NQ Mobile, The Emerging Global Mobile Security Leader

One of the defining global technology mega-trends of this decade is the evolution and widespread adoption of mobile computing across both consumer and enterprise sectors. We believe that security threats tend to lag major computing cycles by several years, and we believe that 2013, a year in which developed market smartphone and tablet growth and adoption curves have begun to form their eventual asymptote, will mark the year in which mobile security threats start to peak. Already in this new year, there have been numerous high-profile cases of mobile security breaches that serve as evidence. We believe NQ Mobile (NQ), a little-known and misunderstood company, is best positioned to exploit the mobile security trends that are beginning to reach the public eye, and we believe that NQ's current market pricing provides an opportunity to generate a multiple of investment greater than 3x over the next 12 to 18 months.

Key Stats (as of 2/21/2013 or as last reported)

- Price per ADS: $6.40

- Market Capitalization: $329 million

- Enterprise Value (TEV): $204 million

- Debt/2012 EBITDA: NM

- Liquidity (daily): 0.3 million shares, or ~$2 million

- 2013 Analyst Consensus Estimates (Bloomberg): $154 million of net revenue, $50.2 million of EBITDA, $0.96 EPS

- 2013 Analyst Consensus Multiples (Bloomberg): TEV/EBITDA = 4.0x, P/E = 6.6x, TEV/Revenue = 1.3x

Investment Summary

- Best-in-class global mobile security company levered to sustained secular mobile and security industry growth trends.

- Deeply undervalued: virtually debt-free, trading at 38% of net cash balance with a ~15% FCF Yield.

- Substantial technological moat based on network effects derived from large global user base and proprietary IP.

- Unique and valuable distribution channel providing significant competitive advantage.

- Misunderstood strategic acquisitions provide a significant competitive advantage.

- Imminent potential for significant revenue growth through monetization of nonpaying user base.

- Unique and valuable distribution channel providing significant competitive edge.

- Proven management (e.g. Omar Sharif Khan, "Godfather of the Samsung Galaxy S").

- Significant and highly accretive strategic value to global industry giants in Internet, mobile, software, telecom, and service industries such as Baidu (BIDU), Symantec (SYMC), Tencent (TCEHY.PK), Microsoft (MSFT), Qualcomm (QCOM), and many others.

Market Misperceptions (i.e. Source of Investment Opportunity)

1. NQ's mobile security product is a commodity and will lose market share

- Market does not understand NQ"s strong technological moat due to its large and broad user base.

- Market is missing the tremendous industry validation NQ has received vs. its competitors.

2. NQ will be unable to achieve its guidance of $200 million run rate revenue by Q4 2013.

- Due diligence and financial modeling indicate that NQ has numerous drivers to achieve its projections.

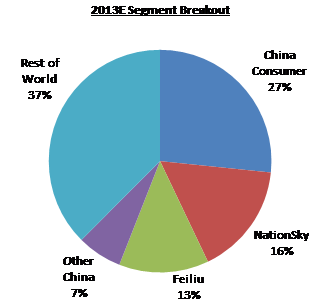

3. NQ's acquisitions of NationSky and Feiliu are a waste of money and management is attempting to buy growth.

- NationSky and Feiliu have established new distribution channels and revenue streams to previously untapped markets and provide a significant competitive advantage.

Company Summary

NQ Mobile is a global mobile security and privacy protection software-as-a-service (SAAS) provider for smartphones. Its security services protect users from mobile malware, data theft and privacy intrusion. Its offerings can be grouped in three segments: Consumer Security, Enterprise Mobility, and Mobile Games and Advertising.

|

Segment |

Description |

Products/Rationale |

|

Consumer Security (legacy NQ business) |

Protects against malware, viruses, spam and privacy intrusion. Also offers productivity enhancing solutions |

Mobile Security, Mobile Vault, Family Guardian, Call Blocker, Android Booster |

|

Enterprise Mobility (NationSky acquisition) |

Managed mobility solutions |

Helps Fortune 500 companies procure, deploy, manage and train their mobile assets in China |

|

Mobile Games and Advertising Platform (Feiliu acquisition) |

Mobile interest-based community platform with 64 million registered users and 11 million monthly active users and is the #1 mobile online game distribution platform on iOS in China as of Sept. 30, 2012, according to third party research firm Sino MR |

Allows further monetization of registered and active user base through mobile games, mobile advertising and cross selling |

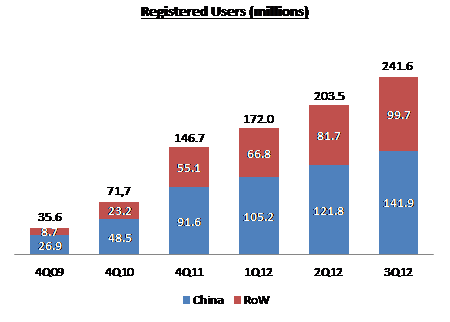

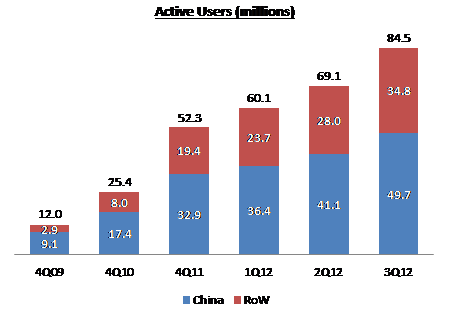

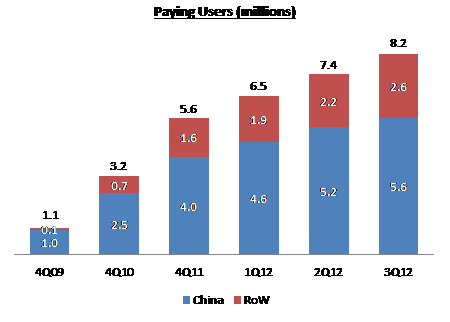

The company's user base consists of 241.6 million registered users, 84.5 million active user accounts, and 8.2 million paying user accounts as of September 30, 2012 (these figures are just for NQ Consumer and exclude Feiliu's users).

Source: NQ Analyst Investor Day 2012 presentation

Business Model

Consumer Security Business (legacy)

NQ's legacy consumer business operates a Freemium business model. It provides users with a set of free basic services along with the option to select a set of premium (paid) services to meet individual needs. NQ charges a subscription fee to upgrade and use the premium services. The subscription fee can be invoiced monthly, quarterly, semi-annually or annually producing a recurring revenue stream.

NQ Mobile reaches consumers through mobile and Web application marketplaces, pre-loads by handset manufacturers and carriers, bundling its product with smartphone insurance providers, connecting its product to carrier value-added services, through retail stores at point of sale and through storefront distribution..

Enterprise Mobility Business

NQ's enterprise business operates directly in the Chinese market through its acquisition of NationSky, where it provides security enabled managed mobility services. Enterprise customers work with NationSky to procure, deploy, manage, train and service their mobile deployment in China. NationSky currently services over 50% of the Fortune 500 companies' hardware procurement in China. Customers include: HSBC (HBC), ABN-AMRO, Pfizer (PFE), DuPont (DD), Intel (INTC), General Electric (GE), Toyota (TM), and Shell (RDS.A).

NQ is expanding its enterprise business indirectly outside of China by extending its security platform to accompany third-party managed mobility solutions by leveraging the various strategic relationships with Brightstar eSecuritel, TD Mobility, and Vox Mobile.

The key difference between the two markets is that while in China, NQ will provide the software/services and also manage the lower margin hardware procurement for enterprises, outside of China it will primarily offer its software component through third party vendors who are managing the hardware deployment directly.

Mobile Games and Advertising Platform

Feiliu is a leading mobile interest-based community platform in China that engages users in real-time mobile online activities. Feiliu provides application recommendation services, interest-based exchanges, and mobile games to its user communities. Feiliu has over 64 million registered users and 11 million monthly active users, distributes over 400,000 apps and is the #1 mobile online game distribution platform on iOS in China as of September 30, 2012, according to third party research firm Sino MR. Feiliu generates revenues mainly from mobile games, mobile advertising and application referral services.

Mobile app and software, especially mobile game developers find Feiliu attractive because it is a monetization vehicle for their products that allows targeted engagement with consumers with a high interest in specific product categories. Feiliu has established a successful track record of operating mobile games in China. Community members are able to discuss, read reviews, given sponsored recommendations, shown advertisements, given direct advertisements and offered sponsored downloads.

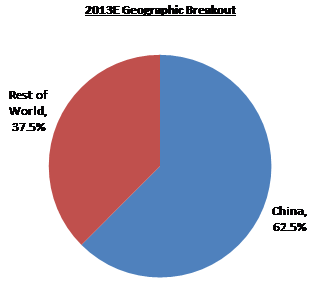

2013E Revenue Breakout

Source: Toro Investment Partners estimates based on management team interviews, past earnings call transcripts, and SEC filings

Competition

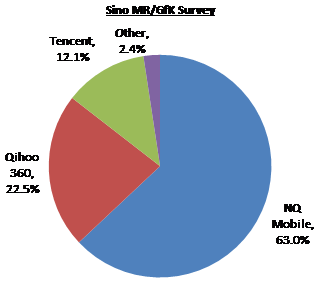

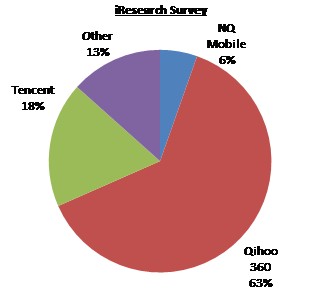

In China, NQ's primary competitor is Qihoo 360 (QIHU), the dominant PC security platform. Substantial controversy exists between NQ and Qihoo 360 regarding mobile security market share. NQ claims ~60%+ market share based on surveys from Frost & Sullivan and Sino MR/ GfK, two Western-based market research firms. Qihoo 360 cites Chinese-based iResearch and CCID Consulting surveys that claim Qihoo 360 has dominant market share and NQ"s market share is <10%.

Outside of China, NQ has other competitors such as a Lookout Mobile, AVG Technologies (AVG), Symantec, McAfee, and others. However, NQ has consistently outperformed these Western competitors due to their lack of presence in the emerging markets. The majority of mobile malware is developed in China, India and Russia. NQ's dominant presence and large user base in these markets allows it to more proactively detect and neutralize these threats before its competitors.

Source: iResearch, Sino MR/Gfk survey

Management

|

Name |

Title |

Tenure |

Prior Experience |

|

Henry Lin |

Chairman, Co-CEO, Founder |

8 years |

Associate Professor at Beijing University (#1 university in China) of Posts and Telecom |

|

Omar Sharif Khan |

Co-CEO |

1 year |

Chief Strategy, Tech, & Product Officer at Samsung Mobile; Motorola |

|

Zemin Xu |

President |

3 years |

Vice President at AsiaInfo-Linkage |

|

Suhai Ji |

Chief Financial Officer |

3 years |

Director in NYSE Beijing; Deutsche Bank; A.T. Kearney |

|

Vincent Wenyong Shi |

COO, Founder |

8 years |

PhD in Geographic Information Systems from Beijing University |

|

Will Jiang |

VP of Strategy |

3 years |

Dell China, Research in Motion |

|

Gavin Kim |

Chief Product Officer |

1 year |

GM for Windows Phone Product Marketing at Microsoft, VP of Content, Services and Enterprise Business at Samsung Mobile |

The three founders of NQ (Henry Lin, Vincent Wenyong Shi and Xu Zhou) own ~20% of the company.

Investment Thesis

1. Best-in-class mobile security company

- Although significant controversy exists regarding market share estimates between NQ and Qihoo 360's mobile security offerings, independent testing, customer satisfaction and NQ's numerous partnerships with major smartphone OEMs point to a significant competitive and technological advantage and market preference for and support of NQ

- Independent Testing: October 2011 study done by West Coast Labs resulted in NQ correctly identifying 96% of the malicious application packages tested vs. 41% for the second-best vendor (though Qihoo 360 did not participate in the study). NQ also correctly achieved a 99% malware detection rate in research conducted by AV-TEST Institute, a leading international and independent service provider in the fields of IT security and anti-virus research. It was also reported in the recent Chinese media that Qihoo just failed the initial AV Test this year while NQ passed it. Reference (in Chinese):http://tech.xinmin.cn/2013/01/29/18413338.html andwww.pcpop.com/doc/0/878/878604.shtml

- Customer Satisfaction

| January 2013 |

NQ Mobile Security and NQ Family Guardian selected as top 25 at the Mobile Apps Showdown for CES 2013 source: corporate IR site |

| November 2012 | Piper Jaffray survey revealed that 96% of NQ Mobile users would recommend the product to a friend |

| October 2012 |

NQ Mobile Security was selected as a top 20 app at the Global Mobile Internet Conference Silicon Valley 2012. NQ Mobile Security was the only security app in the top 20 source: corporate IR site |

- Selected Strategic Partnerships

| China Mobile | The largest wireless carrier in China utilizes NQ as its exclusive security partner, with NQ's technology running China Mobile's anti-spam product and also acting as a security provider for China Mobile. |

| MediaTek | Starting in 2013, NQ's software will be integrated and preloaded into MediaTek's smartphone chipsets through Hesine Technologies. MediaTek produces chipsets for Tier 2 and 3 manufacturers and white label smartphones. These are typically less expensive smartphones and these manufacturers rarely alter the messaging software stack that MediaTek incorporates with its chips. MediaTek is also a strategic investor in NQ, investing US$2-3m in 2010. NQ bought an approximately one-third stake in Hesine Technologies from MediaTek in 2012. |

| Qualcomm | Invested $2-3 million in 2010. Qualcomm investment is notable given the animosity between it and MediaTek. |

| HTC | In December 2012, HTC announced that its app store in China will include pre-scanning service from NQ for all applications and plug-ins prior to their inclusion in HTC's App Store. HTC also invested $2-3 million in NQ in 2010. |

| Vox Mobile | In November 2012, a leading provider of managed mobility solutions for enterprise, announced its intent to integrate NQ's mobile security solutions into its product offerings to customers. |

| TDMobility | In June 2012, a joint-venture between Brightstar Corp. and Tech Data announced an alliance with NQ to bring its enterprise mobile solution (NQ Enterprise Shield) to its 65,000 value-added resellers across the United States. |

| Brightstar eSecuritel | In March 2012, announced that it will extend its device protection offering to include data protection and privacy solutions from NQ. |

| Huawei and ZTE | NQ has pre-load relationships with those two leading Chinese smartphone OEMs who are becoming more significant global players. |

2. NQ's global user base of ~241 million represents a significant technological moat which is not easily replicated

- The effectiveness of a mobile security network depends in large part on its size and coverage through its user base. Having a deep and broad user base allows a mobile security company to identify and neutralize mobile security threats as soon as they appear. The majority of malware is developed in China, India and Russia, markets where NQ has an entrenched and large user base.

- NQ is only mobile security company that has a user base that is large and active in all major global markets. Qihoo 360 may or may not have as many users as NQ in China, but it has zero users outside of China. Symantec, McAfee, AVG Technologies and Lookout Mobile lack significant presence outside of Western markets.

- Difficulty in replicating NQ's technological advantage is one reason why NQ consistently outperforms its competitors in independent testing.

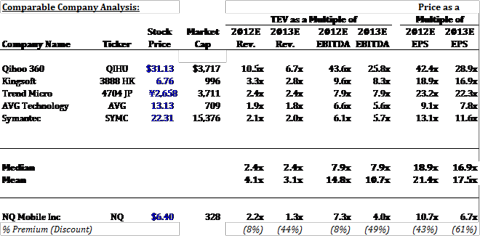

3. NQ's valuation offers the opportunity to invest in one of the world's highest-growth companies priced as a deep value opportunity

- Notably, several of the world's most overvalued companies by any metric (e.g. LNKD, TRLA, etc.) enjoy their hyper-valuations due to growth rates meaningfully slower than NQ's in part because of their exposure to mobile industry trends (while 100% of NQ's business is directly levered to the same trends).

- Street estimates for NQ project >70% sales and EBITDA growth in 2013. Companies that exhibit such hyper growth often have nose bleed valuations and are frequently not cash flow positive or even profitable. However, NQ currently trades at: FY 2013 EBITDA 4.0x, FY 2013 P/E 6.7x, FY 2013 FCF Yield (as a % of market cap) 14.9%.

- 38% of NQ's market cap is in net cash.

- Even relative to its slow-growth software security peers, NQ is substantially undervalued by virtually every meaningful financial metric.

4. Transition from product business to a platform company

- NQ has built an impressive mobile user base (~241m registered users) around smartphone anti-virus and security services and is now seeking to increase monetization by developing a supporting platform of analytics, cloud services and other mobile Internet capabilities.

- Qihoo 360 as a Case Study: Qihoo 360 has quickly established itself as a major force in the Chinese Internet sector - with multiple business lines such as its online portal, online search, and both consumer and enterprise security - by leveraging a large desktop/PC browser user base that it was able to attract by first offering PC security and optimization desktop software.

- Tencent as a Case Study: Tencent similarly began with QQ Messenger, desktop instant messaging software, which it used to build a platform of 600 million users and then expanded into music, video, gaming, etc…

- Similar to what Qihoo 360 and Tencent did historically, NQ has developed the infrastructure to continue adding ~40 million new users per quarter. Newly released applications such as Mobile Vault and Family Guardian represent a natural deepening of the market served by Mobile Security.

- Expansion into the enterprise through the NationSky acquisition and partnerships with managed mobile services companies such as Vox Mobile allow greater utilization and monetization of the company's core product offerings.

- The Feiliu acquisition further cements the transition to a platform as it enables NQ to further engage and monetize its large user base through mobile games, advertising, downloads, referrals and targeted marketing. There are substantial near-term synergies in cross-promotion between NQ's and Feiliu's user bases due to the low level of overlap between them.

5. The market has misunderstood and negatively overreacted to NQ's potential transition to a platform company

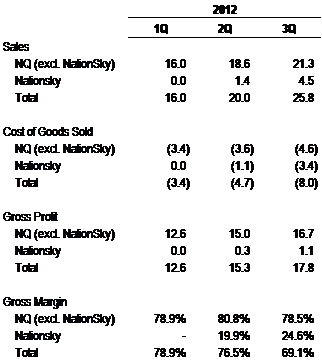

- Transition from a pure mobile security player to a mobile Internet platform naturally introduces increased complexity and investment in the company's business model. Some investors have reacted negatively to the increased complexity and NQ's share price has suffered, which has been exacerbated by temporary margin pressure, due to the NationSky acquisition.

- Excluding the NationSky acquisition, NQ's margins have continued to remain in the expected 78-80% level. NationSky margins will improve as the revenue mix shifts from lower margin hardware sales to higher margin recurring subscription revenues.

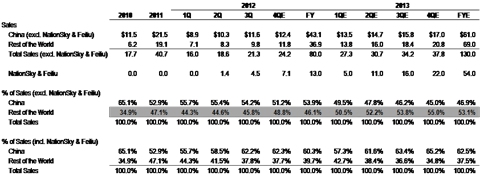

source: SEC filings

- NationSky acquisition allows the establishment of an effective and unique channel for NQ's offerings into the enterprise market in China. NationSky is already a trusted resource in helping over 50% of the Fortune 500 manage its mobile hardware procurement in China. The biggest barrier to widespread adoption of enterprise mobility has been around security and NQ is a natural partner due to its existing mobile security portfolio. Integrating and cross selling NQ's mobile security portfolio into the mobile deployment is a natural and effective way to overcome this barrier.

- Similarly, the market has not appreciated the benefit of the accretive Feiliu acquisition. Not only does Feiliu allow NQ to further market, advertise and engage with its users, it will also allows third party developers and advertisers to similarly engage with NQ's registered user base. Importantly, Feiliu's margin structure is at least as good as that of NQ's core security business, and possibly better as synergies between the two businesses are realized

6. Extensive distribution network as a key differentiating competitive advantage

- NQ has developed an extensive moat in product distribution due to its agreements with mobile handset and chipset manufacturers, mobile enterprise vendors, carriers and global cellular retail.

- Handset and Carrier Pre-installation: NQ security offerings come pre-installed due to agreements with Samsung, Motorola, Nokia, ZTE, Huawei, HTC, Taiwan Mobile, MediaTek, Cricket and Telefonica. NQ only incurs marketing cost if consumer becomes an active user.

- Enterprise penetration: Given that NationSky already serves a large number of enterprise customers in China (currently serves over 50% of the Fortune 500 in hardware procurement), NQ has a unique advantage in cross selling its mobile security solutions to enterprise customers in China. Similarly, by collaborating with managed mobile services providers such as a Vox Mobile in markets outside of China, NQ has established credible partners that will be an effective channel into enterprise markets outside of China.

- Effective retail channel partners: NQ began rolling out its product offerings through its retail partners in the summer of 2012. Initial results have substantially exceeded expectations, with NQ achieving an attach rate of >20%. The retail wireless salesperson explains the value of mobile security (malware protection, safe browsing, privacy protection, etc.) during the sales process around the same time insurance for the smartphone is discussed. NQ and its partners have found that a very convincing argument is reminding consumers that as they would be very hesitant to perform certain common functions (banking, shopping, email) on a computer that lacked anti-virus software.

- NQ's competitors lack any presence in these channels that is comparable in scale or breadth.

7. NQ's user base is substantially under monetized with numerous catalysts that will drive increased monetization

- NQ's user base is substantially under-monetized with numerous catalysts that will drive increased monetization.

- When NQ first enters a new market, it aims to build a large user base before activating billing, which acts as a temporary negative bias on the blended global conversion rate. Numerous markets are slated to be "turned on" in 2013, which will drive an increase in monetization. Management has noted that typically, an integration into the billing channel of the carrier increases sales by 500% in developed markets.

- Although NQ's products are available in over 150 countries, NQ has currently only turned on billing in 61 countries and expects to have 75 countries turned on by the end of 2013.

- The Feiliu acquisition will also enable NQ to increase monetization of its ~241 million registered users and ~85 million active users. Feiliu allows NQ, developers and advertisers to more effectively target NQ's user base through mobile games, advertising and user engagement.

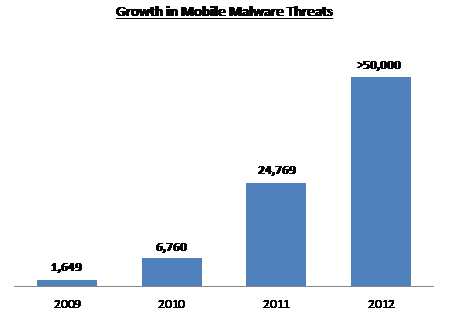

8. Increasing importance of mobile security

- Mobile security's importance in the smartphone and digital ecosystem will grow increasingly faster, following a trend currently underappreciated by investors that has several historical precedents in the PC, browser, email, enterprise, and social Internet industries.

- Smartphones are increasingly being used as repositories for critical personal and financial data and are increasingly under attack by mobile malware.

source: Pew Internet

- Consumers are now becoming increasingly aware of the threats from mobile malware and are increasingly concerned about the threat to their privacy. A September 2012 survey by the Pew Research Center indicates that over 50% of U.S. mobile users are worried about threats to their privacy from their mobile phones.

- Recent high-profile attacks are increasing awareness of the need for security on even the most emerging online platforms such as social networking and microblogging, all of which are increasingly done on smartphones. Apple (AAPL), Facebook (FB), and Twitter were attacked in January 2013 by an Eastern European ring of hackers attempting to steal company secrets, research and intellectual property. News reports have indicated that these hackers were also responsible for attacks on over 40 different companies. The hackers gained access to the various companies by first hacking a mobile developer's site. The fact that the hackers were able to exploit a weakness in the mobile ecosystem points to the increasing need for companies to fortify their security on the desktop and mobile devices alike.

9. Impressive management team

- NQ's Dallas-based management team consists of impressive industry veterans that offer substantial validation given the negative sentiment towards Chinese companies.

- Omar Khan, a highly regarded Chief Technology Officer and Chief Product Officer at Samsung Mobile (SSNLF.PK), joined NQ in January 2012 and brought over with him six other senior Samsung Mobile executives. Mr. Khan is sometimes referred to as the "Godfather of the Galaxy," due to his oversight in the development of the record-setting Galaxy S and Galaxy S II smartphones

- In September 2012, NQ's Chinese founders locked up their 20% stake in the company for two years.

- Furthermore, management recently completed the purchase of $2 million of ADRs in the open market.

10. Strategic Value

- Although NQ's strategic value is under-appreciated by the market, it is well recognized by leading industry participants.

- Qualcomm, HTC and MediaTek are strategic investors in NQ.

- NQ also would help Baidu move offensively against its hated rival Qihoo 360 by pressuring Qihoo 360 on its native turf of digital security. James Ding, a ~15% holder of NQ shares and director on NQ's board, also serves on Baidu's board.

- During its IPO process, NQ attracted significant inbound strategic interest.

- Both industry sources and our own advisory sources suggest that a large number of both strategic and investment firms likely would have interest in NQ, including Symantec, Tencent, Microsoft, Qualcomm.

Catalysts

1. Quarterly earnings reports

- Significant market skepticism exists regarding management's goal of a $50m quarterly sales run rate by Q4 2013.

- Progress towards achieving this goal will likely result in stock re-rating.

- Management tends to guide conservatively, which will likely result in significant beat and raises.

2. Progress in building out non-China business

- Diversifying revenues away from China will be rewarded by the Street given negative market sentiment towards China.

- Excluding the recent NationSky and Feiliu acquisitions, NQ has rebalanced its revenue mix to outside of China - which will accelerate due to the ramp up in retail channel in 2013.

- Revenue diversification could further accelerate as NQ realizes enterprise sales outside of China, which we do not consider below.

- Greater retail traction outside of China will also result in greater EPS upside due to the larger ARPU and paying ratio realized outside of China, a country which currently has relatively low mobile monetization industrywide.

3. Strategic investment or acquisition by any of numerous strategics in the Internet, mobile, telecom, software, and service industries.

- Notably, NQ's second-largest shareholder is on the Board of Directors for NQ and Baidu.

- Further retail partnership and carrier announcements.

Valuation

We believe fair value is between $15-17 / share

- Implies 130-165% upside from current market prices.

- Multiple would be 15x current year EPS, which is ~15% discount to the mean of NQ security software comparables. Discount is applied due to NQ's smaller market cap, "Chinese discount," and management execution risk.

We believe the upside scenario is $21-26 / share

- Contingent on market concerns regarding freemium business model and China discount dissipating, whereby a more appropriate 20-25x P/E multiple can be applied due to NQ's projected hyper growth.

- Projected multiple would bring NQ's valuation more in line with SaaS comparables, but still trade at a significant discount to the SaaS universe.

- Implies 225-300% upside from current market prices.

Our assumptions for 2013E earnings are conservative and leave significant margin of safety

- Significant deceleration in QoQ cumulative registered growth:Conservative assumption given smartphone industry growth and channel expansion projected in 2013 (i.e., retail store rollout, integration into MediaTek chips). We assume China decelerates from 16% QoQ growth in Q3 2012 to 9% QoQ growth in Q4 2013. We assume the QoQ cumulative registered growth outside of China decelerates from 19% in 3Q 2012 to 13% in 4Q 2013.

- Stable paying ratio and ARPU: Potential upside in paying ratio and ARPU due to expansion outside of China. Users signed up in retail stores have a significant higher paying ratio and ARPU.

- Flat NationSky gross margins: NationSky margins may come in significantly above expectations due to ramp up in higher margin subscription sales.

Risks to Thesis

1. Fraud: Many fraudulent Chinese firms such as Longtop Financial and Sino-Forest have soured investor appetite for Chinese companies in the United States

- COUNTERPOINT: NQ is one of the few Chinese tech companies to have a non-Chinese national as its CEO (although it also has a Chinese Co-CEO).

- COUNTERPOINT: Omar Khan is a highly respected smartphone veteran who would unlikely seek to blemish his prestigious career by joining a fraudulent company.

- COUNTERPOINT: Sequoia, a preeminent venture capital firm, has maintained its 7% pre-IPO stake in NQ.

- COUNTERPOINT: NQ founders have voluntarily locked up their shares (20% of company) for two years. Management at fraudulent companies are usually in a hurry to unload shares onto the market.

- COUNTERPOINT: NQ has been successfully audited by PWC, the only US Big 4 auditor with a clean track record of zero fraudulent clients or clients.

2. Qihoo 360 gains significant market share since it does not charge for its products

- COUNTERPOINT: NQ offers a free version of its product as well.

- COUNTERPOINT: QIHU considers itself an exclusively Chinese Internet service company that competes with BIDU, Tencent, and companies of their ilk. QIHU has heretofore never expressed strategic interest in monetizing its security assets directly and has neither developed the institutional competence nor built or hired the substantial team required to pursue such a strategy.

- COUNTERPOINT: Qihoo 360 lacks the numerous pre installation agreements that allow NQ software to be preinstalled into smartphones prior to purchase.

- COUNTERPOINT: Frost & Sullivan and Sino MR/GfK research has shown NQ market share to be quite stable.

- COUNTERPOINT: Qihoo 360 does not compete outside of China.

- COUNTERPOINT: Qihoo 360 lacks an enterprise solution and distribution channel.

3. NQ is unable to gain users outside of China due to users lack of familiarity vs. established players such as Symantec and McAfee

- COUNTERPOINT: NQ has grown its user base from 8.7 million registered users in December 2009 to 100 million as of September 2012.

- COUNTERPOINT: 20% attach rate at retail stores suggest significant traction in the US.

- COUNTERPOINT: NQ's security software consistently outperforms all its competitors. In January 2013, NQ Mobile Security and NQ Family Guardian selected as top 25 apps at the Mobile Apps Showdown for CES 2013.

Disclaimer: As of the publication date of this report, Toro Investment Partners, LP and its affiliates (collectively "Toro"), others that contributed research to this report and others that we have shared our research with (collectively, the “Authors”) have long positions in the stock of the company covered herein (NQ Mobile, Inc.) and stand to realize gains in the event that the price of the stock increases. Following publication of the report, the Authors may transact in the securities of the company covered herein. All content in this report represent the opinions of Toro. The Authors have obtained all information herein from sources they believe to be accurate and reliable. However, such information is presented “as is”, without warranty of any kind – whether express or implied. The Authors make no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results obtained from its use. All expressions of opinion are subject to change without notice, and the Authors do not undertake to update or supplement this report or any information contained herein. This document is for informational purposes only and it is not intended as an official confirmation of any transaction. All market prices, data and other information are not warranted as to completeness or accuracy and are subject to change without notice. The information included in this document is based upon selected public market data and reflects prevailing conditions and the Authors’ views as of this date, all of which are accordingly subject to change. The Authors’ opinions and estimates constitute a best efforts judgment and should be regarded as indicative, preliminary and for illustrative purposes only. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This report’s estimated fundamental value only represents a best efforts estimate of the potential fundamental valuation of a specific security, and is not expressed as, or implied as, assessments of the quality of a security, a summary of past performance, or an actionable investment strategy for an investor. This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein or of any of the affiliates of the Authors. Also, this document does not in any way constitute an offer or solicitation of an offer to buy or sell any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction. To the best of the Authors’ abilities and beliefs, all information contained herein is accurate and reliable. The Authors reserve the rights for their affiliates, officers, and employees to hold cash or derivative positions in any company discussed in this document at any time. As of the original publication date of this document, investors should assume that the Authors are long shares of NQ and stand to potentially realize gains in the event that the market valuation of the company’s common equity is higher than prior to the original publication date. These affiliates, officers, and individuals shall have no obligation to inform any investor about their historical, current, and future trading activities. In addition, the Authors may benefit from any change in the valuation of any other companies, securities, or commodities discussed in this document. Analysts who prepared this report are compensated based upon (among other factors) the overall profitability of the Authors’ operations and their affiliates. The compensation structure for the Authors’ analysts is generally a derivative of their effectiveness in generating and communicating new investment ideas and the performance of recommended strategies for the Authors. This could represent a potential conflict of interest in the statements and opinions in the Authors’ documents.

The information contained in this document may include, or incorporate by reference, forward-looking statements, which would include any statements that are not statements of historical fact. Any or all of the Authors’ forward-looking assumptions, expectations, projections, intentions or beliefs about future events may turn out to be wrong. These forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties and other factors, most of which are beyond the Authors’ control. Investors should conduct independent due diligence, with assistance from professional financial, legal and tax experts, on all securities, companies, and commodities discussed in this document and develop a stand-alone judgment of the relevant markets prior to making any investment decision.