout the US market, and STAG has a very aggressive dividend yield, similar to Canadian REITs.

As we can see, there is a striking difference between the different REITs. It's important to note, as well, that the average for the industrial REIT sector in the US, as of March 31, 2015, was 22.9x P/AFFO, meaning most of the above listed REITs represent significant discounts in the space, the exception being Terreno Realty.

As we can see from the above, there are a multitude of options for valuing these companies, and the market consensus. PIRET's focus on single-tenant, with a multi-tenant kicker, has helped stabilize its share price. The REIT is also growing well, and is starting to leverage its operating platform that was a little expensive for its size, but now, additional growth will translate into appreciable AFFO growth per unit.

For our worst-case valuation, we would apply STAG Industrial's multiple, a similar REIT whose property valuations are well under its growth potential, and priced for abnormally high risk compared to its execution history. At that multiple, PIRET would trade at $4.14, a capital loss of 10%, coupled with a dividend of 6.8%, for a total return of negative 3.92%.

For our base case, we will assume that Pure Industrial REIT trades closer to its fair value estimate, compensating for the higher payout ratio, but giving the company credit for its flexible properties, high growth and US market participation, at a P/AFFO of 17.5. At this multiple, PIRET would trade at $5.60 per share, for a total return of 28.5%.

In our best case, where the single-tenant industrial space and warehouse focus begins to be valued by the market for its strength during downturns and for increased warehousing usage with improving economic activity in its core markets, we will estimate a scenario of P/AFFO of 20, just under the P/AFFO multiple for industrial REITs. PIRET would trade at $6.40 per share, for a total return of 45.98%.

Why Pure Industrial Deserves a Premium

The big question here is why Pure Industrial REIT deserves to trade at a premium to the listed peer group, and why the value in this particular company may be realized faster than other sectors. I believe there are many reasons to value Pure Industrial higher than the industry average.

Dream Industrial's external manager, Terreno's focus on large US markets and STAG Industrial's very low valuation make comparisons between the different companies difficult. I will try to address the different ways that an investor might want to value Pure Industrial's operations higher than these comparables.

Geographic Diversification

Almost every other REIT that I have analyzed to begin this comparisons are international. They have properties in different markets around the world, and focus on new developments due to their increased return profile. While greenfielding production is well within the grasp of Pure Industrial, it is something the company will look at once its opportunities start to become harder to identify. At the moment, accumulated businesses that match its profile is a much better use of the company's resources. Compared to the REITs listed, Pure Industrial's exposure to the Canadian market and its inroads into the US give it an international weighting, and that should justify a higher multiple.

Canadian Dollar Weakness

Canadian dollar weakness has been strengthening the profile for industrial properties in Canada, making purchases of Canadian goods cheaper for international customers. It is also allowing investors outside of Canada an opportunity to purchase the Canadian-listed entity at a discount to its already weak price.

The Toronto and US Markets Are World-Leading

The Toronto and Vancouver markets are some of the strongest in North America. The exposure of Pure Industrial in the rest of Canada is some of the strongest in North America, due to a strong Canadian market and weak currency (bear in mind the disconnect between economic forecasting methods and oil weakness). Companies such as Terreno's main markets are just as desirable, but Terreno trades at a P/AFFO of 22. This discount applied to the Canadian market is not deserved, and cannot be accounted for by the Alberta exposure alone, as the Alberta market was, prior to oil weakness, the strongest in North America. That, and its exposure is quite limited to the oil part, meaning that if there is a discount applied, it is mispricing the stock.

Little Exposure to the Alberta Oil-Sensitive Market

Although PIRET has exposure to Alberta, there is relatively small exposure to the oil industry itself, due to the focus that the company has built into the portfolio. Its focus on the e-commerce, distribution and warehousing sections of the market make the Alberta oil business weakness a smaller factor than other industrial operators. The REIT does have some exposure, but most are to creditworthy suppliers of necessary equipment that represent small portions of total AFFO (Tervita is 3% of its NOI, but is an environmental solutions company with regulatory experience in a variety of industries with a presence throughout the US and Canada).

Inclusion in the S&P/TSX Composite Index

Any company that gets included in an index has a greater investor profile in that more individual investors and institutional investors begin to take interest. This increased liquidity and exposure should help ensure that Pure Industrial REIT continues to perform well for its investor base.

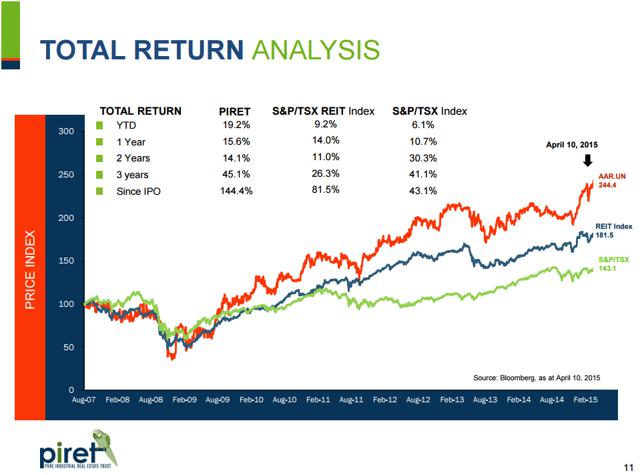

Impressive Historical Returns

PIRET has done well over time in building shareholder value per unit, as showcased in its investor presentation that highlights the company's total return since becoming a publicly traded entity.

All these combine into an investment vehicle that gives investors a strong, growth-oriented investment vehicle at a reasonable price and a strong dividend while it waits for investors to realize the value in this company and its high-return industrial warehousing/distribution-focused strategy.

Risks and Mitigating Factors

Payout Ratio - Pure Industrial is currently disbursing more than its 2014 AFFO amount, as shown in my previous report, though this is not truly representative, as the company is currently on track to disburse around 87.1% of its AFFO in 2015 and 80.9% in 2016, due to strong incremental rate increases.

Real Estate Competition - Warehousing and distribution centers are high-demand, easy-transfer buildings, but that also exposes the company to competition risk, as building new warehouses is relatively inexpensive compared to other building types. They do generate incremental revenue increases and are valuable, but it limits the ability to charge out-of-market rents to tenants without very high industrial demand in the region.

Refinancing Risk - Mortgages coming due could be refinanced at higher rates than they were previously. Due to their increased size, liquidity profile and low historical rates, it is more likely that mortgages are refinanced at lower rates; there is still a risk to companies in this area.

Default Risk - Pure Industrial has chosen its tenants carefully and is exposed to some very credit-worthy companies, but there is always the risk that tenants may default or be unable to pay their obligations to their REIT. Pure Industrial's properties are well suited for transfer between companies due to their nature, helping to mitigate this risk.

Potential Catalysts

Quarterly Earnings - Each quarterly result will continue to showcase Pure Industrial's strategy and showcase its improving financial picture. As it continues to post numbers where it are paying out less than its AFFO, investors will grow more comfortable with the company and its strategy.

Interest Rate Weakness - Historically low interest rates in Canada, and the expectation of them continuing over time has allowed Pure Industrial and other Canadian REITs a very advantageous interest rate environment for mortgage maturities. The longer interest rates stay low, the better companies like Pure Industrial can refinance themselves.

Continued Expansion Into The US Market - As the company continues to diversify its holdings away from Canada, I expect that investors will reward it with a strong multiple. Pure Industrial was able to accumulate Fed-Ex properties in the US for very favourable terms, and more deals in the pipeline of that nature will help lower its risk profile and increase its exposure to the very favorable US market conditions.

Continued Joint Venture Announcements - PIRET recently announced that it is utilizing its management platform with joint ventures in Ontario (7 properties) and Quebec (1 property). Due to the company's low exposure to the Quebec market, and due to the particular unique characteristics there, PIRET will be well served leveraging its management platform with other investors/institutions by making inroads into these other markets.

Conclusion

Pure Industrial REIT is a quality Canadian- and US-focused REIT trading at a very reasonable price. There are different companies that present opportunities in this particular market, but Pure Industrial presents a very alluring investment case for any investor. For those looking for North American- Canadian-focused industrial entities with a focus on warehouses, distribution and e-commerce in a high-yield structure, there are few REITs that have a profile as strong as Pure Industrial for a strong price.

(Source: Pure Industrial website)

Cominar REIT: Quality REIT Trading At Seemingly Perennial Discount

Summary

- Cominar faces a largely unnecessary discount stemming from several sources, all of which will dissipate with time.

- There are ample opportunities for Cominar as it avoids the Alberta-based turmoil affecting other REITs in the sector.

- With a strong tenant base, diversified industry profile and high dividend yield, investors can enjoy a strong distribution and relative safety while waiting for the value to be realized.

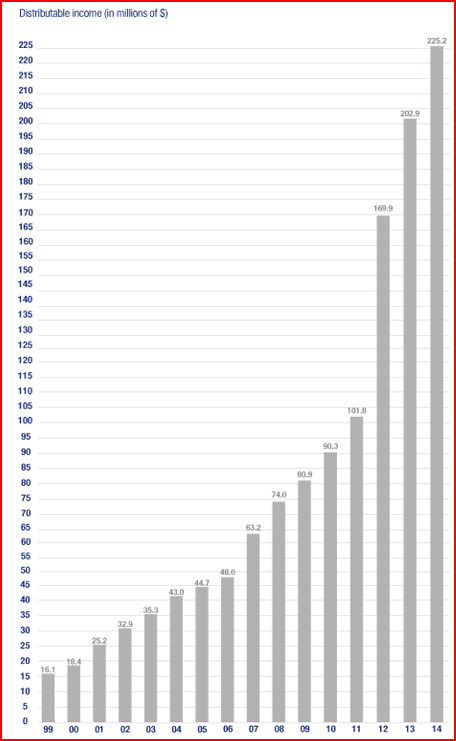

Cominar REIT (OTC:OTC:CMLEF or TSE: CUF.UN) is a diversified Canadian Real Estate Investment Trust, and the largest operator in the province of Quebec, Canada. With 566 properties and $8.2B in assets, it is one of the largest REIT operators in Canada, using a highly disciplined approach that has allowed Cominar to increase its dividend's paid every year since becoming a publicly-traded entity. Note that this is cumulative dividends, and the per-share increases have been irregular over time, with the most recent in August of 2014.

https://www.cominar.com/ENGLISH/info_Performance_EN.html

As one of the largest operators in Canada it enjoys a large scale, well-diversified portfolio of assets and has impressive insider ownership of approximately 7.2% of outstanding shares. With one of the largest dividends in the industry we are left wondering if this REIT is undervalued.

Portfolio

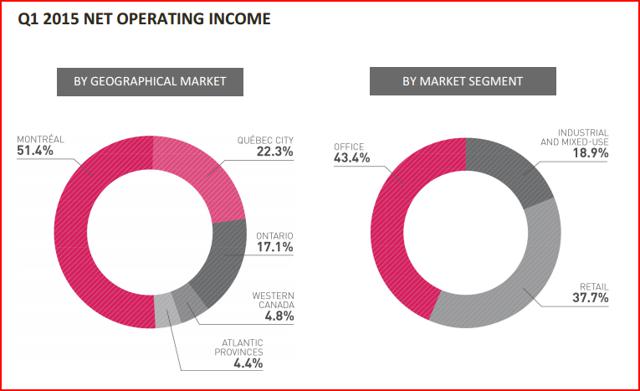

In this graphic from the Q1 update, we start to get into some of the overhang for this stock:

https://www.cominar.com/ENGLISH/Documents_PDF/Appels_Conf_PDF/confcall_Q115.pdf

Any company with 51.4% of its operating income from one city may have outsized geographic risks. Combine that with a total of 73.7% coming from the province of Quebec and suddenly we have a company with some serious provincial risks associated with it. They have been making some serious entries into other markets to further diversify, but the risks remain.

The diversified nature of its income by market segment is more promising, though they are office focused with some manageable parlays into other areas, such as the higher cap-rate industrial section. I enjoy a higher margin "kicker", and I prefer they are less than 25% of NOI, which sits Cominar comfortably below that level.

Cominar "suffers" from its own success. Its competitive advantages in its home market, the province of Quebec, give it the ability to purchase properties at very competitive rates. It can also manage them at a cost advantage, combined with the provinces government and people's preference to deal with local institutions. This leads to some concentration risk that other REITs do not need to deal with.

Montreal and Quebec City

The two largest markets for Cominar are Montreal and Quebec City, the two largest cities in the Canadian province of Quebec. The province is largely French speaking (~78%) and the only province where French is the sole official language. As the second most populous province and second largest in economic output, the province has long been an anomaly, politically speaking, in Canadian history. As a particularly influential province, with a particularly strong historical proclivity to protectionism and a desire to preserve its culture against a largely English-speaking federal government, it has been a major force in Canadian politics and economic life.

As two of Canada's largest cities, ranking 11th (Quebec City) and 2nd (Montreal) they are economic powerhouses within the province. The province itself has many strong industries supported by the federal and provincial governments, combined with new immigrant populations and increased presence of local companies growing on the world stage. On the downside, increasing regulations designed to protect the French-speaking population, and the French language requirement for immigrants is limiting the strength of candidates companies are able to draw from. The aging infrastructure does not line well with the new age of high-tech cities.

The protectionist policies of the local government, in their attempt to protect the dominant French-language in Quebec, have put a damper on growth prospects in the province. Although Montreal and Quebec City are large and growing there are issues stemming from some of the political issues in the province. All of the province-specific issues are fixable, but it will be a long-term process.

Perennial Discount Causes

Quebec-Based Discount

Quebec-based companies often trade at a discount to their Canadian peers, who tend to trade at a discount to their US-based peers. As the liquidity of the Quebec-Non Quebec companies is the same (TSE), this discount stems from perception rather than a liquidity issue. This means that on top of concerns about the Canadian Real-Estate market, there is also an underlying Quebec discount that is largely unnecessary.

As an investor I believe this discount stems from a few sources. The main one is difficulty analyzing these companies properly. Their investor presentations and main websites are sometimes in French, though most major companies will produce all information in English on the English-language site (Cominar defaults to French, but you can select to view the website in English).

The second stems from lack of analyst following, most Quebec companies who have eliminated traces of their discount (BMO (NYSE:BMO), Alimentation Couche-Tard Inc (OTCPK:ANCUF), BCE Inc (NYSE: BCE), Valeant Pharmaceuticals (NYSE: VRX), etc) are exceptionally large and there is no reason to view them as Quebec-based. They have also grown to the point that analysts begin to cover them as a global company. Growing their scale and re-orienting their websites help eliminate any discount, regardless of where they are headquartered.

The third is an undervaluation of Quebec itself, as investors are simply less familiar with it. There are different laws and regulations for those based in Quebec that do not affect their ability to grow (as illustrated in the aforementioned companies) but that investors seem to automatically attach to Quebec, a stigma if you will, due to investor unfamiliarity.

Due to investors misunderstanding/under-rating of Quebec-based businesses there is an ability to accumulate assets based in that province with a higher than usual level of safety. It also allows businesses like Cominar, who deal actively in Quebec to get the best of both worlds. Low-cost leverage in the same vein of every other credit worthy institution, better cap-rates as sellers are more likely to prefer a local company and lower competition for properties as other major players are not as active in the Quebec market. These three advantages over other competitors in its home market allow for solid returns for investors at a discounted price.

Diversified Discount

As a diversified REIT there is already a discount associated with this type of investment vehicle. As Brad Thomas, the king of REIT contributors on Seeking Alpha, puts it in his article on Investors REIT (NYSE:IRET) which you can read here he states:

"I'll admit I've never been a big fan of Diversified REITs and neither has Mr. Market. One of the primary reasons that I like REITs is because I can hand pick REIT sectors with management teams that have a "core of competence". Coined as "pure play" REITs..."

This is Brad's preamble to an analysis of a diversified US-listed REIT, one of many I researched whose business models and asset mixes were simply too different from the Canadian equivalent to use in the comparisons (IRET for example trades at a 13 P/AFFO, is very small to trade at that level, but has considerable healthcare and multi-family buildings exposure, both sectors none of the Canadian REITs have exposure to).

This discount to peer groups of the more focused-REIT businesses allows for purchasing the assets of the REIT at a discount that I feel is largely unnecessary. At one time diversified companies, in the vein of General Electric (NYSE: GE), were all the rage. This turned out to be temporary, but "diversification as a strength" is a viable strategy in the authors opinion, and a change in investor sentiment is very possible in the future.

Valuation

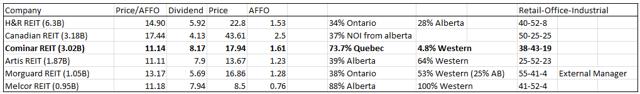

Comparable companies include Artis REIT (TSE: AX.UN), H&R REIT (TSE:HR.UN), Melcor REIT (TSE: MR.UN), Canadian REIT (TSE: REF.UN), and Morguard REIT (TSE: MRT.UN) in Canada. All the companies chosen operate a diversified REIT structure with the majority of earnings coming from Retail/Office, with most having an industrial component, much like Cominar.

As we evaluate the REITs we can see that there is a theme. The smallest REITs, and thereby least diversified, are valued very closely to how Cominar REIT is currently valued. The larger REITs are valued much higher, depending on their individual diversification.

As we can see from the information above, there is quite a bit of diversity within the valuations and sizes for diversified REITs, who themselves generally trade at a discount to US listed diversified REITs. This unlocks tremendous value for shareholders who have the opportunity to purchase at very reasonable multiples.

Cominar REIT, H&R REIT and Canadian REIT are the closest comparables of the Canadian REIT world. Cominar REIT and Canadian REIT in particular represent the sibling REITs in Canada, as they both began operating at a similar time and have produced some impressive returns for shareholders. In this graphic you can see the three REITs capital returns, and notice in particular Cominar and Canadian REIT diverging from their early life as concentrated REITs. There are two main reasons for this divergence of return, in the author's opinion. The first is that Canadian REIT was never particularly Quebec focused, allowing it to trade without that overhang. The second is Canadian REIT started diversifying across Canada more quickly. These two features allowed Canadian REIT to trade at a persistent premium, which gives it a competitive advantage in issuing new shares (higher price, more funds to reinvest, smaller dividend per share hurdle for investment).

Where Cominar has been trading with an aggressive dividend its entire life, Canadian REIT has been able to pay around 4% dividend (compared to Cominar's 8%) since about 2010, and occasionally before that, including between 2006 and 2008 (up to the crash). H&R REIT has been paying a distribution since late 2008 (interesting time to start), and has consistently paid around 5-6% its entire life. Cominar, on the other hand, has been grappling with a distribution in the 8-10% range since inception, trading at a yield below that for a short time late 2006 to early 2007 and again in late 2011 to 2012 (in both instances the distribution was still well above the REIT average at the time).

Accounting for this dividend discrepancy the return difference between the three narrows considerably, but there is still a gap. I would argue this gap stems from the advantage of better prices for equity issuances, coupled with greater exposure to the very hot (and currently struggling) Alberta market for the other two REITs.

As per my table above we can see that Cominar trades at a P/AFFO discount to both HR and Canadian REIT (CREIT), trading more in line with much smaller counterparts. Both HR and CREIT have increased exposure to struggling markets in Western Canada, which has hurt H&R more than Canadian. One of the stand-outs is the weightings for Retail-Office-Industrial buildings between H&R and Cominar, making H&R the basis of comparison for our base case.

H&R has a large exposure to Ontario, a market I consider very comparable to Quebec in terms of risk weighting. They are both sensitive to manufacturing and immigrant numbers, though Quebec has outsized government agency (less risky) and Ontario is growing marginally faster (less risky), I consider the comparison a wash.

H&R has increased exposure to commodity volatility (NYSEARCA:OIL) due to its increased investment in Western Canada, notably Alberta. Canadian REIT still trades at a hefty premium despite similar weightings, but I still feel there is a justifiable risk that needs to be accounted for. Cominar has increased geographic exposure to Quebec, which in itself is less risky, but the sheer volume of its properties being located there adds an element of geographic risk. Again, I will consider the two as canceling each other out, compensating investors adequately for the risk at H&R's P/AFFO value.

In our base case, we presume that Cominar will trade more in line with H&R's P/AFFO multiple over time. This will start to eliminate the equity issuing gap between the three and allow for strong growth in the future. In this case Cominar is worth $23.99 per share, a total return amount of 39.3% to this one-year price target.

In our best case, we presume Cominar will trade more in line with Canadian REITs P/AFFO, allowing outsized future growth through strong equity issuance pricing. If this were to occur, Cominar would be worth $28.08 per share, a total return potential of 61.65%, though this return would take considerable amounts of time, strong growth in Quebec (stronger than Ontario, similar to Alberta's growth rate before the crash) and policy changes in Quebec itself. Assuming any of the discount is because of the property mix, Cominar would also need to increase its exposure to Retail buildings considerably.

In our worst case, we presume that a crash in Quebec affecting Montreal and Quebec City (and not the rest of Canada) push Cominar to a P/AFFO multiple of 10, among the lowest I have seen in Canada, rarely applied to such a high-quality REIT. At this multiple we have a price of $16.10 for a total return of negative 3.88%, and would require some very aggressive miss-pricing (or lowered AFFO) from a downturn in Quebec where national renters are struggling. An event I find extremely unlikely, even in a real-estate market downturn.

Risks & Mitigating Factors

Canadian Real Estate Market - The Canadian Real Estate market is at one of the highest levels in history, and shows signs of finding the top of the cycle. Many analysts are calling for a "soft landing" that would not affect REITs to the extent that is priced in, but there is always a risk of a "hard landing" where real estate values fall rapidly.

Quebec Real Estate Market - The Quebec market is usually less sensitive to the Canadian market due to different political and legislative differences making the markets less correlated (generally Quebec grows slower, and slows down less, than a commensurate change in the Canadian market, due to higher government intervention - Note: This is the authors opinion only). An unusual event that disproportionately affects the province of Quebec, would affect Cominar much more than other Canadian REITs.

Interest Rate Risk - All REITs are sensitive to interest rate changes. The recent cut to the Bank of Canada rate (two recently) is bullish for Cominar and other similar REITs, but interest rate increases will be forthcoming as Canada generally follows in the footsteps of the United States, which is widely expected to start raising rates later this year, or early next year.

High Payout Ratio - Cominar commonly distributes a large portion of its income to investors each year (~90% of AFFO). This relatively aggressive payout ratio leaves less room than a comparable REIT should events affect the REIT's earnings. Cominar's long history and strong/diversified tenant base help mitigate this risk, but it is a consideration in evaluating the company.

Potential Catalysts

Diversification Potential - Cominar, due to its weightings in other jurisdictions in Canada, has been relatively unaffected by the turbulent oil price issues that most other REITs have been dealing with. This lack of exposure might allow Cominar to invest in the Alberta market at solid cap rates should other REITs need to shore up their capital amounts. The market would also likely reward Cominar for diversifying out of Quebec.

Large-Scale Merger - Cominar's strong asset base in a market that many lack proper exposure to, and experience in, allows for some opportunity for mergers in the space between Cominar and other REITs, within and outside Canada. Due to its large mispricing, strong properties and lack of overlap, a merger with H&R REIT or Canadian REIT would allow each to add valuable assets at below-market prices, and diversify each out of troubled markets. They would also enjoy the revaluation of Cominar to their own AFFO multiples, unlocking tremendous value for their shareholders.

Discount to Peers Dissipates - Cominar trades at an unnecessary discount due to its Quebec presence, its diversified nature, and being Canadian listed. It also has a necessary discount due to it being overweight in key Quebec cities. The discount will dissipate over time due to three main changes. The first is Cominar grows its asset based outside of Quebec, a stated strategy for the company. The second is an eventual dual-listing (not stated but a natural step for larger REITs in Canada), adding the liquidity of a large US exchange will lower any liquidity discount. The third is a growing realization by the Quebec government that to remain competitive their legislative and regulatory environment will need to change, a change that should come as the economic competitiveness issues begin to arise. All of these will happen with time, and all lead to a strong valuation for Cominar.

Conclusion

With a strong asset-base, dividend and operating history, Cominar represents one of the strongest, yet perennially under-appreciated of the Canadian REIT sector. With its unique combination of several unnecessary discounts, investors will be (and have been over its history) able to buy an impressive array of assets with a margin of safety. Should any of these overhangs eventually dissipate, the return potential is very impressive. If they do not, investors can continue to accumulate some great assets at great prices well into the future, and enjoy the increasing distributions and high current income.

选择“Disable on www.wenxuecity.com”

选择“Disable on www.wenxuecity.com”

选择“don't run on pages on this domain”

选择“don't run on pages on this domain”