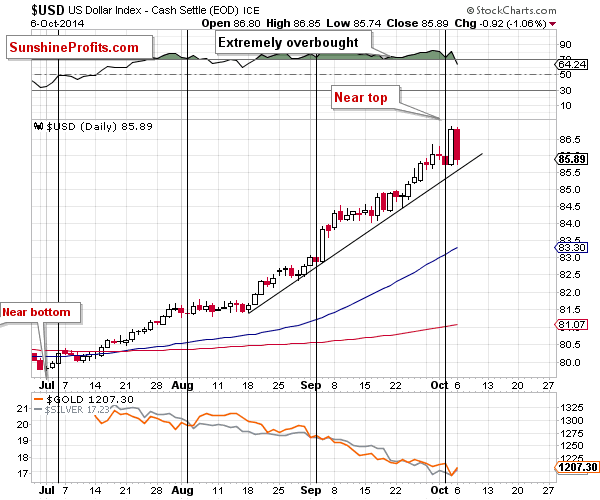

We already saw a significant daily decline yesterday, so it could be the case that the corrective downswing in the USD Index is already underway. The odds will further increase once we see a move below the rising short-term support line (which is likely to be seen shortly).

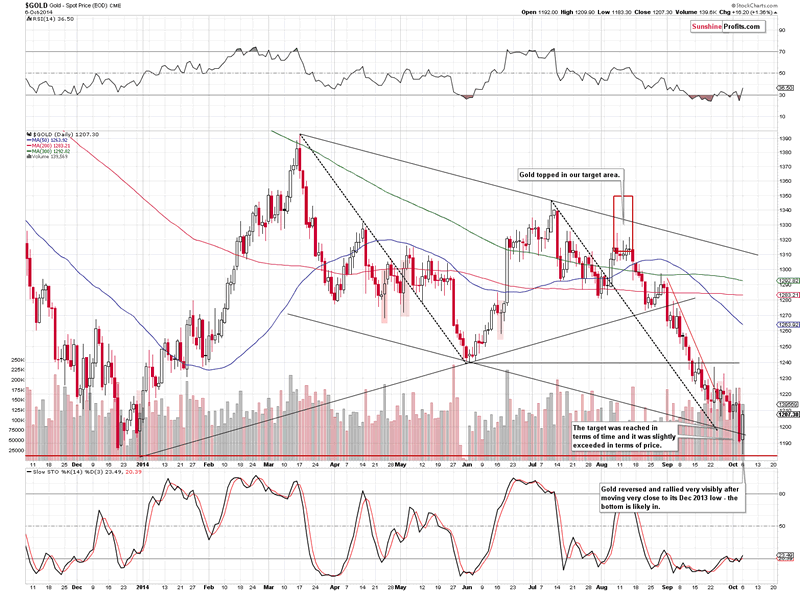

Gold moved almost to its Dec. 2013 intra-day low, which is a very important support, so this fact by itself makes a move higher very likely. The fact that gold rallied shortly after declining to this level and ended the session over $16 higher (and forming a reversal hammer candlestick) makes the situation even more bullish. This kind of action is likely to be followed by further rallying.

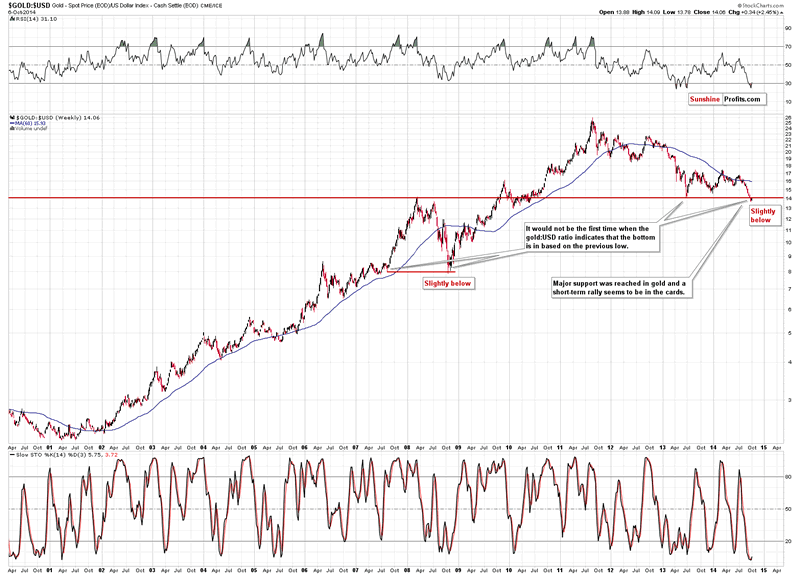

We recently commented about the gold to USD Index ratio as something that could provide us with technical confirmations. Based on Friday's and today's price moves we saw a small decline below the 2008 high (and 2013 low) that was followed by another move higher. Before viewing the decline as a breakdown, please note that back in 2008 the ratio also moved very temporarily below the horizontal support only to invalidate this move and rally shortly thereafter. It seems that we are seeing this type of action once again.

Summing up, the situation in the precious metals market is still bullish for the short term, even if Friday's intra-day action might suggest otherwise. Monday's price action seems to be the true direction in which the market is likely to head next - up. The corrective downswing in the USD Index has probably already begun. The same goes for the precious metals sector, only in this case, the correction would be to the upside. A lot of money has been saved by staying out of the precious metals market in the past months with one's long-term investments, and it seems that the corrective upswing will provide additional profits from the trading capital.

To summarize - Trading capital (opinion):

It seems that having speculative (full) long positions in gold, silver and mining stocks is a good idea:

- Gold: stop-loss: $1,172, initial target price: $1,249, stop loss for the UGLD ETF $11.29, initial target price for the UGLD ETF $13.56

- Mining stocks (price levels for the GDX ETF): stop-loss: $19.94, initial target price: $23.37, stop loss for the NUGT ETF $18.25, initial target price for the NUGT ETF $28.99,

In case one wants to bet on higher junior mining stock ETFs, here are the stop-loss details and initial target prices:

- GDXJ stop-loss: $28.40, initial target price: $37.14

- JNUG stop-loss: $6.19, initial target price: $16.34

选择“Disable on www.wenxuecity.com”

选择“Disable on www.wenxuecity.com”

选择“don't run on pages on this domain”

选择“don't run on pages on this domain”