假设20年前都拥有4万元,三种投资方案。

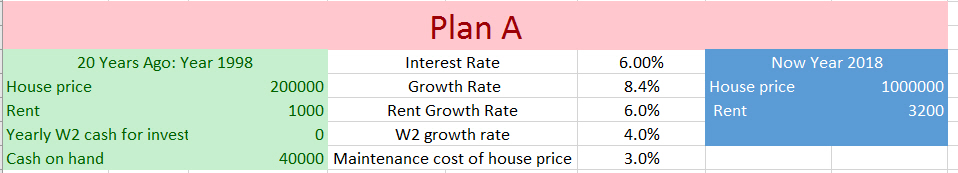

A: 投资高增值但是是负现金流的房子。20年房子增值4倍,房价是原来的5倍,房子年增长率8.4%。租金年增长率6.0%。各种维护开销是房价3%。租金原来只有1000,现在3200。Plan A 利率6%.

数字是假设的,我做了excel表格。如果大家有兴趣我可以用你当地的数据。

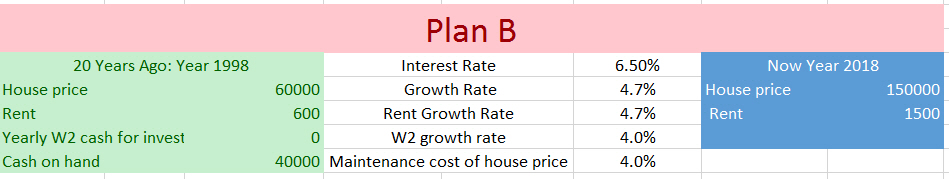

B: 投资低增值但是是正现金流的房子。20年房子增值1.5倍,房子年增长率4.7%。租金年增长率4.7%。就是大家经常说的1%rule的房子。各种维护开销是房价4%, 比上面高1%。Plan B 利率6.5%,也比上面高。

如果是你,你会选择A还是B呢?

PLAN A

| Plan A | |||||||||||||

| 20 Years Ago: Year 1998 | Interest Rate | 6.00% | Now Year 2018 | ||||||||||

| House price | 200000 | Growth Rate | 8.4% | House price | 1000000 | ||||||||

| Rent | 1000 | Rent Growth Rate | 6.0% | Rent | 3200 | ||||||||

| Yearly W2 cash for investment | 0 | W2 growth rate | 4.0% | ||||||||||

| Cash on hand | 40000 | Maintenance cost of house price | 3.0% | ||||||||||

| Year | # House Had | House Price | Down Payment | Rent | Mortgage/mo | Insurance, tax, vacancy, management /mo | Cash flow/mo | Cash flow/ye | W2 cash | Total cash | Buy House Next Year? | Principe paid | Net Worth |

| 1 | 1 | $200,000 | 40000 | 1000 | ($959) | ($500) | ($459) | ($5,511) | 0 | -5511 | FALSE | 2024 | $36,512 |

| 2 | 1 | $216,760 | 43352 | 1060 | ($959) | ($542) | ($441) | ($5,296) | 0 | -10807 | FALSE | 2145 | $50,122 |

| 3 | 1 | $234,924 | 46985 | 1123 | ($959) | ($587) | ($423) | ($5,079) | 0 | -15886 | FALSE | 2274 | $65,481 |

| 4 | 1 | $254,610 | 50922 | 1191 | ($959) | ($637) | ($405) | ($4,862) | 0 | -20748 | FALSE | 2410 | $82,715 |

| 5 | 1 | $275,946 | 55189 | 1262 | ($959) | ($690) | ($387) | ($4,647) | 0 | -25395 | FALSE | 2555 | $101,960 |

| 6 | 1 | $299,070 | 59814 | 1337 | ($959) | ($748) | ($369) | ($4,434) | 0 | -29829 | FALSE | 2708 | $123,358 |

| 7 | 1 | $324,131 | 64826 | 1418 | ($959) | ($810) | ($352) | ($4,224) | 0 | -34053 | FALSE | 2871 | $147,066 |

| 8 | 1 | $351,293 | 70259 | 1502 | ($959) | ($878) | ($335) | ($4,021) | 0 | -38074 | FALSE | 3043 | $173,250 |

| 9 | 1 | $380,731 | 76146 | 1592 | ($959) | ($952) | ($319) | ($3,824) | 0 | -41898 | FALSE | 3226 | $202,089 |

| 10 | 1 | $412,635 | 82527 | 1688 | ($959) | ($1,032) | ($303) | ($3,637) | 0 | -45535 | FALSE | 3419 | $233,776 |

| 11 | 1 | $447,214 | 89443 | 1789 | ($959) | ($1,118) | ($288) | ($3,462) | 0 | -48996 | FALSE | 3624 | $268,517 |

| 12 | 1 | $484,689 | 96938 | 1896 | ($959) | ($1,212) | ($275) | ($3,300) | 0 | -52297 | FALSE | 3842 | $306,535 |

| 13 | 1 | $525,306 | 105061 | 2010 | ($959) | ($1,313) | ($263) | ($3,156) | 0 | -55453 | FALSE | 4072 | $348,067 |

| 14 | 1 | $569,325 | 113865 | 2130 | ($959) | ($1,423) | ($253) | ($3,033) | 0 | -58486 | FALSE | 4317 | $393,370 |

| 15 | 1 | $617,034 | 123407 | 2257 | ($959) | ($1,543) | ($244) | ($2,934) | 0 | -61420 | FALSE | 4576 | $442,720 |

| 16 | 1 | $668,740 | 133748 | 2393 | ($959) | ($1,672) | ($239) | ($2,863) | 0 | -64283 | FALSE | 4850 | $496,414 |

| 17 | 1 | $724,780 | 144956 | 2536 | ($959) | ($1,812) | ($235) | ($2,825) | 0 | -67108 | FALSE | 5141 | $554,770 |

| 18 | 1 | $785,515 | 157103 | 2688 | ($959) | ($1,964) | ($235) | ($2,825) | 0 | -69932 | FALSE | 5450 | $618,130 |

| 19 | 1 | $851,340 | 170268 | 2849 | ($959) | ($2,128) | ($239) | ($2,868) | 0 | -72800 | FALSE | 5777 | $686,864 |

| 20 | 1 | $922,681 | 184536 | 3019 | ($959) | ($2,307) | ($247) | ($2,961) | 0 | -75762 | FALSE | 6123 | $761,367 |

| 21 | 1 | $1,000,000 | 200000 | 3200 | ($959) | ($2,500) | ($259) | ($3,111) | 0 | -78873 | FALSE | 6491 | $842,065 |

PLAN B 20年后会是多少钱呢?

| Plan B | |||||||||||||

| 20 Years Ago: Year 1998 | Interest Rate | 6.50% | Now Year 2018 | ||||||||||

| House price | 60000 | House Price Growth Rate | 4.7% | House price | 150000 | ||||||||

| Rent | 600 | Rent Growth Rate | 4.7% | Rent | 1500 | ||||||||

| Yearly W2 cash for investment | 0 | W2 growth rate | 4.0% | ||||||||||

| Cash on hand | 40000 | Maintenance cost of house price | 4.0% | ||||||||||

| Year | # House Had | House Price | Down Payment | Rent | Mortgage/mo | Insurance, tax, vacancy, management /mo | Cash flow/mo | Cash flow/ye | W2 cash | Total cash | Buy House Next Year? | Principe paid | Net Worth |

| 1 | 3 | $60,000 | 12000 | 1800 | ($910) | ($600) | $290 | $3,478 | 0 | 7478 | FALSE | 1667 | $45,145 |

| 2 | 3 | $62,813 | 12563 | 1884 | ($910) | ($628) | $346 | $4,153 | 0 | 11631 | FALSE | 1776 | $59,512 |

| 3 | 3 | $65,757 | 13151 | 1973 | ($910) | ($658) | $405 | $4,860 | 0 | 16490 | TRUE | 1891 | $75,097 |

| 4 | 4 | $68,840 | 13768 | 2754 | ($1,258) | ($918) | $577 | $6,930 | 0 | 9652 | FALSE | 2685 | $149,032 |

| 5 | 4 | $72,067 | 14413 | 2883 | ($1,258) | ($961) | $664 | $7,962 | 0 | 17614 | TRUE | 2860 | $172,763 |

| 6 | 5 | $75,446 | 15089 | 3772 | ($1,640) | ($1,257) | $875 | $10,501 | 0 | 13026 | FALSE | 3807 | $260,942 |

| 7 | 5 | $78,983 | 15797 | 3949 | ($1,640) | ($1,316) | $993 | $11,916 | 0 | 24942 | TRUE | 4054 | $294,597 |

| 8 | 6 | $82,686 | 16537 | 4961 | ($2,058) | ($1,654) | $1,250 | $14,995 | 0 | 23400 | TRUE | 5181 | $399,435 |

| 9 | 7 | $86,562 | 17312 | 6059 | ($2,496) | ($2,020) | $1,544 | $18,528 | 0 | 24615 | TRUE | 6438 | $516,908 |

| 10 | 8 | $90,620 | 18124 | 7250 | ($2,954) | ($2,417) | $1,879 | $22,551 | 0 | 29042 | TRUE | 7836 | $648,198 |

| 11 | 9 | $94,868 | 18974 | 8538 | ($3,434) | ($2,846) | $2,259 | $27,103 | 0 | 37172 | TRUE | 9388 | $794,570 |

| 12 | 10 | $99,316 | 19863 | 9932 | ($3,936) | ($3,311) | $2,685 | $32,224 | 0 | 49533 | TRUE | 11110 | $957,384 |

| 13 | 12 | $103,972 | 20794 | 12477 | ($4,987) | ($4,159) | $3,331 | $39,967 | 0 | 68705 | TRUE | 14198 | $1,245,257 |

| 14 | 15 | $108,846 | 21769 | 16327 | ($6,638) | ($5,442) | $4,246 | $50,955 | 0 | 97891 | TRUE | 18901 | $1,678,373 |

| 15 | 19 | $113,949 | 22790 | 21650 | ($8,943) | ($7,217) | $5,490 | $65,885 | 0 | 140987 | TRUE | 25498 | $2,279,302 |

| 16 | 24 | $119,291 | 23858 | 28630 | ($11,959) | ($9,543) | $7,127 | $85,529 | 0 | 202658 | TRUE | 34301 | $3,073,224 |

| 17 | 32 | $124,883 | 24977 | 39963 | ($17,011) | ($13,321) | $9,631 | $115,570 | 0 | 293251 | TRUE | 48708 | $4,345,805 |

| 18 | 43 | $130,738 | 26148 | 56217 | ($24,283) | ($18,739) | $13,195 | $158,344 | 0 | 425448 | TRUE | 69705 | $6,173,165 |

| 19 | 58 | $136,867 | 27373 | 79383 | ($34,664) | ($26,461) | $18,258 | $219,095 | 0 | 617169 | TRUE | 100132 | $8,781,564 |

| 20 | 79 | $143,283 | 28657 | 113193 | ($49,879) | ($37,731) | $25,584 | $307,004 | 0 | 895516 | TRUE | 145252 | $12,586,252 |

| 21 | 108 | $150,000 | 30000 | 162000 | ($71,875) | ($54,000) | $36,125 | $433,504 | 0 | 1299020 | TRUE | 211480 | $18,081,890 |

低增值的PLAN C,增值也就和通胀打平。20年后5million.

| Plan C | |||||||||||||

| 20 Years Ago: Year 1998 | Interest Rate | 6.50% | Now Year 2018 | ||||||||||

| House price | 80000 | House Price Growth Rate | 2.8% | House price | 140000 | ||||||||

| Rent | 800 | Rent Growth Rate | 2.8% | Rent | 1400 | ||||||||

| Yearly W2 cash for investment | 0 | W2 growth rate | 4.0% | ||||||||||

| Cash on hand | 40000 | Maintenance cost of house price | 4.0% | ||||||||||

| Year | # House Had | House Price | Down Payment | Rent | Mortgage/mo | Insurance, tax, vacancy, management /mo | Cash flow/mo | Cash flow/ye | W2 cash | Total cash | Buy House Next Year? | Principe paid | Net Worth |

| 1 | 2 | $80,000 | 16000 | 1600 | ($809) | ($533) | $258 | $3,091 | 0 | 11091 | FALSE | 1482 | $44,573 |

| 2 | 2 | $82,270 | 16454 | 1645 | ($809) | ($548) | $288 | $3,455 | 0 | 14546 | FALSE | 1578 | $54,146 |

| 3 | 2 | $84,605 | 16921 | 1692 | ($809) | ($564) | $319 | $3,828 | 0 | 18374 | TRUE | 1681 | $64,324 |

| 4 | 3 | $87,005 | 17401 | 2610 | ($1,249) | ($870) | $491 | $5,893 | 0 | 6867 | FALSE | 2685 | $147,309 |

| 5 | 3 | $89,474 | 17895 | 2684 | ($1,249) | ($895) | $540 | $6,486 | 0 | 13352 | FALSE | 2860 | $164,061 |

| 6 | 3 | $92,013 | 18403 | 2760 | ($1,249) | ($920) | $591 | $7,095 | 0 | 20448 | TRUE | 3046 | $181,818 |

| 7 | 4 | $94,624 | 18925 | 3785 | ($1,727) | ($1,262) | $796 | $9,550 | 0 | 11073 | FALSE | 4325 | $279,225 |

| 8 | 4 | $97,309 | 19462 | 3892 | ($1,727) | ($1,297) | $867 | $10,409 | 0 | 21482 | TRUE | 4606 | $304,980 |

| 9 | 5 | $100,070 | 20014 | 5004 | ($2,233) | ($1,668) | $1,102 | $13,226 | 0 | 14695 | FALSE | 6131 | $415,439 |

| 10 | 5 | $102,910 | 20582 | 5145 | ($2,233) | ($1,715) | $1,197 | $14,362 | 0 | 29057 | TRUE | 6530 | $450,529 |

| 11 | 6 | $105,830 | 21166 | 6350 | ($2,769) | ($2,117) | $1,465 | $17,575 | 0 | 25466 | TRUE | 8345 | $575,715 |

| 12 | 7 | $108,833 | 21767 | 7618 | ($3,319) | ($2,539) | $1,760 | $21,119 | 0 | 24819 | TRUE | 10369 | $712,288 |

| 13 | 8 | $111,921 | 22384 | 8954 | ($3,885) | ($2,985) | $2,084 | $25,011 | 0 | 27446 | TRUE | 12621 | $861,074 |

| 14 | 9 | $115,097 | 23019 | 10359 | ($4,467) | ($3,453) | $2,439 | $29,268 | 0 | 33694 | TRUE | 15121 | $1,022,948 |

| 15 | 10 | $118,363 | 23673 | 11836 | ($5,065) | ($3,945) | $2,826 | $33,906 | 0 | 43928 | TRUE | 17893 | $1,198,831 |

| 16 | 11 | $121,722 | 24344 | 13389 | ($5,681) | ($4,463) | $3,245 | $38,945 | 0 | 58528 | TRUE | 20962 | $1,389,702 |

| 17 | 13 | $125,176 | 25035 | 16273 | ($6,947) | ($5,424) | $3,902 | $46,822 | 0 | 80315 | TRUE | 26383 | $1,726,217 |

| 18 | 16 | $128,728 | 25746 | 20596 | ($8,900) | ($6,865) | $4,831 | $57,977 | 0 | 112546 | TRUE | 34582 | $2,225,391 |

| 19 | 20 | $132,381 | 26476 | 26476 | ($11,577) | ($8,825) | $6,074 | $72,884 | 0 | 158954 | TRUE | 46038 | $2,905,803 |

| 20 | 25 | $136,137 | 27227 | 34034 | ($15,019) | ($11,345) | $7,671 | $92,046 | 0 | 223773 | TRUE | 61288 | $3,787,723 |

| 21 | 32 | $140,000 | 28000 | 44800 | ($19,974) | ($14,933) | $9,892 | $118,707 | 0 | 314480 | TRUE | 83548 | $5,038,553 |