Most Agricultural Commodity Markets and Natural Gas feeling the pressure of good Weather Conditions

Those of you who are neophytes to the game of relating weather forecasts to commodity prices, need to know that all the hype and talk by some 'so-called' well known macro commodity analysts about higher commodity prices, has been a huge mistake. Without being to surreptitious, the bottom line has been that a rebound in world grain, sugar and coffee stocks (due to good world weather since winter), plus my expectations of a normal to cool summer in key U.S. consuming natural gas regions, have all had a bearish impact on most commodities. Overall, I DO NOT see that trend changing. If there are any issues this summer, it would be from "too much", not too little rain in some areas.

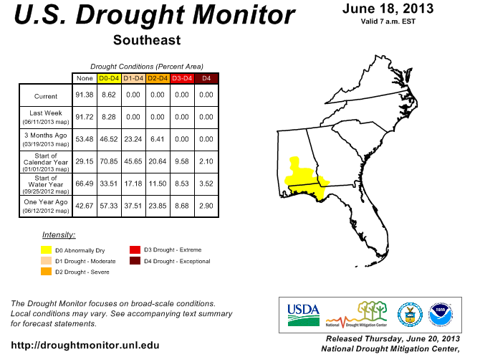

Even the thinly traded orange juice market has collapsed some 20% on drought easing rains in Florida the last few weeks. However, it remains to be seen whether or not farmers and agronomists, can come up with a solution to eradicate a harmful 'green disease' pest that threatens the Florida citrus industry. My guess is, when we put our minds together, we are always ingenuous as a nation and a people solutions to complex problems are often found.

Florida had lots of orange colors (moderate drought) a month or so ago, but improved rainfall now means that only the panhandle (yellow) has slight drought conditions. Most citrus areas are improving.

One of our highest confidence trades the last 12-18 months, other than forecasting back to back 2011-2012 corn/soybean belt droughts, followed by what we believed to be the top of the grain market last fall , has been in gold. Traders that took my advice more than a year ago, may look to take profits if they shorted the ETF (GLD). Otherwise, using trailing stops to preserve profits at 130.50 in GLD and stay short. Less Federal stimulus, a stronger dollar, slowing Chinese economy and too many "bulls" in the market, could still mean that gold challenges $1200 or lower in the weeks or months ahead. I am content with a 30-35% sell off in gold prices for the moment. That does not, however, suggest that gold prices will be storming back some 15-25% in the months ahead. There are too many other investment opportunities these days to diversify risk. There are still too many moms and pops holding onto gold, hoping for higher prices (that's never a real bullish sign!)

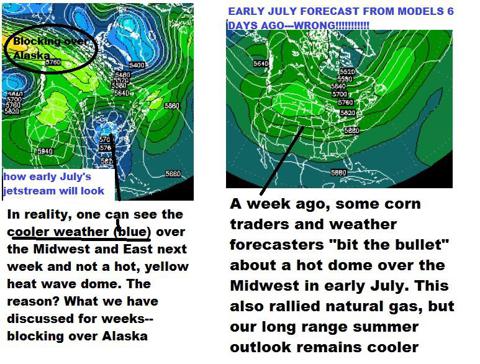

So why do corn futures have another 10% down the next 4-6 weeks? Not only will ideal weather remain for the month of July in the U.S. break-basket, but good weather for Ukraine and China also means potential big crops. While I have expressed concerns about too much rain in parts of Iowa, N. Illinois, Minnesota and Wisconsin, the U.S. will still see ending stocks bounce back close to 2 billion bushels this year. Look for the ETF (CORN) to fall another 10% by late summer or by the fall harvest. This Friday's USDA may throw some surprises with respect to the recent wet spring and planting delays, but any major sustained move up in prices is unlikely. IF there is any issue this summer in the grain market, it would be from too much (not too little) rain in some areas. Soybeans are a dry weather crop and grain traders will be on edge this summer watching weather patterns and how much rain may be a bit too much in places. A cool, dry summer (if we have that), given all the great Midwest soil moisture, would be bearish the soybean market, later on.

In cotton, if you are a Texas farmer, I have some hope for you with more good rains expected in early July. This will not completely erase the entire drought, but at least allow for some improvement in the situation.

After our bullish late winter attitude in natural gas (UNG), I continue to feel the lack of hurricanes (too much earlier hype over that) a normal to cool summer will keep natural gas prices from rallying back above $4.00 anytime soon. While coal producers might be shocked and fearful over a possible White House announcement on carbon emission reductions, I don't think this would have anything more than a short term positive reaction in the natural gas market. The lack of demand, given my outlook for normal to cool summer weather, will be king.

SOURCE:WSI

While wet Midwest weather has created volatility in the grain market, plus some talk last week about hot Midwest weather in July (right), this is mostly bogus. With the critical time coming up for the Midwest weather markets, a normal to cool summer is just what the doctor ordered for good summer yields for crops and potentially lower natural gas prices, later.

Will Sugar Prices Sweeten from Wet Brazil Weather?

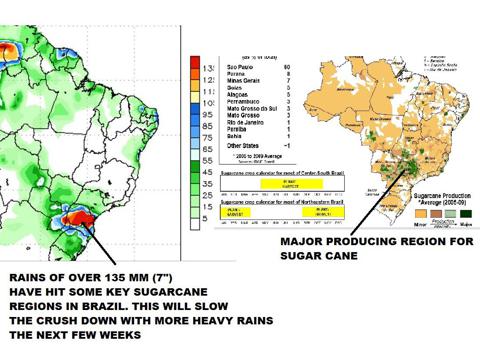

Sugar prices have broken some 30% the last 6-9 months. When compared to the incredible 50-60% break in coffee futures and the ETF (JO) on a huge rebound in global coffee production, this does not seem like much. I became friendly sugar prices to clients last week on my concerns about wet weather returning to Brazil cane regions into early July. After ideal Brazilian sugar yields this year, the influence of the MJO wave and stratospheric warming over far southern South American, has resulted in some very wet weather for Sao Paulo this last week.

SOURCE: USDA/FAS

If we had an El Nino and warmer waters to the Northeast of Brazil and along the equator, the chances for a repeat 2009 weather disaster for Brazil sugar cane, from too much rain would be more likely. We do not have that. Hence, some occasional concerns with harvest delays may occur the next 2 weeks, but any longer term detrimental impact to sugar crops is not likely at this time.

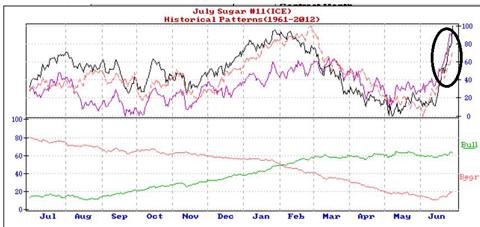

The wet Brazil weather is matching up simultaneously, with a strong seasonal to be long sugar prices from mid June into early July. However, just how far sugar prices and the ETF (CANE) can rally is questionable. I expect a potential huge Indian crop from the early onset of the monsoon and without an El Nino, Thailand (#2 exporter) in the world, should have a normal to better than average crop. Hence, it would take crop problems in at least 2 of these major producing areas all summer and fall long, to get me real bullish sugar. Once this wet weather in Brazil breaks, it will probably offer a shorting opportunity in mid-late summer in sugar again.

SOURCE: MOORE SEASONAL TRADES

Sugar prices often rally in mid June through early July as evidenced by the chart above. Wet Brazil weather should keep this market firm on breaks for the next week or two, with possibly lower prices, later this summer on big world crops.

COCOA Prices Feeling the Effects of Increased Global Production

I continue to believe that some computer models forecasting an El Nino later this summer are wrong and too emphatic. Also, the MJO will be in one of the strongest phases in the Atlantic that I can remember, during June. This should bring about an end to short term dryness in West Africa in about 10 days or so and keep cocoa crops in mostly good shape.