Market Preparing For Some Crazy Action

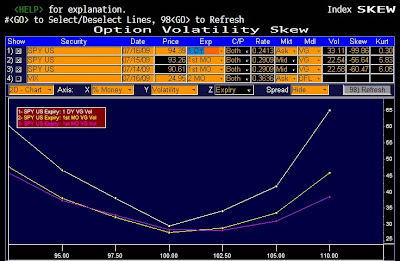

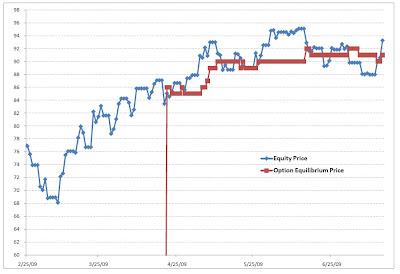

Two days ahead of OPEX, market is gearing for some fireworks. The chart demonstrates the vol skew on SPY over the last three days. Today we have seen net Call covering and net Put buying - this is what one would expect given the current SPY price is way above the equilibrium option price.

So Vol is dropping as it always tends to drop more quickly into OPEX, the skew is likely forcing near the money Vols down as dealers hedge OTM buying, also the net impact of the option action would mean net buying of underlying to delta hedge. With HFT taking away most of the market liquidity, could delta hedging be the primary culprit for the inexplicably stupid market move over the past week.

The volatility rise over the last two days is much ado about not that much.

For starters the volatility skew shown above is extremely misleading. Out-of-the-money options of the 100 strike and higher are completely worthless. 1 day to expiration and $12.00 out of the money? Who cares? That means nothing to an active options trader because I'm pretty sure the S&P 500 will not be rallying 120 handles tomorrow. And in the case it does, well, that would be a great example of extreme volatility where option vols will pop into the stratosphere (think last October-November and daily S&P movements of 70+ handle moves a regular occurence).

The best explanation for the last two days can be related to Monday of this week. Monday's rally off of the lows was a solid 30 handles in the spooz from 865 to 895 ($3.00 in the SPY). The upside of the vol skew (i.e. the calls) were heftily crushed on Monday's rally and again on Tuesday. Aggresive players felt confident about selling the 92.50-95.0 calls in that rally figuring they collect everything in a few days after expiration.

Wednesday's rally induced a nice round of panic covering in those strikes. Since the SPY rallied near those strikes, there was significant buying in these now ATM strikes. That extensive ATM buying acted like a rising tide to lift all boats, and volatility in general increased across the whole skew on Wednesday, explaining why the VIX seemed to move in tandem with the SPY.

In regards to delta hedging, it's not going to move the markets for more than a few seconds. If you have a 50 delta call option and you are short 180,000 of them (such as the open interest of the SPY July 95 calls), then your current hedge would be to buy 90,000 shares. O.K. And to totally hedge you would buy another 90,000. So that's 180,000 shares to buy at a maximum....out of a n average daily volume of 243,000,000. There would have to be some stupendously huge short position (10,000,000+ contracts) right at the money for the delta hedging argument to make any kind of a serious impact on market fluctuations. Nobody would sell that kind of size or stay short in such vast quantities in strikes close to ATM during the expiration week. It just doesn't happen