ZT ZT 的 ZT

明天大盘

跳空高开。

所有的技术指标都清清楚楚的告诉会是那样的。

不论这二天的Pattern 是 Bearish Engulfing 还是 1 小时 和 4 小时 的 K 线, MACD, CCI 的位置 都佐证了明天的高开。

其它的 TA Indicator 也表明了 反弹是箭在弦上,不得不发。

不管明天的非农保告是好是坏, 明天都会涨, 坏,更暗示近期无 Tapering, 好, 经济在回复。

最关键的是 历史统计数字,年底前大盘一直是偏牛的。

今天的跌与其说是重大报告前的回避风险还不如说是 计术调整。

明天反弹的高度上看 1765

纯粹乎悠贴, 看后忘了最好。

〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉〉

下周去四川,有同学在么? 朕请客吃火锅。

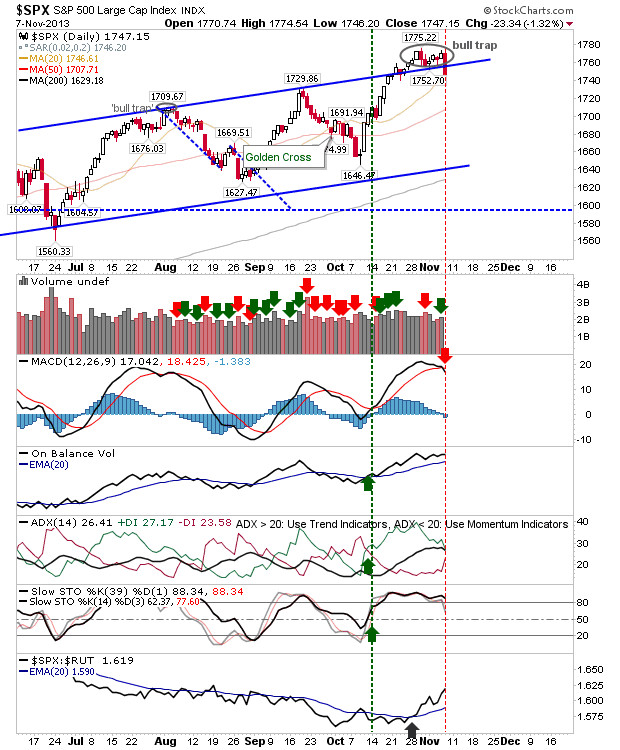

Danger! For those of you below the age of 40, that probably makes little sense but a quick translation is today's session calls for some caution to now enter your minds. We mentioned yesterday there was an interesting divergence in that the NASDAQ and Russell 2000 - the two "risky" indexes - were down, while the S&P 500 and DJIA were up. That need not be a disaster but it should be noted as a small warning, which we did yesterday. And we also noted how the consumer staples ETF (XLP) - full of companies who produce stuff like diapers, paper towels, Kleenex was rallying the sharpest lately - again usually not a great leading indicator. Also biotechs - leaders of the entire year - took a big hit yesterday. Last we had the NYSE McClellan Oscillator stuck below the zero line for more than a session or two. This all came home to roost today as we had a classic "outside day" on the S&P 500, and with a close near the low this is a short term yellow flag . Outside of the general market, the booming debut of Twitter (TWTR) was obviously the story of the day. The S&P 500 fell 1.32% and the NASDAQ 1.90%.

In economic news the first pass at 3rd quarter GDP came in better than expected. Data showed the U.S. economy grew 2.8 percent in the third quarter, but that estimate, which will be revised, was affected by a larger-than-expected build-up of inventories, which tends to subtract from growth later on.

The S&P 500 chart pulled back to the trendline that connected recent highs - in and of itself that is fine - but the nature of how that pullback happened today is concerning. We'll mark this day in yellow and watch it go forward to see if it affects the next few weeks.

Here is our NYSE McClellan Oscillator - almost in the first band of oversold territory.

Twitter is a name we won't be able to chart for the next few months until at least the 50 day moving average is created but obviously it had a big first day - it is very expensive, almost double now what LinkedIn (LNKD) and Facebook (FB) are on a "price to sales" ratio; and those aren't cheap stocks themselves.

Speaking of, the move by Twitter seemed to suck the life out of some other social media stocks ....

Mobile chip giant Qualcomm (QCOM) reported after the bell yesterday and its report weighed on the NASDAQ.

Qualcomm Inc on Wednesday forecast revenue below expectations and said it would curb fast-growing operating expenses, stoking concerns the leading mobile chipmaker faces tough competition in Asia, and sending its stock down. Qualcomm's components are used in smartphones made by Apple Inc and Samsung Electronics Co Inc and its patents pulling in revenue from licensees across the cellphone industry. But with growth in the smartphone industry shifting away from wealthy markets such as the United States and toward emerging economies such as China, analysts have been concerned that less expensive phones could impact Qualcomm's profitability. Qualcomm posted double-digit growth in the fiscal fourth quarter for the 13th consecutive time, but its revenue forecast suggests the company's explosive growth in recent years might be slowing as smaller competitors challenge it in Asia.

Whole Foods Markets (WFM) - another darling of many institutions - took a major dive for similar reasons.

The grocery chain reported a revenue shortfall in its fiscal fourth quarter and trimmed its annual outlook for 2014. The food chain, known for its organic and natural food offerings, posted a 7 percent increase in profits, helped by lower food inflation. The latest results show that Whole Foods Market Inc is facing a more competitive landscape. The chain has been able to boost sales in large part because its health glow fits with changing eating habits. But more mainstream players are increasingly tapping into that trend as well, and rolling out more products or sections labeled as natural or organic.

Tesla Motors (TSLA) continued to bomb and this shows you the dark side of momentum stocks - once the momentum fades it can get very ugly.

222222222222222222

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

It looks like indices were doing their best to upstage Twitter's IPO. Both the S&P and Nasdaq closed with 'bull traps', threatening larger pullbacks. It will take a push above October's highs to knock out the 'bull traps', which may take a few days. What today offers is an opportunity for shorts to take a shot at a possible larger move lower.

The S&P also managed to log a MACD trigger 'sell', but countered by holding its 20-day MA. Assuming some defense of the 20-day MA on Friday, look for shorting opportunities as the bounce takes the index back to Thursday's open. Stops go above 1,775.

The Nasdaq took a larger hit than the S&P, which was combined with a distribution day. The index cleanly sliced through its 20-day MA (which is likely what will happen with the S&P too). The index has already registered a MACD 'sell', and followed with a bearish cross of -DI on +DI. Risk:reward is measured from the 3,967 high, with the 50-day MA and lower channel support the downward targets (i.e. a bounce back to the 20-day MA is the time to short).

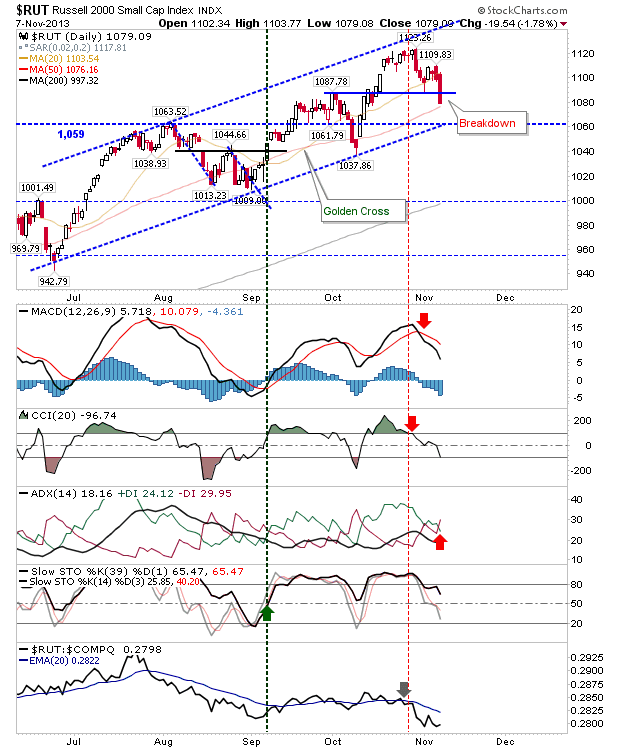

The Russell 2000 lost its breakout and is only a couple of points above its 50-day MA. The decline from October highs has hit Small Caps hard, as noted by the large relative swing away from the Russell 2000 towards the Nasdaq and S&P. It's also looking like it will be the first index to turn net bearish technically.

Today was the first indication shorts might be offered something to work with. Bounces can be worked for moves to channel support at the least. Profit taking continues to be the order of the day for existing longs. Those looking for value can wait a bit longer before jumping in.

YMYD.