| Gold Sentiment Updated | |

| Jordan Roy-Byrne, CMT on 2013-03-02 20:29:07.0 | |

|

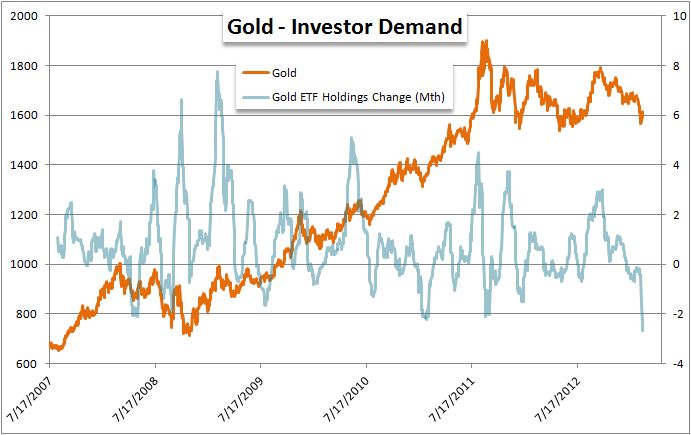

GLD Outflows have occurred for a record 41 consecutive days and as you can see, have surpassed 2008 levels.

The MarketWatch Blog, The Tell quotes Barclays in saying that Gold ETP flows are now the weakest on record. Barclays also notes that net fund length in Gold is at its lowest since December 2008 and gross short positions are at their highest since July 1999. Quoting MarketWatch:

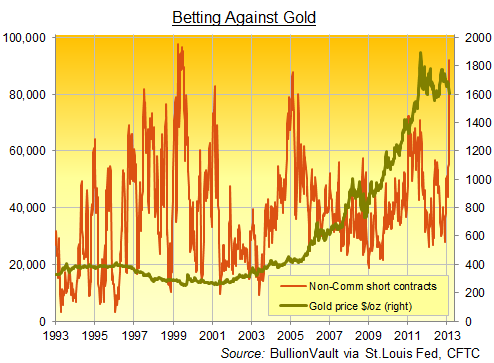

According to BullionVault, spec shorts are now at their highest levels since 1999!

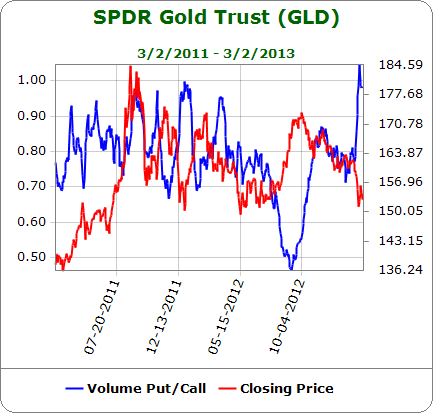

Next, let's take a look at the GLD put-call from Schaeffers Research. Days ago it hit a 2-year high (minimum) though GLD has yet to close at a new low.

|

黄金空仓已经超过14年来任何时候,接近历史纪录的1999年,1999-2000年是黄金低谷

所有跟帖:

•

难道大佬们盯住了炮神,要把他08年赚的都吐出来

-mtlu2-

♂

![]()

![]() (0 bytes)

()

03/02/2013 postreply

19:16:09

(0 bytes)

()

03/02/2013 postreply

19:16:09

•

泡森的黄金只有世界的3000分之一,没那么重要吧,再者他是GS的人。

-_学无止境-

♂

![]()

![]() (0 bytes)

()

03/02/2013 postreply

19:26:03

(0 bytes)

()

03/02/2013 postreply

19:26:03

•

还没让泡森吐出来,DQ就吐得差不多了,内线人物可不像我们一样好摆布

-_学无止境-

♂

![]()

![]() (0 bytes)

()

03/02/2013 postreply

19:55:23

(0 bytes)

()

03/02/2013 postreply

19:55:23

•

其他大众黄金SENTIMENT指标也达新低

-_学无止境-

♂

![]()

![]() (138 bytes)

()

03/02/2013 postreply

19:21:02

(138 bytes)

()

03/02/2013 postreply

19:21:02

•

the biggest chunk of those outflows came from a single gold ETF,

-hercules007-

♂

![]()

![]() (834 bytes)

()

03/02/2013 postreply

19:32:24

(834 bytes)

()

03/02/2013 postreply

19:32:24

•

Thanks for sharing!

-info2008-

♂

![]() (0 bytes)

()

03/02/2013 postreply

19:38:44

(0 bytes)

()

03/02/2013 postreply

19:38:44

•

听起来象是反向指标,但这次很可能是正的.Long的人你们祈祷吧.

-bouncel-

♂

![]() (0 bytes)

()

03/02/2013 postreply

19:49:07

(0 bytes)

()

03/02/2013 postreply

19:49:07

•

反向指标永远觉着像正指,否则谁去跟?

-_学无止境-

♂

![]()

![]() (0 bytes)

()

03/02/2013 postreply

19:53:01

(0 bytes)

()

03/02/2013 postreply

19:53:01

•

虽然空的人14年新高,一,还是少数人,他们可能掌握真理喔;二,高了还可以更高,

-bouncel-

♂

![]() (93 bytes)

()

03/02/2013 postreply

20:33:24

(93 bytes)

()

03/02/2013 postreply

20:33:24

•

看看我连接的SENTIMENT指数,多数人早看空了。

-_学无止境-

♂

![]()

![]() (0 bytes)

()

03/02/2013 postreply

20:38:03

(0 bytes)

()

03/02/2013 postreply

20:38:03

•

真正去short的人,也许不多?

-bouncel-

♂

![]() (0 bytes)

()

03/02/2013 postreply

21:07:55

(0 bytes)

()

03/02/2013 postreply

21:07:55

•

这不是矫情吗?任何时候空的都是少数人

-_学无止境-

♂

![]()

![]() (0 bytes)

()

03/02/2013 postreply

22:11:43

(0 bytes)

()

03/02/2013 postreply

22:11:43

•

跌势可能会持续,然后反弹到目前价位附近,盘整一段时间后再续 跌势.

-bouncel-

♂

![]() (35 bytes)

()

03/02/2013 postreply

20:16:56

(35 bytes)

()

03/02/2013 postreply

20:16:56

•

如果持续增加货币发行量而又不形成通胀,那美国可能是历史仅见,但看1913到现在的历史会让你失望

-_学无止境-

♂

![]()

![]() (32 bytes)

()

03/02/2013 postreply

20:22:33

(32 bytes)

()

03/02/2013 postreply

20:22:33

•

FED 在定向爆破,通胀没有表现到最敏感的统计数据上,但已经在房地产上很明显了。

-goldengate-

♂

![]()

![]() (156 bytes)

()

03/02/2013 postreply

20:28:41

(156 bytes)

()

03/02/2013 postreply

20:28:41

•

短期可以定向但长期不可能,联邦政府花的钱是不可能只导向股市和房市的。

-_学无止境-

♂

![]()

![]() (45 bytes)

()

03/02/2013 postreply

20:35:30

(45 bytes)

()

03/02/2013 postreply

20:35:30

•

当失业率真的好转时,传统意义上的通胀应该已经到了无法收拾的地步了。

-goldengate-

♂

![]()

![]() (31 bytes)

()

03/02/2013 postreply

20:47:27

(31 bytes)

()

03/02/2013 postreply

20:47:27

•

增加的货币目前没有导致大的通涨,大家就应该想想了.

-bouncel-

♂

![]() (357 bytes)

()

03/02/2013 postreply

21:03:52

(357 bytes)

()

03/02/2013 postreply

21:03:52

•

我的理解:

-goldengate-

♂

![]()

![]() (487 bytes)

()

03/02/2013 postreply

21:17:21

(487 bytes)

()

03/02/2013 postreply

21:17:21

•

同感!

-bouncel-

♂

![]() (0 bytes)

()

03/02/2013 postreply

21:28:22

(0 bytes)

()

03/02/2013 postreply

21:28:22

•

能不能说说你哪里汽油多少钱?

-_学无止境-

♂

![]()

![]() (0 bytes)

()

03/02/2013 postreply

21:39:55

(0 bytes)

()

03/02/2013 postreply

21:39:55

•

汽油涨价,花在其他上面的钱就少了会.影响需求,抑制通膨.ZF要是觉得油价

-bouncel-

♂

![]() (182 bytes)

()

03/02/2013 postreply

22:19:00

(182 bytes)

()

03/02/2013 postreply

22:19:00

•

买汽油就没钱买别的你是假定了货币发行量不变, QE了,当然就有钱买别的了

-_学无止境-

♂

![]()

![]() (271 bytes)

()

03/03/2013 postreply

09:59:03

(271 bytes)

()

03/03/2013 postreply

09:59:03